Bithoven Review 2024

Bithoven is a MT5-powered online broker offering leveraged cryptocurrency trading.

Crypto Trading

Trade with 1:20 leverage on dozens of popular cryptocurrency coins.

Awards

- Fastest Growing Cryptocurrency Trading Platform 2019, St. Vincent & Grenadines - Global Brands Magazine

- Best Crypto Start Of The Year 2019 - IAFT Awards

Bithoven is an award-winning cryptocurrency exchange platform, offering margin trading on dozens of crypto coins, including Bitcoin, Ethereum, and Ripple. This review covers everything from leverage to payment methods. Find out if Bithoven is a trustworthy and regulated broker.

Bithoven Company Details

Operating under Fortis Ltd since 2019, Bithoven has over 60,000 customers and has seen $300 million in cryptocurrency exchanged through its platform. The company is registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines.

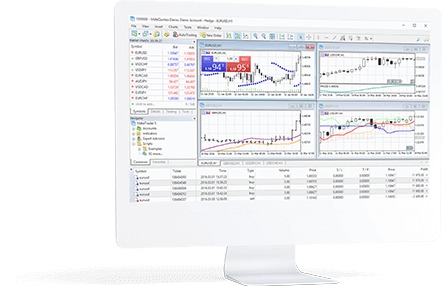

Trading Platforms

Within the Bithoven platform, users can switch between Exchange and Margin. From the Exchange page, there is a web trading platform where you can manage your BTC orders and view moving averages. From the Margin page, users can access MetaTrader 5.

MetaTrader 5

The advanced MetaTrader 5 (MT5) platform is designed to provide easy access to global exchange markets through a simple and intuitive interface.

Features include:

- 21 time frames, 38 technical indicators, 44 graphical objects

- 6 types of pending order, 4 order execution types

- Financial news & economic calendar

- Unlimited number of charts

- Advanced Market Depth

- Hedging & netting

- Historical data

MT5 is compatible with Windows PCs and can be downloaded from the Bithoven website.

MT5 WebTrader

MetaTrader 5 is also offered in a web browser version with the same features as the desktop app and without the need for any program download. Simply log in to your Bithoven account, switch to the Margin trading page, and select Web Terminal.

Markets

Margin traders can open positions against Bitcoin (BTC) or US Dollar (USD). The following markets are available:

- USD pairs – Including BTC, ETH, LTC, XMR, BCH, ZEC, DASH, XRP

- BTC pairs – Including BCH, DASH, ETH, XMR, ZEC

Fees & Pricing

For both exchange and margin trading, Bithoven charges a flat 0.2% trading fee across all cryptocurrencies. The fee is charged once you enter the market (both for opening and closing a position).

For margin trading, floating spreads start from zero, with a minimum order volume of 0.01. The margin call level is set at 40% and the stop out level is 20%.

Other costs to be aware of include a rollover charge levied on positions held overnight, with triple swaps being charged on Friday and Saturday. There is no inactivity fee.

Leverage

For margin trading, leverage can be set at 1:3, 1:10, or 1:20. These can be selected from within the Bithoven platform, upon opening a Live or Demo account.

Mobile Apps

Bithoven offers the MetaTrader 5 platform in a mobile app, compatible with both iOS and Android devices. The app allows traders to access the same features 24/7 wherever they are, including real-time quotes, push notifications, financial news, and rich historical data.

The app can be downloaded from the App Store or Play store.

Payment Methods

Bithoven only allows cryptocurrency deposits and withdrawals, so if you do not currently hold any cryptocurrency, you will first need to purchase them in an exchange (Bithoven recommend Switchere).

For exchange, deposit and withdrawal options include Bitcoin, Ethereum, Ripple, Bitcoin CASH, Tether, Litecoin, EOS, TRON, Stellar, and Cardano. Margin trading is in Bitcoin only.

There is no minimum or maximum deposit limits, however, withdrawal minimums will vary depending on the coin. These can be found on the product Fees list on the website. There is no maximum limit on coin withdrawals.

Processing times are eight hours for all coins. In terms of fees, depositing is free, however, there is a withdrawal fee (variable depending on the coin) on top of the 0.2% trading fee. For Bitcoin, the withdrawal fee is 0.0015 BTC and for Ethereum, 0.0428 ETH.

Demo Account

Bithoven offers a demo account where users can test the platform and apply leverage with zero risk. Demo Margin simulates trading with a wide range of cryptocurrencies within the MT5 platform. Leverage can be set up to 1:20 with a virtual balance between 1 and 10 BTC.

The demo account is available for as long as needed and can be opened from your margin account page after registering.

Deals & Promotions

Bithoven offers a fee compensation promotion whereby users deposit from 0.001 BTC to any margin account and they will receive instant compensation of 0.0005 BTC for the withdrawal fee charged on other platforms or BTC wallets.

Bithoven currently does not offer a deposit bonus.

Regulation & Reputation

Bithoven is registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, operating under Fortis Ltd. This isn’t the most respected regulatory agency, so customers may receive limited legal protection should the broker go under or refuse to pay out returns. With that said, Bithoven has picked up multiple industry awards in recent years suggesting they have a good reputation among traders and experts.

Additional Features

Bithoven provides some useful tools and resources that may help beginners, for example, video tutorials on trading signals and trading robots. There is also a list of the different available cryptocurrencies with respective white papers and additional information to provide market and product context.

Account Types

Due to the nature of the platform Bithoven provides only one Live account, however, inside the platform users can switch between the Margin trading page or the Exchange page. Note that Margin trading is in Bitcoin only. For crypto exchange, there are several currencies to choose from.

Benefits

Users of Bithoven can enjoy several benefits:

- User-friendly & intuitive MT5 platform

- Dozens of tradable cryptocurrencies

- Competitive trading fees

- No inactivity fee

Drawbacks

Disadvantages of using Bithoven include:

- Higher than average withdrawal fees

- Only crypto deposits available

- No online chat support

Trading Hours

Crypto trading hours run from 00:00 to 24:00 EET. Every Sunday there is a break in trading between 04:30 and 04:35 EET.

Customer Support

Bithoven customer support can be accessed by filling out an online request form, or by sending an email to customercare@bithoven.com. There is no live chat service or telephone number. However, on testing the online contact form, responses were helpful and received within a couple of hours.

Keep up to date with the latest news on the broker’s social media pages:

Safety & Security

Data exchanges between the platform and client servers are secured with TLS/SSL encryption, as well as two-step verification and automatic logouts. Bithoven is also partnered with BitGo, one of the safest and most secure cryptocurrency wallets.

Bithoven Verdict

With competitive trading fees, a user-friendly internal platform, and the MT5 offering, Bithoven makes it easy to use the exchange or start margin trading with Bitcoin. Though is it a good platform for all levels, its lack of comprehensive education and trading tools may be a slight drawback for newcomers.

Top 3 Alternatives to Bithoven

Compare Bithoven with the top 3 similar brokers that accept traders from your location.

-

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

IC Markets – IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Go to IC Markets -

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG

Bithoven Comparison Table

| Bithoven | AvaTrade | IC Markets | IG | |

|---|---|---|---|---|

| Rating | 2.5 | 4.9 | 4.8 | 4.4 |

| Markets | Cryptocurrency | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | – | $200 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FSA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | ASIC, CySEC, FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA |

| Bonus | Withdrawal fee compensation up to 0.0005 BTC | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral |

| Leverage | – | 1:30 (Retail) 1:400 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:250 (Pro) |

| Payment Methods | – | 13 | 14 | 6 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | AvaTrade Review |

IC Markets Review |

IG Review |

Compare Trading Instruments

Compare the markets and instruments offered by Bithoven and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Bithoven | AvaTrade | IC Markets | IG | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Bithoven vs Other Brokers

Compare Bithoven with any other broker by selecting the other broker below.

FAQ

Is Bithoven trustworthy?

From a security point of view, Bithoven is a safe and secure platform, using TLS/SSL encryption, two-step verification, and automatic logouts. Given the company is relatively new to the industry, we cannot yet comment on its track record.

What is the pricing at Bithoven?

Trading fees are 0.2% for takers and makers. The withdrawal fee depends on the coin, which you can find on the website.

What trading platforms does Bithoven use?

Bithoven uses MetaTrader 5, the most advanced and popular trading platform, accessible via a web browser, desktop, or mobile.

What payment methods are available at Bithoven?

For the cryptocurrency exchange, you can only deposit and withdraw using cryptocurrencies. These include Bitcoin, Ethereum, Ripple, Bitcoin CASH, Tether, Litecoin, EOS, TRON, Stellar, and Cardano. Margin trading is in Bitcoin only.

What margin trading tools are available at Bithoven?

Bithoven offers up to 1:20 leverage in 14 different cryptocurrencies, which you can trade against USD or BTC. There is also the option to trade other coins.

Customer Reviews

There are no customer reviews of Bithoven yet, will you be the first to help fellow traders decide if they should trade with Bithoven or not?