Equiti Review 2024

- Daytrading Review TeamAfter opening an account, I think Equiti is a pretty good option for experienced traders looking for ECN pricing with high leverage rates on the feature-rich MT5 platform. That said, the offshore regulation doesn't give me a great deal of confidence and the lack of educational tools is frustrating.

Equiti is an international STP brokerage, with built-in analysis tools and a wide range of CFD and forex markets. The broker also offers sky-high leverage rates of up to 1:2000 and is regulated offshore for retail traders by the Seychelles FSA, among other tier-2 authorities.

Forex Trading

During my testing, I uncovered nearly 70 foreign exchange CFDs - not a bad line-up compared to other brokers I review. The broker’s STP execution model means that execution times for me are generally quite low and spreads are competitive, starting from 0.0 pips.

Stock Trading

I think the broker’s selection of 300+ US, UK and European stocks is OK, but certainly not the most impressive I’ve seen. That said, I am a big fan of the 14 different ETFs which allow me to diversify my portfolio across more global investments.

CFD Trading

The broker's CFD range encompasses all my favorites: forex, US, UK and European stocks, international ETFs, energy commodities, global stock indices and cryptos. They're all available with competitive ECN conditions from within the MT4 or MT5 trading platforms.

Crypto Trading

I’m pretty happy with Equiti’s 1:10 leverage and spreads from $5 on popular crypto pairs like BTCUSD. Savvy clients can also utilize the broker's signals and market news to get crypto trade ideas and keep abreast of industry developments.

✓ Pros

- I'm pleased that there's a strong range of accessible payment methods, including bank wire, cards, e-wallets and cryptos

- The free demo with unlimited usage is a game-changer for those who want to continuously test their strategies

- DeFi enthusiasts can speculate on an impressive range of 80+ cryptocurrency CFD products

- I appreciate the 24/6 customer support available in 6 languages, via email and live chat

- High leverage rates of 1:2000 are on offer for experienced margin traders

✗ Cons

- I think retail clients should look elsewhere for robust regulatory oversight since Equiti's main brokerage branch is regulated offshore

- Equiti falls short in terms of educational material and extra tools, with one of the most basic offerings I have seen

- I'm disappointed that bank transfer and e-wallet withdrawals are subject to a fee of 1% up to $30

The Equiti Group is a global broker offering trading in forex, shares, indices, and commodities. Clients benefit from the award-winning MetaTrader 4 (MT4) and MetaTrader 5 (MT5) desktop platforms and mobile apps. Our review details their trading fees, leverage, demo account, and more.

Find out whether to register for an Equiti trading account today.

Equiti Overview

Equiti was founded in 2008, originally established as Divisa Capital Group. Over the following years, the firm expands its services to other jurisdictions, including New Zealand and the UAE, before being acquired by Equiti Group Ltd in 2017. The firm rebranded all it’s global entities to Equiti in 2018.

The company has branches all over the world to meet different regulatory demands and client needs. For example, the firm’s main retail brokerage branch is based offshore in the Seychelles, whilst the UK branch is aimed at institutional clients.

The company’s 300 staff can be found in offices across the world, from London to Florida.

Platforms & Tools

2.5 / 5Equiti offers a downloadable trading platform from MetaQuotes – MetaTrader 4 (MT4), plus a web-accessible proprietary interface – Equiti EQ Trader.

MT4

MT4 has become the gold-standard for forex and CFD trading, providing an intuitive environment for newcomers and experienced traders alike. As well as deep trading histories, clients get 30 advanced charting tools, 50 technical indicators, nine timeframes, plus automated trading capabilities through Expert Advisors (EAs).

MT5

For advanced traders, the Equiti Group also introduced MetaTrader 5 in 2022. The terminal offers extensive customisation, close to 40 technical indicators, an unlimited number of charts, plus instant and pending orders.

The MT5 terminal is an excellent addition and will meet the needs of veteran traders looking to conduct in-depth technical analysis and employ automated trading strategies. The platform is available as a free download or via web browsers.

Equiti EQ Trader

Equiti EQ Trader is a web-enabled platform so no download is required. Six charting types are available, along with nine timeframes, 25 analysis tools, and 48 indicators, plus a creation wizard for custom indicators. The platform is available in six time zones and facilitates trading in forex, commodities, stocks, indices, and precious metals, with a favourite function. The webtrader platform also comes with standard risk management tools, such as stop losses and take profits.

Popular Alternatives To equiti

Assets & Markets

2 / 5Over 170 tradeable instruments are available, including shares from the UK, EU, and US markets, totalling 115 companies. There are also 15 global stock indices, eight commodities, including energies and precious metals, plus over 60 forex pairs.

Although a decent range of products, the addition of cryptocurrencies would be welcome.

Fees & Costs

3 / 5Spreads with Equiti are competitive, especially for the Premiere account, which has spreads from 0.2 pips for major pairs. The Executive account spreads are typically between 1.6 and 2 pips for the same pairs.

Equiti also charges commissions on trades, though only for Premiere accounts. Commission rates are charged at $70 per $1 million for forex pairs and $7 per standard lot on precious metals. All other instruments are commission-free.

Rollovers are charged on positions held past 20:45 GMT. These swaps are variable, changing with the instrument and market. Accounts that are inactive for 180 days are charged a monthly fee.

Leverage

Equiti works on a fixed leverage scheme with a maximum level of 1:500 available for major and minor forex pairs. Exotic pairs can access one-tenth the leverage rates of other pairs and shares are further reduced, with rates on US shares up to 1:20 and UK & EU shares up to 1:10.

Mobile Apps

Equiti offers a mobile app for trading on the go. The app is compatible with iOS and Android devices and has almost all the capabilities of the desktop version, though with fewer customisation options and analysis tools. There is, however, real-time market news, notifications and one-touch trading. Your desktop login credentials should work on the mobile app.

Deposits & Withdrawals

Accounts can be funded by bank wire transfer, payment cards, Neteller, and Skrill. Bank transfers take one to three working days to be processed while other methods take one day. There is no minimum deposit for wire transfers, but other options have a $30 minimum limit. It should be noted, however, that the first deposit must be a minimum of $500. No fees are charged for deposits.

Withdrawals can be made through all the same methods, though fees are charged on all options except payment cards. Neteller and Skrill withdrawals are processed within one working day, but wire transfers can take three to five days and payment cards between five and 14 working days.

Demo Account

Equiti offers a demo account for new clients to get to grips with forex trading, the broker, and the trading platforms. Funded with simulated money in a real-time market, there is no risk to personal capital and accounts can be used to explore strategies and experiment with new charting or analysis techniques.

Deals & Promotions

At the time of writing, there are no welcome bonuses or promotions offered by the Equiti Group. However, this may change, so check the broker’s website before you create an account.

Regulation & Trust

1 / 5The Equiti Group of companies are regulated by several global authorities:

Equiti Brokerage (Seychelles) Limited is regulated offshore by the Financial Services Authority (FSA) of Seychelles.

Equiti Group Ltd. is licensed by the Jordan Securities Commission (JSC) and is authorised to provide trading services within MENA.

EGM Futures DMCC is licensed by the Dubai Multi Commodities Centre (DMCC) and regulated by the Securities and Commodities Authority (SCA).

EGM Securities Ltd. is licensed in Kenya by the Capital Markets Authority (CMA) to provide services in Africa.

Equiti Capital UK Ltd. is licensed by the UK Financial Conduct Authority (FCA) and is authorised to provide services within the European Economic Area (EEA), though this is for institutional clients only.

Finally, Equiti AM CJSC, which is also aimed at professional and institutional clients, is licensed by the Central Bank of Armenia.

Overall, Equiti is a legitimate firm but retail traders should be aware that brokerage services for the majority of global clients are regulated offshore by the Seychelles FSA, or by the tier-2 regulators in the MENA and African regions.

Additional Features

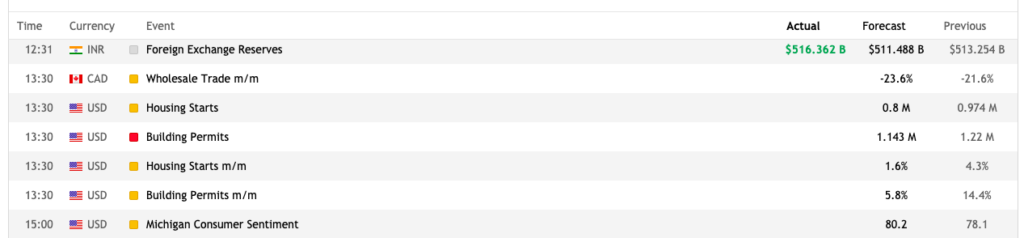

Customer reviews point to the limited additional tools that are available from the client portal. There is a helpful commission calculator, economical calendar, and FIX API for UK and EEA clients, but there aren’t the in-depth training guides and tutorials found at many brokers. As a result, beginners looking for additional support may be disappointed.

Account Types

Two account types are available:

Executive

- Typical forex spread 1.6 pips

- MT4 and Equiti EQ Trader

- Minimum deposit $500

- USD, EUR, GBP & AED

- All instruments

- No commission

- ECN model

- Micro lots

Premiere

- Typical forex spread 0.2 pips

- Forex & metal commission

- Minimum deposit $20,000

- MT4 and Equiti EQ Trader

- USD, EUR, GBP & AED

- All instruments

- ECN model

- Micro lots

Trading Hours

The forex market is open 24 hours a day, 5 days a week. Metals have the same trading hours but there is a break at 21:00-22:00 GMT during British summer time and 22:00-23:00 GMT during daylight saving time. A full calendar with holidays and irregular market times for assets is available on the website.

Customer Support

3 / 5Equiti’s 24/6 customer support team can be contacted via:

- Live chat – online chat available from the bottom right-hand corner of the website

- Telephone – see the broker’s Contact Us page for the phone number in your area

- Email – support@equiti.com

Staff are friendly, helpful and can assist in multiple languages.

Safety

Personal data is held in secure cloud facilities while the website uses SSL encryption technology. User funds are also segregated from the company’s cash and client fund insurance is available up to $1,000,000 per client.

Equiti Verdict

Equiti is an established international forex and CFD broker. Offering the MT4 platform, mobile app, and multilingual support, they’re a decent all-rounder. To improve further, we’d like to see cryptocurrency trading added to the platform and additional training resources for beginners.

Top 3 Alternatives to Equiti

Compare Equiti with the top 3 similar brokers that accept traders from your location.

-

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone -

Vantage – Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Go to Vantage -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade

Equiti Comparison Table

| Equiti | Pepperstone | Vantage | AvaTrade | |

|---|---|---|---|---|

| Rating | 2.8 | 4.8 | 4.7 | 4.9 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $50 | – |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FSA, JSC, CMA, SCA, CBA, FCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, FSCA, VFSC | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Bonus | – | – | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, DupliTrade | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | ProTrader, MT4, MT5, TradingView, DupliTrade | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:500 | 1:30 (Retail) 1:400 (Pro) |

| Payment Methods | 4 | 11 | 12 | 13 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Pepperstone Review |

Vantage Review |

AvaTrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Equiti and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Equiti | Pepperstone | Vantage | AvaTrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | No | No |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Equiti vs Other Brokers

Compare Equiti with any other broker by selecting the other broker below.

FAQ

What's the minimum deposit to open an Equiti account?

Clients need to deposit a minimum of $500 when they open a live trading account. However, after the first deposit the minimum deposit requirement drops to $30 for most methods and there is no minimum for bank wire transfers.

What leverage is available with Equiti?

Equiti offers maximum leverage up to 1:500. However, leverage does vary depending on the instrument traded. See the broker’s website for details.

Is Equiti a safe broker to trade with?

Equiti is a legitimate firm founded in 2008 with several operational branches around the world. That said, the firm’s main brokerage branch is registered offshore and regulated by the Seychelles FSA, a weak regulator with few measures in place to protect client funds.

Does Equiti offer a demo account?

Yes, traders can open a demo account from the broker’s website. The practice account is funded with virtual cash so users can test the platform and broker. The demo account can be closed and a real-money trading account can be opened when clients are ready.

Does Equiti offer a swap free account?

Yes – Equiti offers an Islamic friendly swap-free account. Speak to customer support to open an account.

Customer Reviews

There are no customer reviews of Equiti yet, will you be the first to help fellow traders decide if they should trade with Equiti or not?