Coronavirus: How Bad Can It Get for Financial Markets?

Coronoavirus is the biggest global health scare since the Ebola outbreak in 2014. It is shaping up to be the most influential to financial markets and global output since SARS in 2003. It has already passed SARS in the number of people infected.

In this article, we will look at what the market moves were around the outbreak of recent previous public health scares, such as SARS, bird flu, and swine flu, and what we can realistically expect for coronavirus.

Fatality rates remain below that of SARS. Coronavirus is currently registering a 3 percent fatality rate versus a 10 percent rate for that of SARS.

On the same token, China’s influence on the global economy is much higher than it was back in 2002-03. Accordingly, when looking at how things were historically, this needs to be taken into consideration. Looking at the past as an example of how things should work for the future is only a good assumption when you’re dealing with closed systems and you know the future will be like the past. (This may be a good way of operating to build a chess program, but bad when figuring out how to make money in the markets.)

Even with lower fatality rates relative to SARS, the influence of coronavirus on global economic activity is very likely to be materially larger with China’s current economic output.

Public health scares tend to wash out in the sense that there’s a temporary drop in productivity that causes asset markets to re-adjust before popping back when everything is contained (or rumors thereof).

Structural re-ratings of markets would occur if there was material damage to the labor market, such as a large death toll. SARS, for example, had 8,098 reported cases and 774 confirmed deaths. None of those deaths were in the US. To puts its lethality into context, this means close to 10 percent who were infected died because of it. Those 65 and older were particularly at risk. More than half of those who died were in this age cohort.

Even if you take it that coronavirus is a temporary hit to markets, holding all else equal, you don’t know how bad the price move can get in the interim. Cash should always be some portion of one’s portfolio as a buffer to handle any spikes in volatility.

Equities are likely to sell off temporarily, as they’ve been doing, while safe long-duration fixed income is likely to do well.

Gold will also perform, while most commodities, which are sensitive to growth, will not. Oil and copper, in particular, typically sell off during periods where growth is expected to run below expectation.

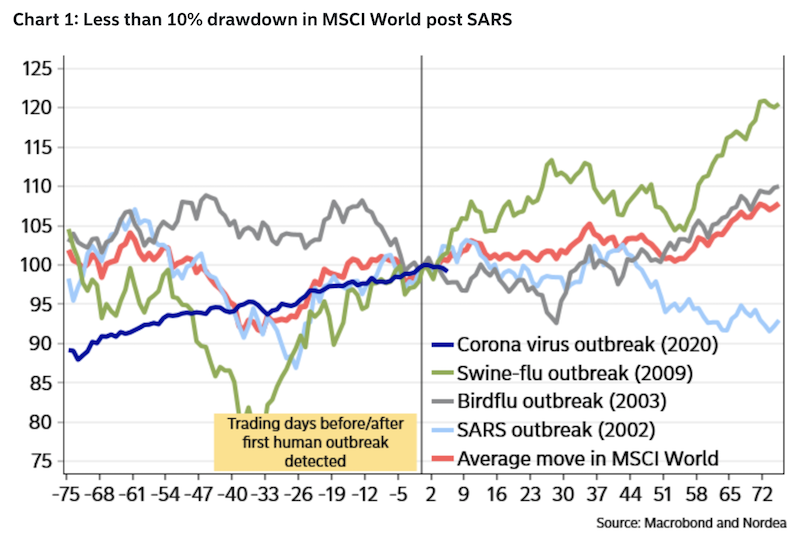

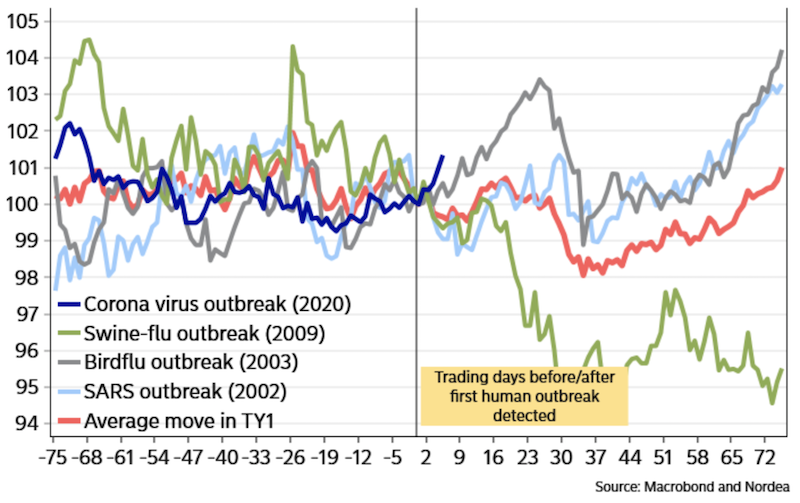

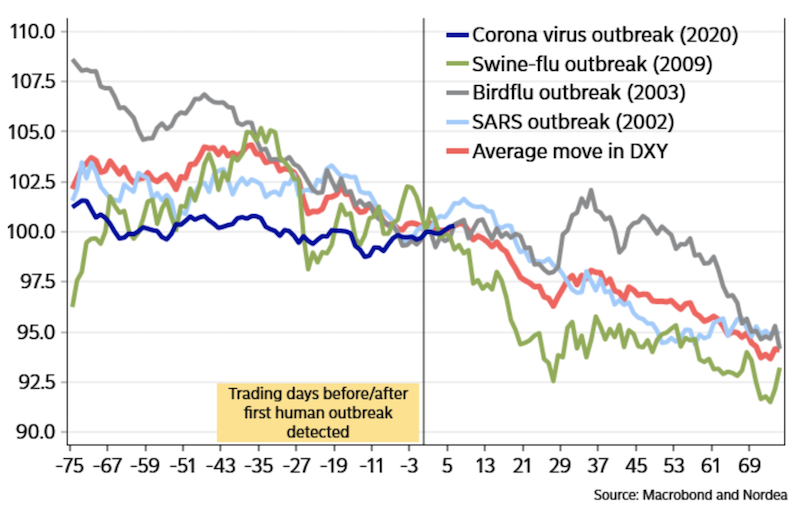

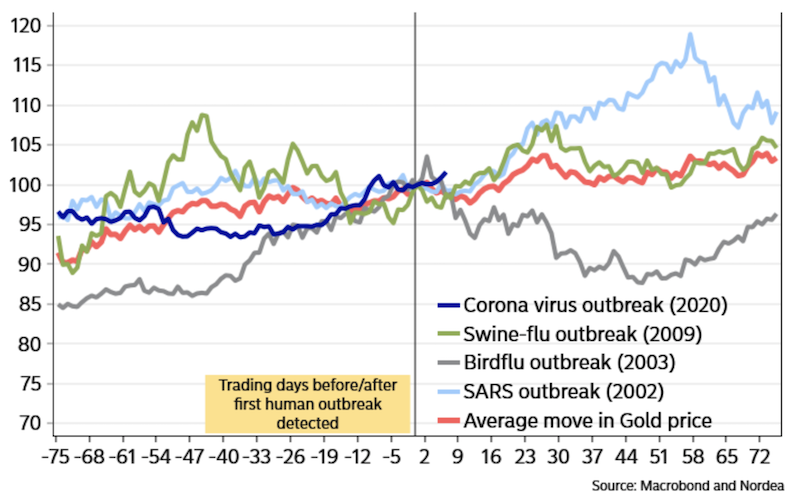

The charts below look at market moves surrounding the outbreak of SARs, bird flu, swine flu, and the current coronavirus outbreak.

Charts

Equities

There was less than a 10 percent dip in global equities – taken as the MSCI World index – during the course of the SARS outbreak.

There were some distributional effects. European equities were hit among the hardest, running down 20-25 percent. Hong Kong’s index lost nearly one-fifth of its value in three months.

Rates and Fixed Income

Fixed income of longer duration is likely to benefit. Market participants move into longer duration fixed income when global growth expectations decline, holding inflation expectations constant.

On the short-term rates front, more rate cuts have been priced in. As of the end of January 2020, the market now expects an 80 percent chance of at least two rate cuts priced in. It was closer to zero at the beginning of the year.

Developed market yield curves (USD, EUR) have became slightly flatter with rates on the back end rallying more than the front of the curve. In other words, the difference between short-term lending rates and long-term lending rates has compressed.

When European equities did poorly during the SARS outbreak, a lot of those flows went directly into German bunds, the EU’s top reserve asset.

US Treasury futures

Since coronavirus worries first began impacting financial markets following the January 17 close, the 10-year US Treasury bond has fallen from 182bps to 158bps (and has been lower).

The long-term Baa corporate bond yield has fallen 15bps from 399bps to 384bps.

The Baa corporate bond yield for all maturities has dropped 16bps from 305bps to 289bps. With respect to the latter, this is the lowest in seven years. This means even with inflation at about 2 percent, traders get not even 1 percent per year in inflation-adjusted yield for taking on a non-immaterial level of credit risk.

The high-yield bond index has naturally been the most adversely affected by coronavirus fears as riskier bonds are largely in the same bucket as equities in terms of the type of market in which they perform best.

On January 17, the US high-yield index stood at 526bps versus the 579bps on January 27. It’s since eased back to under 560bps, though remains at risk until the coronavirus fears dissipate.

Currencies

Risk off moves are normally pretty limited in FX during these viral outbreaks. JPY is a typical gainer because of its use as the short leg in carry trades. This leads to JPY short covering when traders pull back risk in response to lower growth expectations.

DXY (US dollar)

Commodities

Gold rose more than 15 percent following the SARS outbreak. Industrial metals and oil did poorly. The moves in commodity markets have been larger than those seen in previous public health scares. This reflects China’s larger consumption of these materials given its larger size economically.

Gold

Buy the dip?

There is always the possibility that the coronavirus scare will become worse before becoming better and lead to new de-risking. Past scares have been limited to mostly limited, temporary price declines in equity and commodity markets and other growth-sensitive assets like emerging market currencies.

During the SARS epidemic, the tourism sector was hit hard in particular. Inbound tourism fell 27 percent from Q1 to Q2 2003 when the outbreak hit its peak. Declines were notable in retail sales, air freight, and transportation. Sectors more oriented toward intellectual property, construction, financial services (particularly asset management), and exports were largely not affected.

Health scares, similar to localized war campaigns and terror incidents, have historically been buying opportunities rather than sources of sustained selling.

SARS is the most common parallel, given its origination in China.

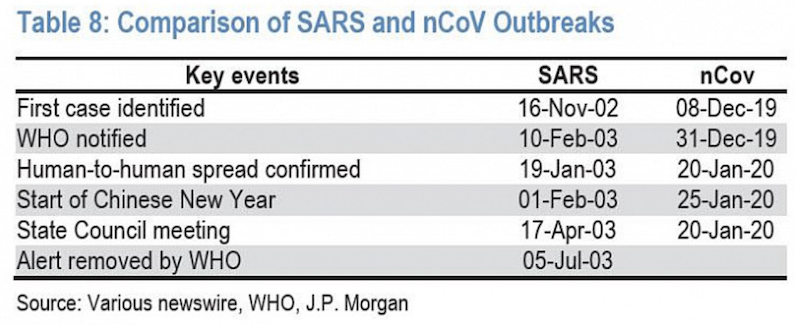

JPMorgan put out a side-by-side comparison of SARS and coronavirus (also known as nCoV) across various criteria:

(i) when the first case was identified,

(ii) when the WHO was notified,

(iii) first confirmed transmission,

(iv) the first material reaction to it by government authorities (i.e., State Council meeting), and

(v) when the alert from the WHO was removed (which is still TBD for coronavirus):

We can see that with respect to the relevant dates of the first case received, the first human-to-human transmission was quicker with coronavirus. However, the responses by WHO and Chinese authorities have been more swift to coronavirus.

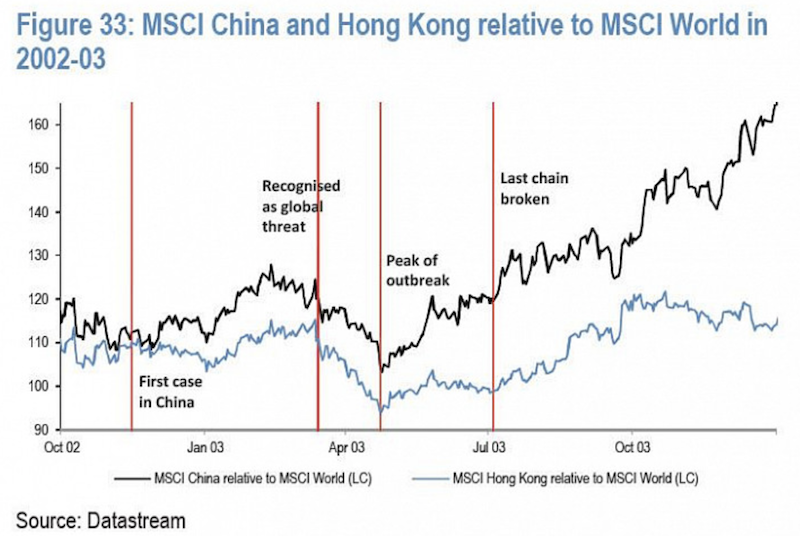

Here we can compare MSCI China and MSCI Hong Kong to their relative changes in MSCI World during the 2002-03 SARS outbreak.

The impact on Chinese equities was significant. Hong Kong equities lost almost 20 percent over the course of a few months. Chinese markets were down 15 percent over this period relative to the world index.

When the uncertainty in outcomes abated during the April to June 2003 period these markets began to come back.

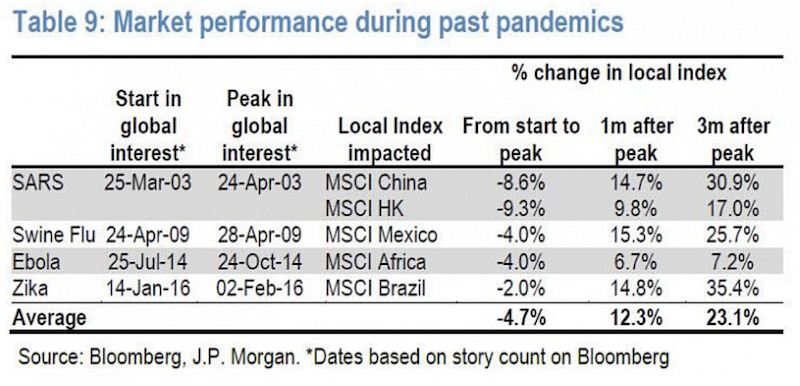

The figure below compares various outbreaks and how they impacted their local MSCI stock indices – SARS (China and Hong Kong), swine flu (Mexico), Ebola (Africa), Zika (Brazil).

Coronavirus is a unique risk

Coronavirus is a unique tail risk to markets. Unlike financial events that drive risk off sentiment, like the 2008 financial crisis and unanticipated rises in interest rates (e.g., Q4’18), policymakers have limitations in how well they can deal with a problem of this magnitude. Rate cut expectations have accelerated, as traders bet on central banks easing to offset any lost productivity stemming from the virus.

As of the end of January 2020, about 8,000 people, mostly in China, have been infected and more than 170 individuals have died since it was identified in December.

Global businesses with Chinese operations are working to scale back operations and close stores while the Chinese government is restricting travel. Airlines are suspending flights and large multinational companies are limiting their travel to China. Some companies are warning that the virus will impact financial results. Many US workers returning from China have been asked to work remotely for a period of weeks going forward as a precaution against its spread.

Within China itself, tens of millions of people have been impacted by government restrictions on travel.

Conclusion

The idea that “everything will be okay” in the sense that markets will regain their footing and volatility will decline is probably correct. In other words, equities and other risk assets are likely to decline then subsequently rebound.

But there’s a level of extrapolation that goes with this prognosis based on what happened during comparable outbreaks. There was not prolonged selling during these episodes. Buying opportunities came to manifest themselves within weeks or months after the initial drop once the “scare” was controlled.

Some aspects of coronavirus are different that could change the way things ultimately pan out. China is obviously a much larger economy now relative to when it experienced the SARS outbreak nearly two decades ago.

With respect to coronavirus itself, there’s an incubation period of seven days that makes it difficult to contain transmission. Some cases don’t display any fever. In other words, when the symptoms don’t immediately manifest, people aren’t aware that they’ve been infected and are likely to go about everyday activities as normal. With all the interaction that comes with that, passing it along to others is easier, and makes controlling it somewhat trickier.

Coronavirus is a material tail risk to markets and brings with it structurally higher volatility. This will last until the virus has run its course even if the coronavirus-related market drop bottoms before that.

This is another case where the range of unknowns are larger than the range of knowns relative to what’s already baked into the prices of financial markets. It serves as another reminder that learning how to balance your bets well and not betting too much on any given asset or asset class is key.