Did the Fed Restart QE?

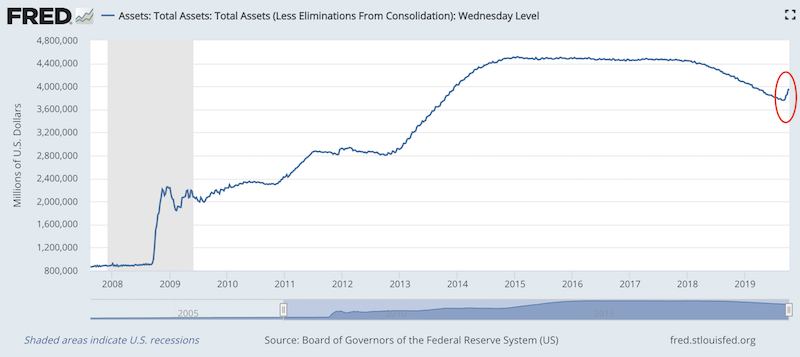

Due to recent issues in the repo market, the Federal Reserve began growing its balance sheet again to avoid a scarcity in reserves (a type of cash asset held by banks).

In 2017, the Fed began to shed around $50 billion per month to unwind some of its post-crisis stimulation designed to lower interest rates further along the curve. This was needed to get nominal interest rates below nominal growth rates so debt servicing demands would stay low and the economy could begin growing again. Chair Janet Yellen at the time said it would non-disruptive to the point of “like watching paint dry.”

Because of the way the Fed sets monetary policy – by paying interest on excess reserves, which influences the incentives of commercial banks’ willingness to create credit – there needs to be ample amounts of reserves in the banking system for the current rate setting paradigm to function effectively. When there is a lack of supply, their price goes up in the form of higher rates.

Now, there’s a somewhat trivial – borderline pointless – debate going on among policymakers, economists, and financial market participants about what to call this new program. Did the Fed restart QE? Is it not QE? Is it QE-lite?

Some argue it’s “QE4”. The Fed had three rounds of quantitative easing (“QE”) during the 2009-14 period, so QE4 would, it that sense, denote the fourth iteration.

There are similarities and differences between the current open market operations and the previous ones.

Like QE 1-3, this is a type of permanent open market operation (POMO) in that its a recurring transaction, or set of transactions, over the course of a given timeframe. This is different from a temporary open market operation (TOMO), which is a one-off type of transaction. Like QE, it is designed for reserve management purposes; namely, to boost their quantity.

However, the extent and aim of this new program is different from the asset buying of the past.

In this case, the Fed is keeping front-end rates within their desired range by avoiding reserve scarcity. And due to purely technical reasons, such as currency growth in circulation (a liability), the balance sheet needs to expand for organic reasons. This means adding assets (e.g., buying Treasury securities) to offset the corresponding liabilities.

The Fed’s prior asset buying program will restart when its primary form of monetary policy (front-end interest rate adjustment) no longer has any room left to run to stimulate the economy (rates are at zero or whatever the effective lower bound is believed to be).

Asset markets think little of this current new operational adjustment, unlike in the case of QE, where it was a very big deal in pushing investors into riskier assets.

Stocks didn’t care about the spike in repo lending rates that led to this adjustment (and to a lesser extent, the rise in overnight lending rates between member banks). Repo spikes happen from time to time and the issue is typically transitory and doesn’t divert much to extra corporate interest expense, which would otherwise mean less cash to shareholders and lower share prices.

But the Fed nonetheless needs to control front-end rates because it will impact household, corporate, and government funding costs if the higher rates in various money markets go on long enough.

The current technical adjustment to the balance sheet provides no additional easing or “accommodation” or any adjustment to ongoing monetary policy. There is no adjustment of longer-term interest rates. So, there is really not much that is actually “QE” about it.

Did the Fed restart QE? Key differences

Below are the main differentiating factors between QE 1-3 and the current open market operation:

1. QE 1-3 was intended to boost asset prices to create a “wealth effect”; the current open market operation does not.

2. QE 1-3 bought longer-duration assets to lower rates further out on the curve; the current open market operation is only buying the shortest duration assets (T-bills).

3. QE 1-3 was intended to add excess liquidity to the financial system; the current open market operation is trying to prevent excess liquidity from shrinking.

4. QE 1-3 was “secondary” policy due to the fed funds rate at just above 0 (i.e., effectively maxed out in terms of further effectiveness); the current open market operation is conducted at a fed funds rate of 182bps.