CMSTrader Review 2024

CMSTrader offers multi-asset trading with fast payment speeds & useful features.

Forex Trading

Trade FX with high leverage rates.

Stock Trading

Trade on 23 global indices at CMSTrader.

CFD Trading

Trade online CFDs with 1:400 leverage.

Crypto Trading

Trade on a handful of cryptocurrencies.

CMSTrader is a forex and CFD broker offering the MT5 desktop, mobile and web platform. In this review, we’ll find out if CMSTrader is regulated and safe, or if it could be a scam. We’ll also cover everything from deposit times to margin calls. Find out if you should login and trade with CMSTrader.

CMSTrader Company Details

CMSTrader is a brand name of Safe Side Trading Ltd, a company based in Saint Vincent. At the time of writing, the broker has over 300,000 active traders with over $9 billion in trading volume. Unfortunately the company is not regulated by a legitimate regulator.

CMSTrader offers trading across forex, indices, commodities and cryptocurrencies on the popular MetaTrader 5 platform. There are also some additional tools available, including forex signals and social trading.

Trading Platforms

MetaTrader 5

The intuitive and easy-to-use MT5 interface includes one-click trading functionality, which directs trade orders to top-tier liquidity providers without delay. Advanced charting features allow traders to easily calculate market patterns and analyse prices, using real-time data. The financial news feed also allows you to react quickly to global events.

Once you have registered for an account, the MT5 platform is ready to download straight from the website.

MetaTrader WebTrader

CMSTrader’s MT5 web terminal is a convenient way to trade on the world’s most popular financial markets, without having to download any programmes. The platform offers real-time trading, simplified and user-friendly graphics, plus social trading features. As with the desktop version, one-click trading is also available.

Markets

CMSTrader offers 37 major, minor and exotic currency pairs, 23 global indices and a selection of cryptocurrencies. There’s also a range of commodities and precious metals, including gold, oil and sugar, as well as over 120 company stocks. Our review was pleased with the range of assets available.

Trading Fees

Minimum spreads are around 3 pips for EUR/USD and around €3.5 for FTSE 100. Gold is around $0.7 and crude oil spreads start from $0.05. CMSTrader claims to incorporate commission fees into their spreads, though there is a lack of transparency around costs in general.

There is an inactivity charge of $99 each month that there is no new trading activity. This is very high compared to many other brokers, so less active traders should be careful if they are thinking about opening an account. There is also an account closure fee of 50 USD/EUR/GBP which is applied when an account reaches 50 currency units or below.

Leverage

Traders can leverage up to a maximum of 1:400 on forex. Indices and commodities can be leveraged up to 1:50 and stocks up to 1:20. Cryptocurrency trading is available with leverage up to 1:5.

Mobile Apps

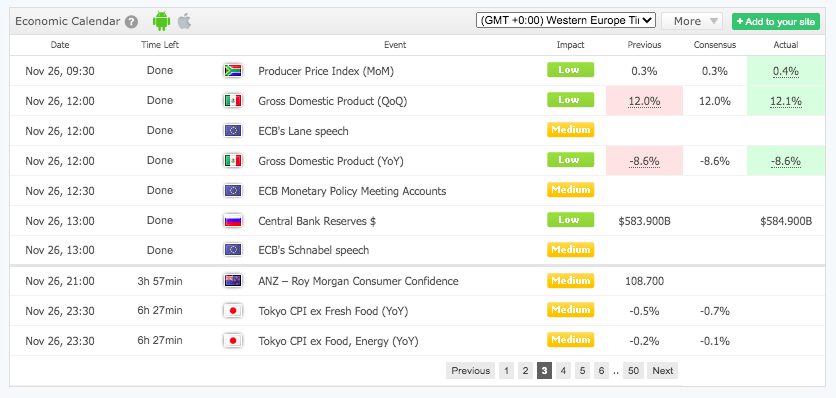

Traders can take the markets anywhere with the MT5 mobile app, which is available on iOS and Android phones. The app allows you to process orders with a single tap, manage accounts in real-time and follow market news in the economic feed.

You can also access many of the same technical analysis and charting features as the desktop app. Social trading is also available on the CMSTrader.com MT5 platform.

Deposit & Withdrawal Reviews

CMSTrader offers several fast payment methods, including wire transfer, bank cards, EPay, Skrill, GiroPay, Klarna and Neteller.

Most methods are fee-free, except for bank wire which costs $20. The minimum amounts for both deposits and withdrawals is $500. The maximum amounts for both is $10,000. CMSTrader is not transparent around payment speeds, so it’s worth checking with customer support for clarity.

Demo Account

CMSTrader does offer a demo account for an unlimited time, which is suitable for traders who wish to try out the platforms before opening a live account. Demo accounts enable you to place simulated trades and test out different strategies without risking any real capital. CMSTrader demo accounts come with 50,000 USD/EUR/GBP in virtual funds.

Given the questionable trust rating of CMSTrader, we’d recommend testing the broker’s services before committing real capital.

CMSTrader Bonuses

At the time of writing, CMSTrader is not offering any bonuses or promotions. Traders should check the broker’s website or social media pages for any future deals.

Licensing

CMSTrader is a brand name of Safe Side Trading Ltd, a company registered offshore in Saint Vincent. The broker is not regulated or transparent with its company history on the website. Due to the lack of regulatory oversight, it is unlikely that traders will receive much, if any, protection on their deposits. This is a major drawback if you’re thinking about register for an account and may give rise to scam concerns.

Additional Features

Additional features at CMSTrader includes pages on forex analysis and a market review, though these are brief. The broker does offer a social trading feature which allows traders to copy successful traders within the MT5 platform. There are some other practical tools advertised on the website, though most are inaccessible or return you to a blank page.

CMSTrader Accounts

Traders can choose between the Mini Account, Silver Account or Gold Account at CMSTrader. All accounts offer free daily signals and market updates, hedging and 24/7 multilingual support. The minimum trade volume in all accounts is 0.10 lots and the margin call is 30%.

The Mini Account requires a $500 minimum deposit, which is a very high starter deposit compared to other brokers. The account also offers instant execution, fixed spreads and leverage up to 1:200. Note that this account only permits trading via the WebTrader.

The Silver Account offers NDD execution, fixed spreads, leverage up to 1:400 and cross-platform trading options via web and mobile. Additional features include video tutorials and VIP events. Note that you will need a deposit of at least $10,000 to trade in this account.

With a $50,000 minimum deposit, the Gold Account offers instant or NDD execution, fixed or variable spreads, leverage up to 1:400 and cross-platform trading options. Gold account holders also get additional features including monthly performance reports and fast withdrawal options.

Benefits

Trading with CMSTrader comes with benefits:

- Good funding methods

- Range of instruments

- Social trading feature

- Free daily signals

- Islamic account

Drawbacks

However, we did find some notable drawbacks:

- Unregulated

- Low trust rating

- High account fees

- Lack of transparency

- Poor customer opinions

- $500 minimum deposit

Trading Hours

The forex market is open 24/5, from Sunday at 22:00 GMT to Friday at 21:00 GMT. Gold and silver markets are available from 23:00 to 22:10 GMT. Other markets vary and are listed in the product specifications or within the trading platform.

Customer Support

You can get help from the customer support team via email, telephone or live chat. The broker also lists several office locations on the website, including the UK, Switzerland, Bahrain and Australia.

- Email – sales@cmstrader.com

- Telephone – +44 203 868 7251

Security

CMSTrader automatically encrypts confidential information between client computers and their own servers, using the Secure Sockets Layer protocol (SSL), with 128-bit keys. The broker also uses electronic firewalls and servers which are not directly connected to the internet.

CMSTrader Verdict

Our review of CMSTrader has uncovered a few areas for concern. Whilst there does appear to be a good range of payment methods and assets on offer, the high minimum deposit and account costs seem unnecessary. With no regulated status and a lack of transparency in certain areas, we do also have to question how safe it is to trade with this broker.

Top 3 Alternatives to CMSTrader

Compare CMSTrader with the top 3 similar brokers that accept traders from your location.

-

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

GO Markets – GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

Go to GO Markets

CMSTrader Comparison Table

| CMSTrader | AvaTrade | Swissquote | GO Markets | |

|---|---|---|---|---|

| Rating | 1.5 | 4.9 | 4 | 3.9 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, forex, indices, shares, energies, metals, cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | – | $1000 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | – | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | FCA, FINMA, DFSA, SFC | ASIC, CySEC, FSC of Mauritius |

| Bonus | – | – | – | 30% cash rebate |

| Education | No | Yes | No | Yes |

| Platforms | MT5 | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, AutoChartist, TradingCentral | MT4, MT5, AutoChartist, TradingCentral |

| Leverage | 1:400 | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:500 |

| Payment Methods | 7 | 13 | 5 | 7 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | AvaTrade Review |

Swissquote Review |

GO Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by CMSTrader and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CMSTrader | AvaTrade | Swissquote | GO Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

CMSTrader vs Other Brokers

Compare CMSTrader with any other broker by selecting the other broker below.

FAQ

Is CMSTrader regulated?

Safe Side Trading Ltd (CMSTrader) is an unregulated broker based in an offshore location. This broker will therefore not offer the same protection as firms who are regulated by trusted agencies such as the FCA or CySEC.

Is CMSTrader a scam?

With the lack of transparency and no regulatory license, our trust rating of CMSTrader is low. It is possible the broker could be a scam.

What can I trade at CMSTrader?

CMSTrader offers 37 currency pairs, 23 popular indices and a range of cryptocurrencies. There’s also dozens of company shares, as well as oils, precious metals and agricultural commodities.

How much capital do I need to trade with CMSTrader?

For the Mini Account, you will need to deposit at least $500 initially. The Silver Account requires a $10,000 minimum deposit and the Gold Account requires $50,000.

What deposit methods are available at CMSTrader?

CMSTrader offers deposits via bank wire and credit/debit cards, plus e-wallets and online payment systems such as Skrill, Neteller, Klarna and Giropay.

Customer Reviews

There are no customer reviews of CMSTrader yet, will you be the first to help fellow traders decide if they should trade with CMSTrader or not?