ATC Brokers Review 2024

- Daytrading Review TeamBased on my extensive tests, ATC Brokers is best for experienced traders who can afford the initial $2,000 cost and can trade enough volume to overcome the high deposit and withdrawal costs.

ATC Brokers is a London-based brokerage that was founded in 2012 and has since opened offices in California and the Cayman Islands. The firm benefits from rigorous FCA regulation for maximum client security, with leverage rates are capped at 1:30. The broker offers both self-directed investing as well as PAMM accounts, with access to the broker's MetaTrader 4 and MT Pro software.

Forex Trading

ATC Brokers offers a poor range of 35 forex products through the MT Pro platform. That said, I was impressed with the very tight spreads and low latency speeds.

Stock Trading

Aside from the 7 stock indices including the Dow Jones and S&P 500, stock traders will be disappointed that there are no equities on offer at ATC Brokers.

CFD Trading

My tests only uncovered 51 CFD products spanning currencies, indices, energies, precious metals and cryptocurrencies - a very underwhelming line-up compared to most other brands.

✓ Pros

- I'm a fan of the broker's advanced MT4 toolset called MT Pro, which supports advanced reporting and a more sophisticated one-click trading functionality

- I also rate the rapid trade execution through the broker's ECN pricing model, which allowed me to access spreads from 0.3 pips on EUR/USD

- Top-tier FCA regulation ensures that certain customers are protected from financial malpractice via robust safeguarding measures

- ATC Brokers offers both self-directed trading and PAMM investment accounts for experienced account managers

✗ Cons

- ATC Brokers has a disappointing asset range compared to most competitors, supporting a total of just 51 products

- I'm disappointed that there is no commission-free pricing model available for less experienced and lower-volume traders

- I expected a larger range of educational and analysis materials from the broker, which would help clients make more informed trading decisions

- The minimum deposit limit of $2,000 is pretty high in my opinion, especially with such a small asset list on offer

ATC Brokers Ltd is a forex broker offering ECN spreads on the MT4 and MT Pro trading platforms. Before you log in and download the terminal, follow this review for details on leverage, minimum deposits and commission fees.

ATC Brokers Details

ATC Brokers Limited was established in 2012 in London and is regulated by the Financial Conduct Authority (FCA). The broker also has an additional entity based in the Cayman Islands which is regulated by the Cayman Islands Monetary Authority (CIMA).

ATC Brokers follows an STP model, providing instant execution to top liquidity providers. The broker offers forex and CFDs instruments using innovative technology that suits both new traders and institutional clients.

Platforms & Tools

3 / 5MT Pro (MetaTrader)

MT Pro is an enhanced version of the MetaTrader 4 (MT4) platform, providing a range of features that aims to improve the overall trading experience. Traders can customise orders with comprehensive risk management tools, including bracket orders, trailing stops, and strategy orders.

The software also produces detailed trading reports including profit and loss, winners and losers, performance, and time analysis. In addition, there’s access to Depth of Market view, a complete charting package with a customised layout, and access to EA signals and automated trading.

Assets & Markets

1 / 5ATC Brokers offers over 35 currency pairs, from majors to exotics, as well as CFD indices such as the Dow Jones and S&P 500. You can also trade a selection of commodities, including oils, gold and silver. On the downside, cryptocurrency trading isn’t available.

Fees & Costs

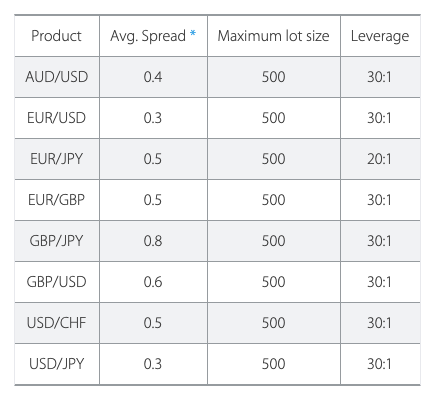

4 / 5Average variable ECN spreads on currency pairs such as EUR/USD are competitive, starting from 0.3 pips. Spreads are 0.7 pips for silver and around 0.6 pips for major indices such as the FTSE 100.

The commission is set to $0.60 round turn for a mini contract (10,000 lot size) and $6.00 round turn for a standard contract (100,000 lot size).

There is also a dormant account fee which is either 50 units of the account currency or the remaining account balance. This applies to accounts that have been left inactive for at least 6 months. Rollover fees also apply and these can be found within the portal.

Leverage

Trading leverage at ATC Brokers is set to 1:30 for major currency pairs, 1:20 for non-major currency pairs, gold, and major indices, and 1:10 for silver and other commodities. Professional traders can apply for 1:100 leverage. The broker details margin calculations within the FAQ section.

Mobile Apps

The MetaTrader 4 trading platform is available as a downloadable mobile app, free of charge from the App Store or Google Play. The app facilitates full account management, real-time data, and financial news. You can also utilise the 30 pre-loaded technical indicators for analysing the markets.

Once you have installed the app, you can use your ATC Brokers live account credentials to log in.

Deposits & Withdrawals

Deposits and withdrawals are available via bank wire, Visa, MasterCard, Skrill, and Union Pay, which accept USD, EUR, and GBP. Depositing via bank wire is fee-free, however, debit/credit cards and Skrill incur a 2.9% fee.

Withdrawal fees are 25 GBP/30 EUR/40 USD for international bank wire, 10 GBP for faster payment (UK only), and 1.0% for Skrill. Withdrawals via credit/debit cards are fee-free. Withdrawals are typically processed within 1 – 2 business days.

Demo Account

ATC Brokers offers a 60-day demo account. Traders can access live market pricing and place simulated trades in a safe and risk-free environment. Once you’re ready you can then open a real-money trading account.

ATC Brokers Bonus

There are no available deals at ATC Brokers. This is common with FCA-regulated brokerages, who are subject to restrictions designed to protect traders.

Regulation & Trust

3 / 5ATC Brokers Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, with FRN 591361, and by the Cayman Islands Monetary Authority (CIMA), with license number 1448274.

The FCA protects consumers by placing high standards and processes on firms. This includes segregating clients funds in separate accounts. ATC Brokers uses Barclays and NatWest for account custodian services.

UK clients are also protected by the Financial Services Compensation Scheme (FSCS) which protects up to £85,000 per person.

However, the CIMA is not considered a reputable financial authority, so traders should bear this in mind if they fall under this branch’s jurisdiction.

Additional Features

ATC Brokers does offer some educational content on forex and CFD trading basics. There’s also an economic calendar to keep track of global news, plus daily market news. Overall, the additional resources are good but are not particularly unique or substantial.

Account Types

Clients can open an individual, joint or corporate ECN account, which comes with narrow spreads and leverage up to 1:30 for individuals and 1:100 for professionals. The minimum lot size is 0.01 and there is no maximum trade size. The account is largely aimed at experienced traders, as the minimum initial deposit is 5,000 USD or the equivalent amount in GBP or EUR.

For those looking for custom money management solutions, PAMM accounts are also available upon request.

Trading Hours

The FX market is open from Sunday 5:05 PM EST to Friday 4:59 PM EST. This may vary during holiday schedules.

The metals market is open from Sunday at 6:00 PM EST and closes at 5:00 PM EST each day, re-opening at 6:00 PM EST. On Friday the market closes at 5:00 PM EST and re-opens on Sunday.

Specific times for other assets can be found in the contract specifications.

Customer Support

2.5 / 5You can get in touch with ATC Brokers via several methods:

- Email – support@atcbrokers.com

- Telephone – +44 20 3318 1399

- Live chat support

The broker’s headquarters is located at 1 Fore Street Avenue, London, EC2Y 9DT.

Security

MT Pro (MT4) follows industry-standard security requirements and is protected with 128-bit encryption. Traders can also opt for email and phone authentication at the login stage, to add an extra layer of safety.

ATC Brokers Verdict

ATC Brokers has performed well in this review, including the narrow ECN spreads and FCA regulation. We also liked the MT Pro and MT4 trading platforms as well as the 60-day demo account. This broker would be a good choice for experienced traders, however, the $5,000 minimum deposit may be a barrier for casual traders and beginners.

Top 3 Alternatives to ATC Brokers

Compare ATC Brokers with the top 3 similar brokers that accept traders from your location.

-

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Go to Interactive Brokers -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone

ATC Brokers Comparison Table

| ATC Brokers | Swissquote | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.8 | 4 | 4.3 | 4.8 |

| Markets | Forex, CFDs, indices, commodities | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5000 | $1000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, CIMA | FCA, FINMA, DFSA, SFC | FCA, SEC, FINRA, CBI, CIRO, SFC, MAS, MNB | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | – | – | – | – |

| Education | No | No | Yes | Yes |

| Platforms | MT Pro | MT4, MT5, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade |

| Leverage | 1:30 | 1:30 | 1:50 | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 7 | 5 | 6 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Swissquote Review |

Interactive Brokers Review |

Pepperstone Review |

Compare Trading Instruments

Compare the markets and instruments offered by ATC Brokers and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ATC Brokers | Swissquote | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | No | Yes |

ATC Brokers vs Other Brokers

Compare ATC Brokers with any other broker by selecting the other broker below.

FAQ

How do I register with ATC Brokers?

You can sign up by completing the online application forms and submitting your ID documents. Applications generally take 1 – 2 business days. You can then log in to the ‘My Account’ portal and begin trading.

Does ATC Brokers offer a demo account?

Yes, ATC Brokers offers a 60-day trial account where you can practice your trading strategies without risking funds. You can apply for a demo account by clicking on ‘Demo Request’.

How can I fund my ATC Brokers account?

You can deposit funds within the client portal via bank transfer, credit/debit cards, Skrill, and Union Pay.

How much capital do I need to fund my ATC Brokers account?

You need to deposit at least $5,000 to open an account with ATC Brokers.

What trading platforms are available at ATC Brokers?

You can trade on the MT Pro desktop platform or the MT4 mobile app.

Customer Reviews

There are no customer reviews of ATC Brokers yet, will you be the first to help fellow traders decide if they should trade with ATC Brokers or not?