Trading Demo Competitions

Trading demo competitions are a great way to practise financial speculation without any inherent risk but maintain the possibility of financial reward at the end. Many brokers, especially CFD and forex brokers, offer demo accounts that are funded with virtual capital and mimic real-world market data. Trading demo competitions leverage these benefits in a level playing field tournament amongst traders with a particular broker. This 2024 guide breaks down how they work, the kind of prizes available and how to choose the best ones.

Best Brokers For Demo Trading Competitions

These 10 brokers offer the best demo trading competitions based on our tests:

Trading Demo Competitions Comparison

| Broker | Demo Competition | Minimum Deposit | Minimum Trade | Platforms | Regulator | Visit |

|---|---|---|---|---|---|---|

|

✔ | $10 | 0.01 Lots | R StocksTrader, MT4, MT5, TradingView | IFSC | Visit |

|

✔ | $50 | 0.01 Lots | ProTrader, MT4, MT5, TradingView, DupliTrade | FCA, ASIC, FSCA, VFSC | Visit |

|

✔ | $100 | 0.01 Lots | FxPro Platform, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade | FCA, CySEC, FSCA, SCB, FSC | Visit |

|

✔ | $0 | 0.01 Lots | Web, MT4 | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | Visit |

|

✔ | $5 | 0.01 Lots | MT4, MT5 | ASIC, CySEC, FSC, FSCA | Visit |

|

✔ | $10 | $1 | MT4, MT5 | - | Visit |

|

✔ | $0 | 0.01 Lots | MT4, AutoChartist, DupliTrade | FCA, ASIC, DFSA, FMA | Visit |

|

✔ | $1 | 0.01 Lots | MT4 | IFSC | Visit |

|

✔ | $5 | $1 | Own | National Bank of Georgia | Visit |

|

✔ | $10 | 0.01 Lots | MT4, MT5 | FinaCom | Visit |

|

✔ | $50 | Variable | Trading Station, MT4, TradingView, eSignal | FCA, CySEC, ASIC | Visit |

|

✔ | $5 | 0.01 Lots | MT4, MT5 | FSC, SEBI, JFSA | Visit |

|

✔ | $1 | 0.01 Lots | MT4, MT5 | CySEC, FSA, VFSC | Visit |

|

✔ | $100 | 0.01 Lots | MT4, MT5, AutoChartist | SVGFSA, CySEC | Visit |

|

✔ | $50 | 0.01 Lots | MT4, MT5 | SCB, FSA | Visit |

#1 - RoboForex

Why We Chose RoboForex

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures

- Regulator: IFSC

- Platforms: R StocksTrader, MT4, MT5, TradingView

- Minimum Deposit: $10

- Minimum Trade: 0.01 Lots

- Leverage: 1:2000

Pros

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

Cons

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

#2 - Vantage

Why We Chose Vantage

Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds

- Regulator: FCA, ASIC, FSCA, VFSC

- Platforms: ProTrader, MT4, MT5, TradingView, DupliTrade

- Minimum Deposit: $50

- Minimum Trade: 0.01 Lots

- Leverage: 1:500

Pros

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

- The ECN accounts are very competitive with spreads from 0.0 pips and a $1.50 commission per side

Cons

- Unfortunately, cryptos are only available for Australian clients

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

#3 - FxPro

Why We Chose FxPro

Founded in 2006, FxPro is an established forex, CFD and spread betting broker offering 2100+ assets to over 2 million clients worldwide. The broker is regulated in 4 jurisdictions and offers reliable 24/5 customer support, earning it a high trust and safety score. FxPro has also picked up more than 100 industry accolades for its competitive trading conditions, including fast execution and deep liquidity.

"FxPro is best for experienced traders looking for wide market access, premium research tools and advanced charting platforms. The competitive fees and fast execution will serve serious short-term traders, whilst the BnkPro investment service will appeal to those looking for long-term e-money solutions."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, Futures

- Regulator: FCA, CySEC, FSCA, SCB, FSC

- Platforms: FxPro Platform, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade

- Minimum Deposit: $100

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (Retail), 1:500 (Pro), 1:1000 (Via Prime Ash Capital Limited)

Pros

- There's an interactive learning center for beginners with tests, courses, video tutorials and webinars

- Comprehensive analysis and trading tools are available for seasoned traders, including signals powered by Trading Central and VPS hosting

- FxPro maintains its position as a top no dealing desk (NDD) broker, with fast execution speeds under 13ms and co-located trading servers with Tier 1 banks

Cons

- FxPro's services are mainly geared towards experienced investors and beginners may find the broker's fees and accounts complex

- There's no copy trading service, which reduces the appeal for strategy providers looking to earn extra revenue

- There are only a handful of payment methods available, compared to the 10+ offered at top competitors like AvaTrade

#4 - CMC Markets

Why We Chose CMC Markets

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

"With advanced charting tools and an extensive range of tradable CFDs, including an almost unrivalled selection of currencies and custom indices, CMC Markets provides a fantastic online platform for traders of all levels. "

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting

- Regulator: FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA

- Platforms: Web, MT4

- Minimum Deposit: $0

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (Retail), 1:500 (Pro)

Pros

- The web platform delivers a fantastic user experience with advanced charting tools for day trading and customizable features, catering to both beginners and experienced traders. MT4 (but not MT5) is also supported.

- The brokerage continues to stand out with its wide range of value-add resources, including pattern recognition scanners, webinars, tutorials, news feeds, and research from respected sources like Morningstar.

- CMC offers excellent pricing, including tight spreads and low trading fees for all but stock CFDs. The Alpha and Price+ schemes also offer perks for active traders with up to 40% discounts on spreads.

Cons

- While CMC offers an above-average suite of assets, there is no support for trading real stocks and UK clients can’t trade cryptocurrencies.

- The CMC Markets app offers the complete trading package but the design and user experience trails category leaders like eToro.

- Trading stock CFDs incurs a relatively high commission, especially compared to the cheapest brokers like IC Markets.

#5 - FBS

Why We Chose FBS

FBS is an award-winning forex and CFD broker based in Cyprus. The broker has a strong global reputation with authorization from the CySEC and ASIC, amongst others regulators. The brand has 17 million clients in over 190 countries, attracted by a diverse range of markets and the reputable MetaTrader platforms.

"FBS is a great choice for traders of all experience levels and budgets with various account types, plus MetaTrader 4 and MetaTrader 5 access. That said, the broker's Cent account and intensive forex course will be particularly beneficial for beginners."

- DayTrading Review Team

- Instruments: CFDs, forex, indices, shares, commodities, cryptocurrencies

- Regulator: ASIC, CySEC, FSC, FSCA

- Platforms: MT4, MT5

- Minimum Deposit: $5

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (EU & Restricted Countries), 1:3000 (Global)

Pros

- The MetaTrader terminals deliver a comprehensive day trading environment at FBS, including up to 21 timeframes and 6 pending orders

- There’s a comprehensive learning section with tailored courses, webinars and trade ideas

- FBS maintains its position as a trusted European broker with top-tier licenses, several awards and negative balance protection for clients

Cons

- There’s no copy trading solution which would offer an alternative way to trade and is offered at many top competitors like Skilling

- There's a limited range of assets overall, including only 35+ currency pairs

- Account availability, platform access and market coverage all vary by jurisdiction

#6 - NordFX

Why We Chose NordFX

Founded in 2008, NordFX is an offshore CFD broker offering forex, stock, commodities, indices and crypto trading to over 1.7 million clients in 190 countries. Traders access markets through the MT4 and MT5 platforms and benefit from low commissions, spreads from zero and decent extra features. Minimum deposits start from just $10 and very high leverage is available up to 1:1000.

"NordFX's biggest advantages are available to upper-tier account holders, so this is a good option for experienced, higher volume traders looking for ECN, zero-spread trading. That said, the lack of regulation is a notable concern and the broker's market coverage is weak compared to alternatives."

- DayTrading Review Team

- Instruments: Forex, CFDs, indices, commodities, cryptos, stocks

- Platforms: MT4, MT5

- Minimum Deposit: $10

- Minimum Trade: $1

- Leverage: 1:1000

Pros

- The straightforward copy trading service will suit beginners or improving traders, with just a $100 minimum deposit to get started

- NordFX has strengthened its account options with Pro accounts featuring spread-only pricing and Zero accounts with spreads from 0.0 on assets like the EUR/USD

- There's an impressive 25+ payment methods, including local bank transfers, with zero fees and near-instant processing

Cons

- Pricing trails the cheapest brokers, notably IC Markets

- With only around 100 instruments, NordFX’s market coverage is uncompetitive vs most alternatives

- The lack of strong regulatory oversight is a major concern as clients will receive limited safeguards

#7 - Axi

Why We Chose Axi

Axi is a global forex and CFD trading firm, founded in 2007 in Sydney, Australia. Highly leveraged trading opportunities plus a $0 minimum deposit make it a popular choice among 60,000+ traders worldwide. Axi also stands out for its resources, including copy trading and Autochartist.

"Axi maintains its position as a top forex and CFD broker for seasoned traders, with more than 70 currency pairs, raw spreads and additional benefits for high-volume trading. Beginners will also appreciate the user-friendly copy trading service and free forex eBooks."

- DayTrading Review Team

- Instruments: Forex, CFDs, indices, shares, commodities, cryptocurrencies

- Regulator: FCA, ASIC, DFSA, FMA

- Platforms: MT4, AutoChartist, DupliTrade

- Minimum Deposit: $0

- Minimum Trade: 0.01 Lots

- Leverage: 1:400

Pros

- The broker’s free trading resources are geared towards short-term traders, including various market calendars and dividend forecast schedules

- Experienced traders can benefit from the Axi Select funded trader programme, offering funding up to $1 million and up to 90% profit share

- Traders can choose between 10 base account currencies plus a wide range of free deposit methods, including cryptos

Cons

- The Axi Select program requires a $500 minimum deposit to enter the first Seed stage

- The tightest round-trip commission fees of $3.50 are only available to those who can deposit $25,000

- There's a limited choice of third-party charting platforms compared to other brands, with only MT4 available alongside the proprietary app

#8 - SuperForex

Why We Chose SuperForex

Established in 2013, SuperForex is an offshore CFD and forex broker offering highly leveraged trades on 400+ instruments via the popular MetaTrader 4 platform. The broker has gained clients in over 150 countries and is regulated by the Belize IFSC. With a range of STP/ECN account types, including swap-free, micro and zero spread, this broker continues to suit traders with different styles and setups. SuperForex also offers a range of welcome bonuses and trading contests.

"SuperForex will suit experienced traders looking for high leverage rates and premium membership packages. The broker also continues to stand out for its wide selection of beginner-friendly accounts, although the lack of top-tier regulation is a notable drawback."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Cryptos, Commodities

- Regulator: IFSC

- Platforms: MT4

- Minimum Deposit: $1

- Minimum Trade: 0.01 Lots

- Leverage: 1:2000

Pros

- SuperForex offers an auto-reset balance program, which prevents trading accounts from dropping below zero

- There’s a decent range of educational resources including video tutorials, guides and seminars

- You can get free access to the Pattern Graphix expert advisor software for MT4, a price pattern analysis tool which can help you save time

Cons

- The Belize IFSC is not considered a top-tier regulatory provider, so clients may receive fewer financial safeguards

- The 0.5-pip minimum spreads in the standard ECN accounts are not as tight as some of the cheapest ECN brokers, such as Pepperstone

#9 - CloseOption

Why We Chose CloseOption

CloseOption is a Georgia-headquartered broker with over a decade in the trading industry. The brand offers high/low binary options trading on forex and crypto markets, with decent payouts, welcome bonuses, 24/7 customer support and intuitive trading software.

"CloseOption is a good pick for traders seeking a user-friendly binary options platform with high payouts and joining bonuses."

- DayTrading Review Team

- Instruments: Binary Options on Forex & Cryptos

- Regulator: National Bank of Georgia

- Platforms: Own

- Minimum Deposit: $5

- Minimum Trade: $1

Pros

- CloseOption offers weekly trading tournaments with cash prizes

- New traders can get started with a $5 minimum deposit

- Multiple global payment methods are available

Cons

- CloseOption is not regulated by a well-regarded trading authority

- Clients need to deposit $50,000+ to qualify for the best payouts

- Binary options are only available on fiat and digital currencies

#10 - Grand Capital

Why We Chose Grand Capital

Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

"Grand Capital is a good broker for traders familiar with MetaTrader plus passive investors interested in copy trading and LAMM solutions. On the downside, the broker's regulatory credentials lag behind competitors."

- DayTrading Review Team

- Instruments: CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options

- Regulator: FinaCom

- Platforms: MT4, MT5

- Minimum Deposit: $10

- Minimum Trade: 0.01 Lots

- Leverage: 1:500

Pros

- Six accounts to suit different trading styles and strategies

- GC Invest platform for copy trading

- Demo competitions with cash prizes

Cons

- Limited regulatory oversight

- Basic education and market research

- High spreads on some assets

What Are Trading Demo Competitions?

Trading demo competitions are a more fun way to earn money trading on the forex, cryptocurrency and commodity markets without staking any real money. Through these tournaments, brokers provide demo accounts to traders who try to make as much profit as possible in a set amount of time. Some brokers may measure performance in different ways, such as profitability/risk ratio. Demo trading applies live market prices and is carried out on genuine trading platforms to mimic real trading as accurately as possible.

Once a competition has begun, traders must do their best to generate profit by trading their demo funds on the financial markets offered by the broker, be they ETFs, CFDs or stock indices. Competitions will often have specific sets of rules to follow, presenting unique challenges to clients by varying leverage limits, automated trading, assets and more.

Brokers offer tournaments with durations that can range from a single trading day to month or year-long contests. The best trading demo competition prizes will often be for the longer periods of competition but there can be good prizes on offer for shorter contests too. Prizes are assigned after competitions close and trading results are finalised based on a leaderboard of the highest scoring traders. Rewards are not only for winners, though, with some of the biggest trading demo competitions paying out across ten leaderboard places.

How Do Trading Demo Competitions Work?

Entering A Demo Competition

Trading demo competitions will often have a window in which traders can sign up to take part, which can often be around a week. Before entering a tournament, potential competitors can look at the rules and terms and conditions of the tournament as well as the offered prize fund. Entrants should read the rules carefully to ensure they are fair and reasonable. Additionally, the biggest trading demo contests will allow competitors to see the size of the field and the historical data from previous competitions.

It is normally a straightforward process to sign up for a competition, though some brokers that run trading demo competitions require entrants to possess a live trading account with them to qualify. Many tournaments will also be locked to a set trading platform to ensure a level playing field, so entrants should make sure they are familiar with the specific software.

Demo Account Is Assigned

Each competition entrant is provided with a fresh demo account shortly before the competition starts supplied with a fixed amount of demo capital to trade with. The account might have limits on available trading leverage in line with competition rules or it may be up to traders to independently ensure that they do not break tournament regulations.

Competition Opens

At a set time, the competition will open and traders will have until the competition ends to make as much profit as they can. Trading demo competitions from different brokers will often have their own sets of rules, with some limiting the total number of trades allowed, amount of leverage, the use of EAs and available trading assets.

Performance Tracking

Once the trading demo competition is underway, entrants will want to know how they are performing and how their gains or losses stack up against others. The biggest tournaments provide leaderboards where traders can measure their performance against their competitors’ trades. Entrants can quickly see if they are in a prize-winning position and how aggressively they need to trade if not. Performance data is often also available from past trading demo competitions to give users an idea of the kind of returns that are required to finish in a winning position at the end of the competition.

Competition Ends

At the competition close time, all open trades will automatically be closed and no more trading is allowed. The amount in each demo account at this time is final and will be used to calculate a trader’s leaderboard position and potential prize eligibility.

Final Leaderboard Published & Prizes Allocated

Once all trading has ceased o, profits are finalised for each user. The final rankings of all competition entrants are now decided with prizes awarded to entrants based on these rankings. Rewards are often either in the form of withdrawable cash or trading credit to be used on the broker’s site. The former is often more appealing to entrants but the latter can also be useful and is generally worth more. If a trader is comfortable with the platform and trusts the broker, this credit can be used to generate more profit and then be withdrawn later.

Entrants can be disqualified for breaking competition rules either before the final leaderboard is published or afterwards. Traders that narrowly missed out on prize positions should check back in case someone above them drops out.

Advantages Of Trading Demo Competitions

- Free To Enter – One of the main pulls of trading demo competitions is that they are completely free to enter. Rarely in trading or investment does anything come completely free, so these tournaments are a rare opportunity to gain something for nothing.

- Gain Experience With No Risk – As trading demo competitions are designed to imitate real market trading closely, traders have the chance to gain valid experience with new markets with no risk attached. For emerging trading markets such as cryptocurrencies, this can be very valuable. Experience is important for new or intermediate traders who wish to get a feel for the markets. Tournaments are also a way for veteran traders to gain experience with greater leverage, different software or new currency pairs without risk to their capital.

- Perform Under Pressure – One thing that differentiates demo trading contests from normal demo accounts is the pressure that comes with potential rewards. Competing for the best prizes is a great way to expose traders to the pressure that comes with having a real financial outcome when trading. It is easy to maintain a clear head and watertight strategy when nothing is at stake in a standard demo account, introducing prizes adds similar mental pressures to trading real capital.

- Beginner-Friendly – Trading demo competitions are a great place for new and aspiring traders to start. Gaining a solid amount of practice before staking real capital is crucial to long term success and these tournaments are the perfect place to learn the fundamentals of forex, cryptocurrency and commodity trading. There is no substitute for a hands-on environment for learning and demo competitions allow beginners to test out their knowledge in a realistic trading scenario.

- Prizes – What may appeal most to some traders is the prospect of being rewarded for no-risk trading. The best trading demo competition prizes can be thousands of dollars, with leaderboard places paid out up to the top ten traders. Competition prizes are either paid out in the form of withdrawable cash or trading capital.

- A Chance To Test EAs – Trading demo competitions will have different rules on the use of expert advisors or EAs. Those that allow enhanced trading provide a great opportunity to test algorithms on real market conditions, seeing how effectively they function and whether there are any bugs in their software. Ironing out errors and optimising performance during a trading demo competition means that, when capital is at stake, traders can trust their expert advisor software.

Drawbacks Of Trading Demo Competitions

Here are a couple of reasons why traders may be put off trading demo competitions:

- Limited Prize Positions – If traders are competing in trading demo competitions purely with winning prizes in mind, then this can be a frustrating affair. The biggest demo trading competitions have many thousands of entrants and only a handful are rewarded for their efforts.

- Payouts Can Be In Trading Credit – Many traders will want to be rewarded in cash if they finish in a prize-winning position but some prizes are paid in trading credit. This means that competition prizes have to be traded live before they can be withdrawn, which adds both risk and hassle to being paid out.

- Unrealistic Trading Required To Win – In a demo trading competition, there is nothing to lose and everything to gain from aggressive trading. For the vast majority of traders, the amount of leverage and risk required to compete for a prize position in the biggest trading demo competitions will be an unrealistic strategy when using real funds.

What To Look For In Brokers That Offer Trading Demo Competitions

If you decide that trading demo competitions are something you’d like to try, then many brokers offer monthly, weekly or even daily tournaments. Here are some things to look for when selecting a broker to compete in demo tournaments:

Authenticity & Reliability

When signing up with any broker for a trading demo competition or otherwise, you should first ensure that the broker is trustworthy and reliable. This is especially important for firms who pay their prizes in trading credit because traders will have to use their platform to wager their rewards.

Prospective clients should research brokers, looking at user reviews from external sources as well as recommendations or warnings from trusted websites. The biggest brokers that run trading demo competitions will often be regulated by an independent governing body, so look out for such certification as an indicator of authenticity.

Important aspects of a broker include the reliability of deposits and withdrawals, safe holding of client funds and stability of the platform.

Prizes & Structure

Naturally, traders will be drawn towards the biggest trading demo competition prizes when browsing brokers. The largest tournaments can offer prize funds worth thousands of dollars, which is an appealing prospect for entrants.

As well as the size of a prize fund, it is also worth checking out the reward structure of each competition. More leaderboard places being paid means a higher chance of winning but also a smaller share of the fund for each winner. You should choose carefully between these factors, depending on your priorities.

Depth Of Field

Another key aspect when choosing whether to enter a specific trading demo competition is the depth of field. While larger prize pools are attractive to individual traders, this will likely increase the number of competitors for a prize. Theoretically, traders will have a better chance at winning with a smaller field, so each entrant has to find a balance between the prize pool and the depth of field.

Information on the number of entrants may be available during the sign-up phase to a competition. Alternatively, most competitions will display past leaderboards showing how many entrants there have been in each contest historically.

How Winnings Are Paid Out

An important factor for traders to consider when looking for brokers that offer trading demo competitions is how the prizes are paid out. Some firms will pay prizes in cash or withdrawable funds while others will pay out in trading credit on their platform. Such funds will need to be traded before being withdrawn. You need to decide whether you are willing to jump through these extra hoops before withdrawing your funds.

Available Trading Platforms

To ensure fairness or to promote a particular trading software, trading demo competitions are often locked into a specific platform. Some of these will be platforms experienced traders are familiar with, such as MetaTrader 4 or MetaTrader 5. Others may be unfamiliar or bespoke to brokers. You should ensure that you are familiar with the trading platforms that contests use or are willing to learn quickly during the competition.

Other Aspects To Consider

Now that you are familiar with the intricacies of trading demo competitions, as well as informed with what to look out for in brokers, you are ready to compete. Here are a few additional things to keep in mind:

- Region Locked Brokers – Some brokers that run demo trading competitions may only be open to entrants from specified jurisdictions. Before entering a tournament, make sure that your region is allowed to participate.

- Taxation – The rules around taxation on trading demo competition prizes are murky, so it is best to check out the regulations in your country. Some countries may consider winnings as gambling rewards and therefore tax-exempt, while others may require traders to pay tax if their winnings exceed a certain amount.

- Claiming Prizes – Some brokers require prize winners to claim their prizes manually, so do not expect every reward to be credited automatically. Often, this is through email or other forms of contact, so make sure you are on the ball and claim before the end of any eligibility periods.

Final Word On Trading Demo Competitions

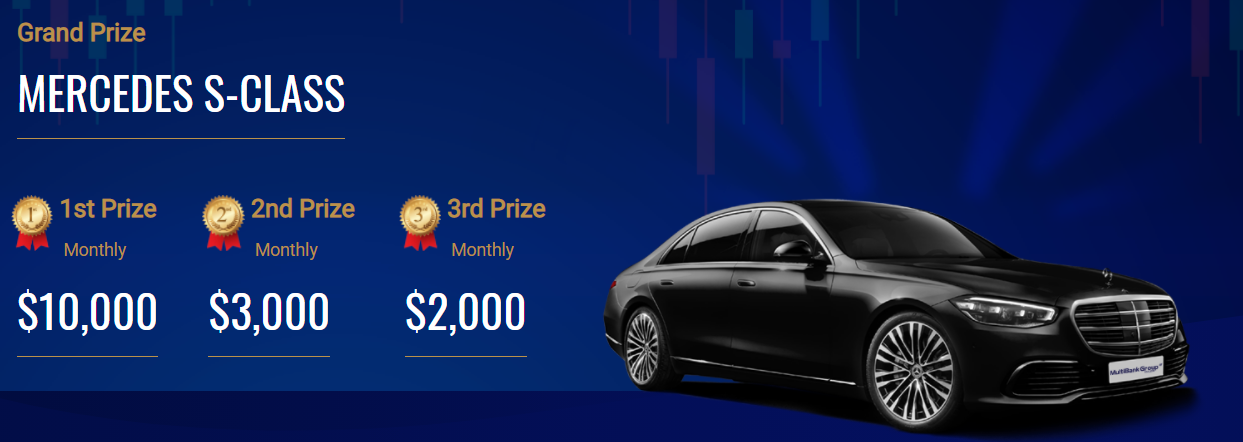

Trading demo competitions draw many people in with their offer of risk-free trading experience and tantalising prizes. Such tournaments are available for almost all forms of financial instruments, from forex and CFDs to cryptocurrency forwards and binary options, providing a little something for everyone. The best trading demo competitions have prize pools worth thousands or tens of thousands of dollars, comprised of pure cash, trading credit or physical items. For experienced traders, the largest tournaments offer a chance to compete with the best around, while beginners can benefit from its risk-free provision of experience.

FAQs

Which Assets Can Be Used In Trading Demo Competitions?

Trading demo contests mainly take place on the forex markets but can also cover cryptocurrency, commodities, CFDs and shares trading. Specific contests may impose limitations on the instruments and assets you are allowed to use, removing some currency pairs, for example, or even whole asset classes.

Can You Make Money From Trading Demo Competitions?

The best trading demo competitions feature monetary prizes ranging from hundreds to thousands of dollars for those who score highly on the leaderboards. It is very possible to make money from tournaments, with up to the top ten leaderboard positions usually taking home a share of the prize pool.

Are Trading Demo Competitions Free?

There is no cost to enter trading demo competitions but some brokers may require entrants to have registered a real money trading account with them first.

Can I Use EAs To Help Me In Trading Demo Competitions?

Whether entrants are allowed to use EAs in trading demo competitions depends on each broker’s specific rules for their contests. There is a good range of brokers that allow EA assisted trading as well as plenty that prohibit it.

How Many People Enter Trading Demo Competitions?

The biggest trading demo competitions often have thousands, if not tens of thousands of competitors. Entrants are drawn in by large prize funds, so look for smaller rewards if you wish to compete against fewer traders.