Stocks Plunge: Fiscal and Monetary Policy Options

Due to a slew of negative coronavirus and oil-related news, stock futures triggered a circuit breaker overnight (5 percent down-trough) and ceased trading. Once the market opened at 9:30am, circuit breakers triggered again after a 7 percent loss and closed for 15 minutes per the customary rules. It was the first decline-related halt in trading since 1997.

And it wasn’t just equities. Lack of liquidity was seen across credit, rates, and even the VIX (which measures the implied volatility of the S&P 500 one month forward). The Chicago Board of Exchange (CBOE) stated that the VIX market couldn’t open as normal given market makers weren’t providing liquidity. When it did open, it spiked to the highest level since the financial crisis.

The entire credit default swap (CDS) market shut down. Even Italian bonds of two-year duration, a normally liquid sovereign debt market, saw a 50-bp yield spike at the open.

After the US stock market re-opened, things stabilized for a bit before heading further south. It turned out to be the worst single day for stocks since 2008.

The backdrop of what sent stocks down

1. There was no letup in the bad news surrounding the coronavirus.

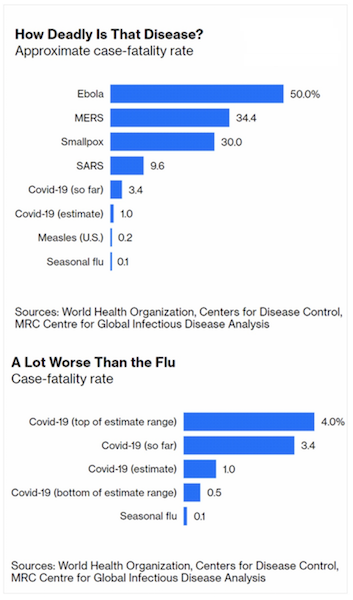

The number of confirmed cases now numbers in the six figures at about 110k, with about 4,000 fatalities globally. While the fatality rate is nowhere near as extreme as some other infectious diseases like Ebola, it’s not insignificant either. Its unique blend of contagiousness and virulence makes it one of the biggest public health scares of the past century.

Seasonal flu spreads widely but has a low case fatality rate. Ebola has a very high case fatality rate, but burns itself out quickly for that reason (it kills the host, and kills itself in the process). Covid-19, the disease that comes out of the coronavirus, is uniquely somewhere in between.

The case fatality rate has been 3.4 percent in practice, with a 0.5 to 4.0 estimate range. This is about 30x the case fatality rate of standard seasonal flu.

The chart below provides a comparison.

Moreover, as you test for it more, you will tend to find it more. This feeds into headlines and has driven asset prices down further in a self-fulling way. When traders don’t know what to make of something, they’ll be more responsive to the headlines that come at them.

At least eight US states, including New York, have declared states of emergency as infections spread to various parts of the country. Italy has quarantined around 17 million people to contain its spread. This exacerbates the economic effects, though is most effective in containing its spread. Policymakers ideally will know when to tap the brakes effectively to contain the virus’s spread, while also knowing when to let up when the rate of acceleration decreases to avoid a hit to the economy and markets.

2. Saudi Arabia decided over the weekend to force an oil price war with Russia. Oil demand was already suffering from the impact of the coronavirus, particularly as it pertained to travel-related demand.

The cost of finding and development (F&D) has also been dropping steadily in recent years; it was $30 per barrel in 2015-16 and is now $12 per barrel based on the latest data from 2018-19.

Traders were expecting OPEC to save the day, which is always a function of when they cut and by how much.

Since 2016, when oil prices last notably bottomed at under $30 per barrel, OPEC’s influence has been dependent on the inclusion of other major oil producers, notably Russia, to help direct the oil market to a stable equilibrium (termed OPEC+).

Since the coronavirus materially impacted demand, the Saudis led an effort to cut production to re-stabilize the market. While it’s always hard to get major countries with different motivations to agree on anything completely, OPEC+ had done a reasonably good job over the past few years of compromising to lift prices out of their 2016 doldrums.

But over the past four years, US oil output has increased by 4 million barrels per day (up to 13 million per day, up from 9 million).

Russia balked at Saudi Arabia’s new proposal and have apparently decided to flood the market with oil at the same time.

When the market gained wind of the news, both WTI and Brent crude futures violently plunged by more than 30 percent, the most since the Gulf War broke out in early 1991.

At $30 per barrel for the US crude benchmark, it is hard for even the most productive shale oil fields to be profitable. Others will have to cut back heavily on spending. Others will be forced into bankruptcy. Many were already struggling with oil in the $50-$60 range.

US shale is no stranger to overseas producers attempting to kill them off. Back in 2014, Saudi Arabia increased production to attempt to drive out weak shale producers. It didn’t work.

Back then, shale producers learned to become more efficient and strip out any spending waste. Investors were also readily willing to step in with capital to keep them afloat and ride out the period of falling oil prices. Now, however, investors are much less sanguine about the industry. Moreover, petroleum demand has also dropped.

The last time oil collapsed in 2015-16, OPEC+ sped up a reversal in oil markets by cutting production. But it also incentivized shale producers to expand their own and take more of the global market. This allowed the US to become effectively “oil independent”; it became a net exporter, which carries with it a material strategic advantage. Russia didn’t want to repeat that mistake.

Russia is in a unique position in that it can balance its budget at a lower price relative to Saudi Arabia. Moreover, it’s also in the best economic shape it’s been in in several years, with stable growth and inflation and no balance of payments issues.

Russia is accordingly well-equipped to ride out a period of low prices. Saudi Arabia will need to expend ample amounts of FX reserves with oil around the $30 mark. It also means OPEC’s influence on the oil markets will be less going forward, and that “lower for longer” prices are more likely to persist.

Fiscal and monetary policy options

Now that stocks have fallen to nearly bear market territory (defined as a 20 percent drop peak to trough), the expectations for central bank or fiscal intervention have run higher.

Given the central bank has used the markets as a conduit for effectuating its policy objectives, traders have gotten accustomed to having a backstop – often called the “Fed put” – that will prevent any selling from going overboard and undermining its policy aims.

Let’s go through the main options, starting with monetary policy, which can act more swiftly and apolitically than fiscal policy:

Monetary policy

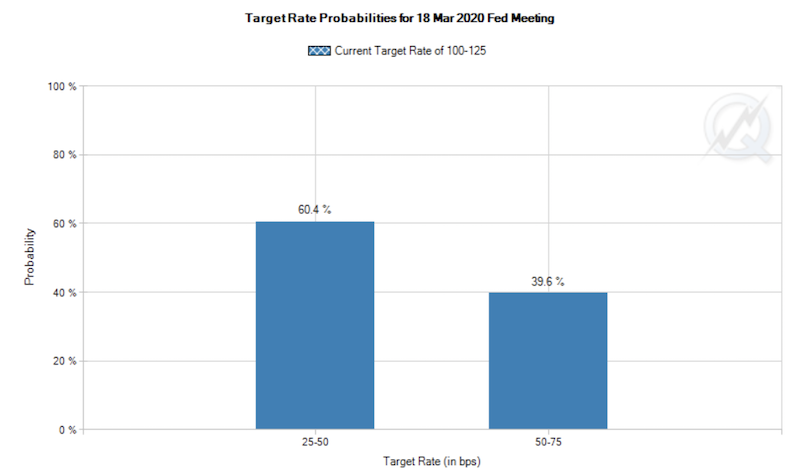

1. The Fed is likely to ease again in March after already issuing an emergency rate cut. The fed funds rate is currently 100bps. However, the remainder of that is already discounted into markets. In other words, by the next meeting, traders already expect the Fed to ease down to zero or very close to it.

2. Forward guidance (central bank communications that rates will be held low and do what’s necessary to support the economy)

3. A new round of quantitative easing (asset purchases)

Fiscal policy

1. Unemployment support – During the financial crisis, the federal government extended unemployment and under-employment insurance.

2. Compensate for lost demand – In an election year, income tax cuts as part of new legislation won’t happen, but payroll tax cuts are possible (but would a Democrat controlled House be willing to work with the White House?).

3. Direct aid – Liquidity support through rate cuts and asset purchases provides broad support, but doesn’t get at providing direct aid to the entities most in need.

Monetary policy is almost out of room. So, it has limited effectiveness at this point. Interest rates are already priced to be at zero and the entire curve is now under 100bps. Back when QE (version 1) was launched in March 2009, the 10-year was above 270bps. Asset buying is most effective when risk and liquidity premiums are high, with the marginal returns becoming less effective as these premiums compress as they are now.

The market will get another cut (after the emergency rate cut) at the official meeting simply because the rates and bond market has already priced it in. The Fed would be reluctant to push against that signal and not deliver on the expectation in order to avoid a tightening in financial conditions. If it didn’t follow through, stocks would decline, credit spreads would widen, and the dollar would go up.

Lower borrowing costs can help some firms to reduce the cost of their liabilities, but it’s not likely to get people to spend who are not willing to or do much to arrest the drop in consumer and business confidence. A certain part of it is psychological.

Monetary policymakers will nonetheless do what they can do. After the Fed’s emergency rate cut, the FOMC statement that the committee “will act as appropriate to support the economy” means further easing at the March 17-18 FOMC meeting.

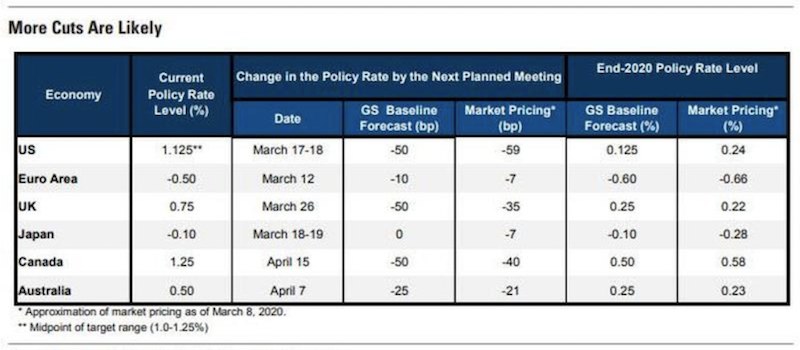

Outside of the US, the ECB is likely to cut another 10bps. It’s deposit rate is already minus-50bps. An additional round of QE is likely to come with that, but won’t have much of an effect given rates further out on the curve are also at, near, or below zero.

The Bank of England’s base rate is at 75bps and is likely to reduce another 50bps. The Bank of Canada, which has already eased is likely to move down another 75bps. As an oil-dependent economy, the massive drop in crude oil prices will also be a motivating factor. The Reserve Bank of Australia is also likely to reduce another 25bps.

(Source: Bloomberg, Goldman Sachs Global Investment Reserarch)

But central banks are already at, near, or below the effective lower bounds so it’s difficult to imagine how a pure mix of monetary policy will work. The yields on cash and bonds are already at least very close to zero in virtually all developed markets, which is what equities and most other asset classes are priced off of.

After a certain point, fiscal policy will need to take higher priority. Can this pick up in a divided political atmosphere? This means direct liquidity support to the entities most in need of it beyond virus testing and treatment.

Due to event cancellations and travel fears, the airline industry has been particularly hard hit. Post-9/11 there was also help for the industry, given the hit to consumer sentiment. This included $10 billion in loan guarantees and $5 billion in direct payments.

In the US, the Federal Reserve is constrained in what it can legally buy. For now, it can only buy Treasury bonds (i.e., bill, bonds, notes), and government mortgage backed securities. Buying mortgage backed securities would work to help lower interest rates in the mortgage market. This would reduce rates on new loans and incentivize more refinancing activity to put more money in the pockets of households. Real estate represents a disproportionate amount of the net worth of the middle class (the upper class typically has most of its net worth wrapped up in business equity).

The US Treasury could also help support credit easing facilities on banks. But this would likely require a further deterioration in market conditions for these facilities to be re-established.

Other forms of policy, such as fiscal deficit monetization (i.e., the Fed directly creating the currency to retire Treasury debt) and/or the Fed directly distributing money to spenders and savers (rather than going through the conduit of the financial markets) is a long way’s off. Both types of policies, which can beyond traditional rates and asset buying, are not currently on the radar.

Final Thoughts

If the coronavirus follows previous episodes, it’ll wash out and won’t be a long-term issue.

Right now, we are dealing mainly with a crisis of confidence. Several fiscal and monetary policy options are on the table. Monetary policy in the traditional sense is close to being expended, which will shift more of the onus onto fiscal policy and the political process that entails.

Long-term Treasuries have been the main safe haven over the course of this episode. Even then, we see gaps in the “ultra bond” market (i.e., futures market that mirrors a 30-year US Treasury) that show an inconsistent flow of market liquidity.

(Source: Interactive Brokers internal charting interface)

During some periods of the day, the security trades without an offer either direction.

But owning Treasury duration has really been the only thing to protect against declines for those who owned a lot of risk assets.

When liquidity shortages emerge, this is the worst-case scenario for leveraged borrowers. When traders are leveraged and can’t come up with the cash to cover their losses, they have to face margin calls. At the same time, there’s often a lack of liquidity when they’re undergoing forced liquidation because most others are facing the same problems. They either can’t sell or see a price that they don’t like.

It’s a problem for not only human traders, but machine-based trading systems as well, such as high-frequency trading.

When confronted with situations and complex fundamental news that they don’t recognize and can’t understand (they’re only as good as what they’re programmed to do), machines will typically widen out their bid-ask spreads or even withdraw from the markets altogether.

Given about one-third of all trading is estimated to operate under some automated machine model, this is significant. When this occurs, it leaves a greater share of the liquidity provision up to human traders, which would be fine if there was still a deep supply of spare risk-taking capacity. But that’s not always there, especially when you really need it – i.e., there’s a bunch of people demanding liquidity but not enough supplying it.

The danger of mistaking low volatility for low risk

Before the coronavirus situation set off a severe market drop, we were in an environment where volatility was low – even historically low – across virtually asset classes (e.g., equities, G-7 FX, bonds, oil).

Traders tend to mistake an environment where low volatility is the equivalent to low risk.

When you don’t have much movement either way, or markets gradually follow the escalator ride up, everyone feels more confident in leveraging their returns. Some trading systems are specifically programmed to leverage up as volatility declines because they target a certain level of risk.

But stable environments normally sow the seeds of the next sell-off. As markets go up and forward returns go down, traders are drawn into more leveraged positions as they try to magnify smaller prospective returns into the desired return on equity. Most people end up leveraged long and stuffed into crowded trades.

When a catalyst emerges – in this case, a public health scare that no one could have anticipated – this shift produces a market reaction that’s magnified relative to what the fundamentals would dictate.

When markets are in a state of flux and the range of unknowns is far larger than the range of what can be known, then we need to be in a position where we are immune to having to take a particular side (without just being in cash). We wrote more about this in ‘How to Build A Balanced Portfolo‘.

Perceptions versus Reality

Markets are priced based on the discounted expectations of the future. This means markets, in times of “panic”, are often more governed not by what actual economic fundamentals are but by the perceived health of the institutions operating in them are.

The market action is unusual and not warranted by the actual underlying fundamentals. A lot of the volatility is a consequence of many market players seeing forced liquidations in order to raise cash. The frequent drops in gold prices since the coronavirus flared up is an example. When people need cash, this could also mean a sell-off in otherwise safe assets.

Gold is not a particularly liquid market relative to equity and credit markets, so any idiosyncratic liquidation, that otherwise has nothing to do with the fundamentals of that particular asset class, is more likely to make a ripple.

While bear markets are when you’d like to go bargain hunting, the health of your fellow market participants will lead to market action that otherwise doesn’t make much sense. This makes timing markets and getting into assets with a “margin of safety” (i.e., a price level that would imply limited further downside) are difficult to pull off.

The only consistent source of capital preservation during the sell-off, running opposite the direction to equities, have been US Treasuries. While some look at the yields on Treasuries and assume they can’t run up much more or that the risk/reward is bad buying them at these levels, if things continue to get worse that means Treasuries are likely to see continued inflows.

Even though banks have become the second-most beaten down sector to energy, they are much more likely to be able to withstand a shock relative to 2008. We also haven’t seen credit markets seize up as they did in 2008.

So it’s important to know that markets are being, and will continue to be, impacted by leveraged market players who are getting squeezed out of their positions and forced to sell into an environment where there’s not a lot of liquidity being provided.

Market movements are therefore heavily characterized by market participants experiencing cash flow-related issues rather than selling because of careful fundamental analysis of the underlying value of various assets.