Dsdaq Review 2024

Dsdaq specialises in crypto trading through its accessible mobile app & low deposit.

Forex Trading

Trade on a modest collection of FX pairs.

Stock Trading

Trade on 150 stocks at Dsdaq including Google & Tesla.

Crypto Trading

Trade on a collection of crypto cross pairs with up to 1:100 leverage.

Dsdaq is an innovative broker specialising in digital currencies such as Bitcoin and Ethereum. The broker offers the world’s first crypto collateral trading app, as well as crypto mining of their decentralised coin, Origin D (OD). Find out if it’s safe to login to Dsdaq, with our review of the trading platform, live chat support, regulations and more.

Dsdaq Headlines

Dsdaq lets traders borrow ‘buying power’ whilst still holding their cryptos in the wallet. This means that clients can use their crypto coins to trade over 300 popular financial assets including stocks, indices, forex, commodities and futures.

As a fintech startup, the company receives investment from Tim Draper, founder of venture capital firm, Draper Fisher Jurvetson. Since its recent establishment, the firm has gained over 200,000 active users and achieves an average daily trading volume of $50,000,000.

Trading App

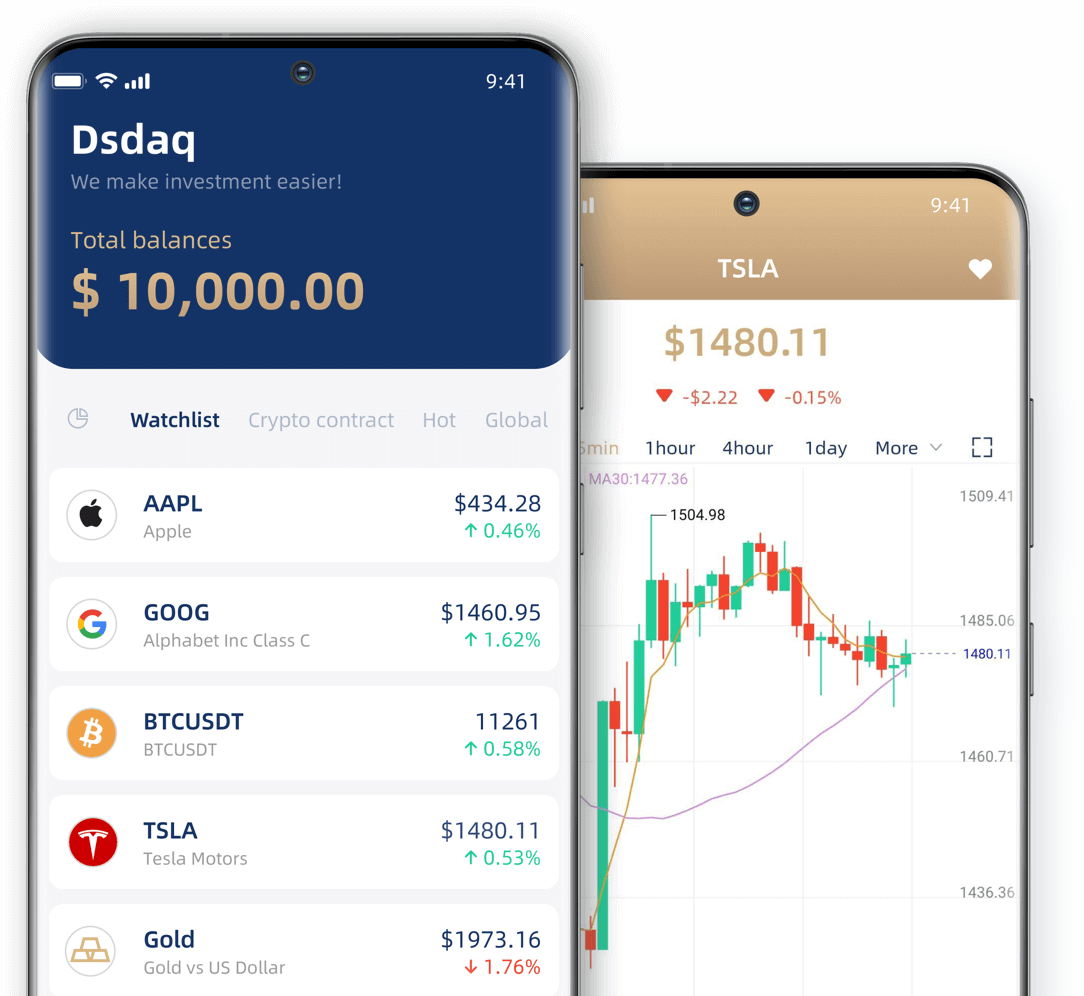

As the broker is committed to speed, simplicity and convenience, the Dsdaq app is mobile-based only. The platform comes with a built-in crypto wallet and allows you to use your cryptocurrency as collateral to trade on other popular financial assets.

As well as full account management features, traders can also manage positions and analyse the markets using the charting features. Instruments can be viewed in multiple timeframes up to 1 week and there is also a selection of 5 indicators for easy technical analysis.

The Dsdaq trading app can be downloaded onto iOS or Android phones, using the App Store or Google Play.

Product Review

Users can trade over 30 cryptocurrency pairs, including Bitcoin, Litecoin and Ethereum. In addition, the app provides access to over 150 stocks including Tesla and Google, 18 ETFs such as iShares Russell 2000, plus a small selection of commodities, indices and forex pairs.

Trading Fees

Dsdaq does not charge any commissions on financial assets, but the broker does profit from the spread. For major forex pairs such as EUR/USD, live spreads are around 2.5 pips which are fairly high. Spreads are around $0.08 for crude oil and around 2.78 points for the FTSE 100.

Crypto contract trading fees are charged at 0.05% for the taker and 0.02% for the maker. The fee on crypto spot trading is 0.1%. There is also an overnight financing fee of 0.015%.

Leverage Review

Dsdaq offers leverage up to 1:100 on cryptocurrencies and forex. Indices and commodities can be leveraged up to 1:50 and stocks up to 1:10. These rates are around the industry norm, but clients should be aware that leveraged trading does carry risks.

Payment Options

Deposits are available in over 10 cryptos, including Bitcoin, Ethereum and Litecoin. Compared to other brokers such as Bitmex and Robinhood, deposits and withdrawals are executed in only 10 minutes or less at Dsdaq.

Minimum deposits start from 0.001 for BTC, BCH and LTC. The minimum deposit for ETH is 0.01, USDT is 1 and XRP is 10.

To make a deposit or withdrawal, simply click on the wallet icon at the bottom of the app and follow the on-screen instructions.

Demo Account

Dsdaq offers a demo account which is an excellent tool for both beginners and seasoned traders, as it allows you to test the waters without trading real money. The broker isn’t transparent about the terms of the demo, so it’s best to get in touch with customer support for details.

Dsdaq Deals

Dsdaq offers a $10 welcome bonus when you register for an account. The bonus cannot be withdrawn and can only be traded within the app. There’s also the occasional demo contest and seasonal offer available; traders can check the broker’s Twitter page for details.

Regulation & Reputation

Dsdaq Market Ltd is not yet licensed or regulated. Nonetheless, the broker does ensure that the majority of customer crypto assets are held in an offline storage system (Cold Storage). A small portion of crypto assets are held in the online wallet (Hot Storage). In addition, the company is backed by well-known investors, including DraperDragon Innovation Fund III, a Silicon Valley-based venture capital firm.

Due to its short history, it’s difficult to make a judgement as to how legit and trustworthy the broker is.

Additional Features

Dsdaq offers crypto mining of their decentralised asset, Origin D (OD). OD is issued on the Ethereum network by Dsdaq. For every trade on the Dsdaq app, the broker will airdrop free OD to your Dsdaq wallet, which is locked up for 180 days before it can be traded into BTC, ETH, USDT, etc.

The broker also offers some educational videos in the Dsdaq Academy. The videos cover everything from crypto trading for beginners to hedging guides.

Trading Accounts

There is a single live account offered at Dsdaq, the Crypto Collateral Account (CCA), which you can register for free once you have downloaded the mobile app. Currently, the cryptos you can use as collateral are BTC, ETH and USDT. The broker aims to add more in the future. The collateral rate is 70% for BTC and ETH, and 100% for USDT.

Note that there are some restricted countries, including the United States, China, Cuba, Iran, Syria, North Korea and Sudan.

Benefits

Trading with Dsdaq comes with multiple benefits:

- Cryptocurrency collateral trading

- Range of other assets available

- Good online reviews

- OD mining rewards

- STP execution

Drawbacks

Disadvantages of choosing Dsdaq include:

- Only available as a mobile app

- Limited education resources

Trading Hours

Cryptocurrency trading is a 24-hour market but bear in mind that other assets do have specific session times. Forex is open Monday to Friday, from 00:00 – 23:59 EST.

Trading times for stocks depend on the exchange, for example, stocks listed on NYSE or NASDAQ are open Monday – Friday, from 16:30 – 23:00 EST. The broker provides a full breakdown of these times on the Fees and Conditions page.

Customer Support

Help is only available via the Help Centre or the live chat support. The chat feature was fast and helpful when tested and is available both on the broker’s website and in the app. The Help Centre is also fairly useful and covers everything from account security to bonuses.

Trading Security

Dsdaq uses robust 256-bit encryption protocols on their platform. The app also allows you to add email, phone or Google verification which can provide additional layers of security. These can be enabled from within the app’s Security Centre.

Verdict

Dsdaq offers a unique trading app that provides collateral trading opportunities with digital currencies and other financial assets. The crypto mining feature also allows users to earn rewards whilst trading. In addition, clients enjoy reliable 24/7 live chat support and low minimum deposit requirements, making Dsdaq a strong overall provider.

Top 3 Alternatives to Dsdaq

Compare Dsdaq with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Go to Interactive Brokers

Dsdaq Comparison Table

| Dsdaq | IG | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 0.5 | 4.4 | 4 | 4.3 |

| Markets | Cryptocurrencies, forex, indices, commodities, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | 0.001 BTC/BCH/LTC | $0 | $1000 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC | FCA, SEC, FINRA, CBI, CIRO, SFC, MAS, MNB |

| Bonus | $10 welcome bonus | – | – | – |

| Education | No | Yes | No | Yes |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:30 | 1:50 |

| Payment Methods | 1 | 6 | 5 | 6 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Swissquote Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by Dsdaq and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Dsdaq | IG | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Dsdaq vs Other Brokers

Compare Dsdaq with any other broker by selecting the other broker below.

FAQ

Is Dsdaq a good broker?

Dsdaq is not as established as other brokers, however, the company has strong investors and a good product range. It’s also worth checking out online reviews from other customers before signing up.

What is Crypto Collateral trading?

Crypto Collateral Trading is a FinTech innovation by Dsdaq. It allows you to borrow ‘buying power’ from the brokerage to trade financial assets such as stocks, indices and forex, without selling your crypto coins.

How do I open an account with Dsdaq?

To open an account, simply download the mobile app from your App Store or Google Play and sign up using the in-app registration form.

What is the minimum deposit requirement at Dsdaq?

There is no minimum initial deposit to open an account. As a result, you can start trading with 0.001 BTC, BCH and LTC.

What can I trade at Dsdaq?

Dsdaq offers over 30 cryptocurrency pairs, 12 crypto contracts, over 150 stocks, 14 indices, 18 ETFs, and a small selection of forex pairs and commodities.

Customer Reviews

There are no customer reviews of Dsdaq yet, will you be the first to help fellow traders decide if they should trade with Dsdaq or not?