Cable Looks Stretched

The last 12 months have been kind to Sterling with the UK currency rising from a low of $1.14 in mid-March 2020 to over $1.42 two weeks ago.

But there are clouds beginning to gather on the horizon as National Debt approaches £2 trillion, Government debt will reach 97.1% of GDP by 2023-24 and Rishi Sunak’s budget barely scratched the surface of the Coronavirus related expenditure (£190 billion and counting) incurred during the last year.

The Furlough scheme prevented mass unemployment but unless we see a V shaped economic recovery, it may have merely postponed the date of large-scale redundancies.

Inflation Concerns

The success of the vaccination programme may lead to a surge in delayed expenditure as lockdown ends, but the track record of the UK with economic booms (combined with enduring low productivity), mean Inflation is the most likely outcome in the short to medium term.

Debates on when to raise taxes and the associated risk of choking off any recovery suggests that neither fiscal nor monetary measures will be taken to address this potential inflation.

Sterling does look vulnerable to a correction in the short term.

Correction Indicators

There are a number of factors lining up against the Pound at present, not the least of which is that US Dollar weakness (which was the primary driver of the recent rise in Cable) appears over at least for now.

- Interest rate differentials favour the US Dollar. The recent sharp rise in US yields leaves Sterling 10-year bond yields 0.8% lower than US equivalents.This means that it is expensive for traders to be long GBP (and thus implicitly short US Dollars, as they need to borrow US Dollars to maintain their position).Looking ahead, the Bank of England has recently raised the prospect of negative interest rates; the US Fed explicitly ruled this out in May of last year).

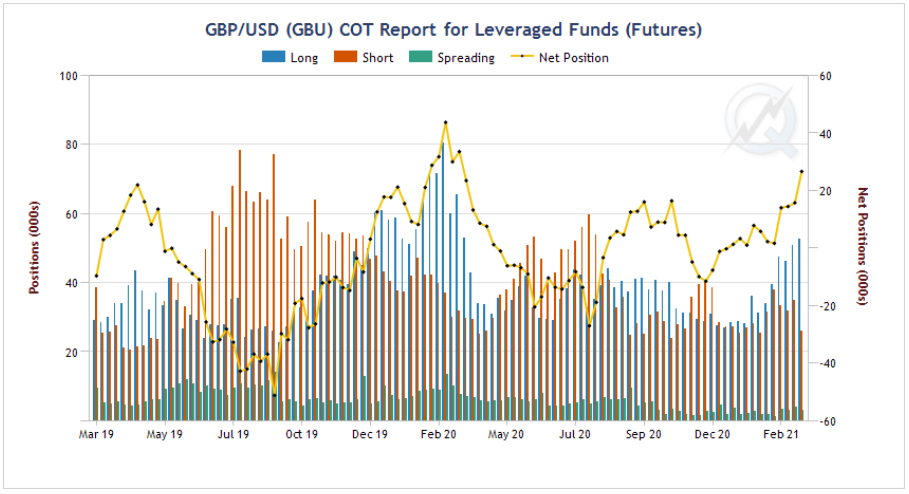

- This has not deterred speculators, (e.g. Hedge Funds) who have raised their long Sterling positions to one-year highs, according to the latest CFTC Commitment of Traders Report– the last time speculators were this bullish on Sterling, it subsequently fell 10% in a fortnight [1].

- The US Dollar has world reserve currency status and a liquid bond market into which investors can “park” money.Safe haven flows thus benefit the Greenback. Sterling, in contrast, has few natural buyers- when trouble strikes, it may well become friendless very suddenly, especially as the BOE has signalled no interest in a strong currency. They may get what they wish for.

[1] Leveraged Fund investors tend to be trend followers and are therefore often most exposed at market turning points. Any reversal in the Pound could force many of those to liquidate their positions very quickly.