Coinmama Review 2024

- Daytrading Review TeamNew crypto investors looking to buy and sell popular tokens like Bitcoin with fiat currency will appreciate Coinmama. We particularly rated the loyalty program as a way to reduce fees.

Coinmama is a popular cryptocurrency exchange that aims to provide streamlined and user-friendly cryptocurrency trading options to the retail market. Traders can buy a range of tokens via a fiat on-ramp, store their tokens in a third-party wallet and earn loyalty bonuses for trading with Coinmama. Millions of clients from over 180 countries have signed up to the firm.

Crypto Trading

Buy, hold and sell 16 crypto tokens including major players like BTC and ETH and lesser-known tokens such as LRC. Use a range of fiat currencies to buy the digital assets, including USD. Cryptos are stored in third-party wallets.

✓ Pros

- Diverse methods to buy crypto with fiat including e-wallets, SEPA, bank transfers and SWIFT

- Save on fees and commissions with larger deposits

- Choice of third-party wallets to store your tokens

- Used by more than 3 million crypto investors

- Straightforward to use for beginners

- Loyalty bonuses with fee discounts

✗ Cons

- No iOS mobile app for iPhone and poor quality Android (APK) app

- No direct crypto trading – clients must first purchase BTC or ETH

- Poor selection of cryptocurrencies compared to competitors

- High commissions from 2.93% for the highest tier account

- User reviews reveal some quality issues

- Limited wallet compatibility vs MetaMask

Coinmama is a reliable cryptocurrency exchange with a global customer base. The firm’s tagline is “the easiest way to buy & sell cryptocurrency”, making it popular with beginner investors. In this 2024 review, we explain whether the platform delivers or not, covering its mobile app, sign-up verification, trading fees, and more.

Coinmama Headlines

Coinmama is a user-friendly crypto trading platform providing access to popular coins like Bitcoin and Ethereum. The brokerage also offers a free mobile application where clients can manage their digital currency portfolio.

Nimrod Laurence, a serial entrepreneur and founder, established the company’s head office in 2015 in Israel. The current owner is New Bit Ventures, and the HQ (headquarters) office is located in Dublin. So far, Coinmama has served more than 3 million customers across 188 countries.

While awareness of cryptocurrencies has grown, many still view them as too technologically advanced for the average person to dabble in. Services like Coinmama are changing this perception by making Bitcoin, for example, easy to purchase, hold, and exchange for other tokens.

Coins & Tokens

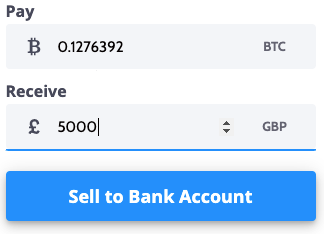

Entry coins can be bought or sold using regular fiat currencies while most cryptos can only be exchanged for other cryptos. Coinmama offers two entry coins: Bitcoin and Ethereum. The fiat selection consists of US Dollars, Euros, British Pounds, Canadian Dollars, Australian Dollars, and Japanese Yen. Chinese Yuan isn’t supported.

The Coinmama crypto list also includes Bitcoin Cash, Litecoin, Tezos, Ripple, Dogecoin, Monero, Uniswap, and Chainlink. However, they can only be bought and sold using Bitcoin or Ethereum.

Note that you can still buy or sell Ripple. When the Ripple lawsuit with the SEC started many traders believed there would be a Coinmama XRP delist, however, this has not yet happened.

Fees

Coinmama uses a loyalty system to determine the charges you pay on transactions.

Loyalty Program

Users are automatically enrolled in the loyalty scheme when they start using the service. The more traders buy and sell, the more loyalty points they earn.

Customers are divided into three categories depending on how much crypto they buy. Investors are assessed over a rolling 90-day period, meaning if they stop using the service or reduce the amount of crypto bought, they may lose the loyalty ranking. The rankings are as follows:

- Curious – 3.90% commission, no discount on fees, no minimum purchase limit

- Enthusiast – 3.41% commission, 12.5% discount on fees, $5,000 (over 90 days) minimum required spend

- Believer – 2.93% commission, 25% discount on fees, $18,000 (over 90 days) or $50,000 (over lifetime) minimum required spend

Additional charges may apply if the rate is locked until the payment is received. If the transfer option chosen requires a locked rate, this will appear as a 0-5% express fee at checkout.

Importantly, fees are relatively high though similar vs Coinbase. Cheaper alternatives, such as Kucoin, which has a maximum fee of 0.1%, can also be found.

Note, there are no deposit or withdrawal fees, but day traders should keep in mind that their bank may charge for cryptocurrency purchases and international transactions.

Crypto Platforms & Wallets

The exchange has its own basic platform, alongside two-third party Bitcoin wallet providers:

Exodus

Exodus provides mobile and desktop access. You can send, receive and exchange 180+ cryptocurrencies. It boasts a straightforward interface and easily integrates with other DeFi platforms, such as the Lightning Network, which makes Bitcoin transactions cheaper. The firm has also partnered with Magic Eden to provide clients access to an NFT marketplace.

Exodus does not need users to register or provide personal information – there are no Know Your Customer (KYC) standards. All transactions are anonymous and Exodus creates a new wallet download link for each BTC transaction.

ZenGo

ZenGo connects to NFT & DeFi dapps. The wallet stands out from the competition because of its keyless facial recognition sign-in process. In addition, it provides 70+ cryptocurrencies alongside low fees. Users are also able to store and stake crypto, a service not offered on Coinmama.

Exodus and ZenGo are both well-established and receive positive reviews online.

Mobile App

Coinmama has an APK mobile app available on the Google Play Store. The application can be used to trade major and emerging cryptos, alongside account management features. Clients can also sign-up and register through the mobile app. On the downside, the Android app only has a 2.9 star rating, with most reviews complaining about poor quality features.

Note, there is no iOS app available in the Apple Store.

Funding

Deposit methods include:

- Skrill

- Fedwire

- Apple Pay

- Debit card

- Credit card

- Google Pay

- Wire transfer

- SWIFT (Global)

- Open Banking (UK)

- SEPA and SEPA Instant

- SWIFT Fast Payment (UK)

You can use all the above methods to buy, but only Fedwire and SEPA to withdraw.

The minimum deposit or withdrawal is $30 on most payment processors, Fedwire is $500, and all SWIFT transfers require $250. To sell your coins, you will need a minimum of $100.

Coinmama offers industry-standard processing times. It doesn’t take much longer than using a credit or debit card, with most options taking less than one hour and the rest up to five days (wire transfers).

Note that you cannot use American Express, Discover card, PayPal, a gift or prepaid card to fund your account.

Demo Account

No demo account is provided, which makes it harder for novices to try Coinmama’s services before investing real funds. This is a real disadvantage versus competitors, especially when the registration process asks for ID verification. This is an area in which Coinmama could make improvements.

Bonuses & Promotions

The only promotion offered is through the loyalty program. When you reach the Enthusiast level, you can save 12.5% on fees, and 25% at the Believer level. Unfortunately this offer is limited in comparison to other brokers. Many have low fees from the beginning in addition to rebates and welcome bonuses.

Is Coinmama A Legit Site?

Coinmama is operated by Cmama LTD, which in term is owned by New Bit Ventures. They both follow Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Cmama LTD is also registered as a money services business with FinCEN and FINTRAC.

Additional Features

The exchange has an academy that helps beginners learn:

- What is Bitcoin

- Exchange origin

- What is fiat money

- How to buy Bitcoin

- What is crypto staking

- What is a crypto wallet

- Market cap of key coins

- How to open an Ethereum wallet

- How to add money to a Bitcoin wallet

- How sales agents can support activities

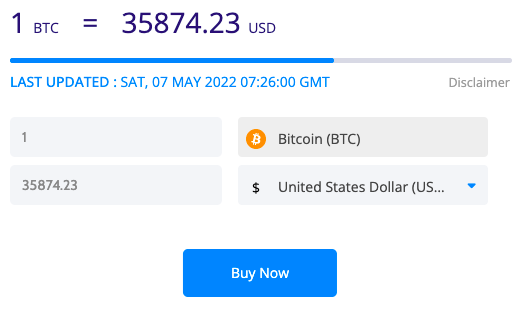

Additional resources include a crypto calculator updated with the latest exchange rates and a news blog where you can find the latest company events. Many YouTube, Reddit, and Wikipedia contributors have also answered inquiries about the verification process and fees.

Live Accounts

Coinmama doesn’t have different account types in the traditional sense. Instead, the loyalty ranking we described above is in place. This separates users based on the invested amount with larger deposits leading to better fees and customer service.

Based on verification, there are four levels. This helps determine the order limit which varies between $5,000 and $1,000,000. For example, level 2 has a daily limit for bank wire transfers of $35,000.

Verification time usually takes 30 minutes and can be completed 24/7. You will need to provide several documents and take a selfie to prove your identity before seeing how the platform works.

Coinmama also offers a business account with special requirements and a buy limit of up to $100 million. This White Glove Service is aimed at high-net-worth individuals and firms who wish to build long-term portfolios. Users can request to join today through the official coinmama.com website.

Trading Hours

Cryptos can be bought and sold 24/7. Account verifications can also be completed during the same period. With that said, customer service and business inquiries can only be made between 7:00 AM to 01:00 AM (UTC/GMT).

Customer Support

Good, efficient customer support is essential for any cryptocurrency exchange. Coinmama’s customer service team can help with:

- Sign in problems

- How long to verify

- Pending for payment

- Order in process issues

- Credit card not working

- How to close or delete an account

- Help to manually process orders

- Fix transaction in process delays

- How to open and create an account

- Process a refund or a referral code

- Supported countries and restricted areas

- Buying coins and transferring them to your wallet

- Information on country-specific fees and login pages, like UK, US, etc

Note, the team can’t help with regional taxes, such as the UK capital gains tax or the 1099 tax form in the US.

Alongside the help center, Coinmama also has a dedicated email channel where most support requests are answered within 24 hours. The live chat logo location can be found in the bottom right corner of the website, offering faster support. The mobile phone number is +1 (650) 600-9939 (California) and the Twitter handle is @coinmama.

The loyalty scheme means that some users, those who spend the most money, are entitled to a priority service from customer support. This is great news for big spenders, but it can leave less wealthy users feeling like they don’t matter.

Security

Coinmama has established Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, in addition to 3D and two-factor authentication (2FA).

But while the homepage will tell you the exchange is legitimate with over 3 million customers in 188 countries, there are numerous online reports of issues such as 3D authentication having failed, the platform not working, orders having failed, hacks, credit card problems and more.

The biggest complaint most users have about Coinmama is the lengthy identity verification system.

Fund Safety & Capital Measures

The Coinmama exchange is a strong advocate of self-custody wallets, meaning retail investors can maintain control over digital assets. This also means that the exchange does not hold any funds in reserve, and it simply sells cryptocurrency to retail customers from its own inventory.

Following the collapse of FTX in November 2022, the exchange has stuck to its motto and its advocacy for individuals to maintain control of private keys. ‘Not your keys, not your crypto’.

Note, when you buy cryptocurrency via Coinmama, tokens are sent to a crypto wallet of your choice. So, retail clients are in complete control of the digital currency once purchased. This also means you don’t have to worry about someone else having access to your wallet’s private keys, or your funds being kept in a major exchange’s hot wallet that may be susceptible to hacking or insolvency.

Remember to stay up to date with personal wallet protection and implement security features.

Should You Join Coinmama?

Whether you should sign up with Coinmama will probably depend on how much you plan to invest. The crypto exchange is clearly interested in big spenders who benefit from the best investing services and fees. Beginners and those starting out, however, may find a more competitive service elsewhere, such as Coinbase, Binance, and Kucoin.

FAQ

Is Coinmama Available In New York?

Hawaii and New York are the only restricted states in the USA – you cannot use the platform in these regions.

Is Coinmama A Fake Site?

Coinmama is a genuine and relatively safe website and the FinCEN and FINTRAC regulate the exchange. The firm also follows Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

Is There A Coinmama App?

Yes, there is an Android app, but the rating is low. There is no mobile application for iOS users.

Should I Choose Coinmama Or Binance?

By comparing Coinmama vs Kraken, Binance, Simplex or Coinbase, you can weigh up the pros and cons to find the best platform for your investing style. Each trader wants access to different products, tools and payment solutions.

What Cryptos Aren’t Available On Coinmama?

Here is a guide on unavailable cryptocurrencies: Coinmama doesn’t have a coin price for 1 coin, R coin, Q coins, K coin, D coin, V coin, H coin, Y coin, W coin, ZMAX coin, WAY-F coin, G coins, PMA coin, X coin, V coin IMVU, MAMI coin, P coin, O coins, BMAX coin, BBT coins, ACH coin, and many others. UMA coin price isn’t displayed either.

Top 3 Alternatives to Coinmama

Compare Coinmama with the top 3 similar brokers that accept traders from your location.

-

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Go to Interactive Brokers -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone

Coinmama Comparison Table

| Coinmama | IG | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.9 | 4.4 | 4.3 | 4.8 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $30 | $0 | $0 | $0 |

| Minimum Trade | $30 to buy, $100 to sell | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FinCEN, FINTRAC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, SEC, FINRA, CBI, CIRO, SFC, MAS, MNB | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 7 | 6 | 6 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

Pepperstone Review |

Compare Trading Instruments

Compare the markets and instruments offered by Coinmama and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Coinmama | IG | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Coinmama vs Other Brokers

Compare Coinmama with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Coinmama yet, will you be the first to help fellow traders decide if they should trade with Coinmama or not?