Assessing Potential Forex Moves With New General Election In Sight

With the FOMC meeting the obvious event risk in late US trade (05 am AEDT), we should see traders using today’s session to further assess their probability matrix and massage exposures accordingly.

Consider the cut tonight is priced at 94%, so when they cut, the move in the USD, rates, gold etc, will be determined on the outlook and the level of appetite to go again in the months ahead.

When 10/17 Fed members envisage no further cuts, if this is truly the third and final insurance cut in this “mid-cycle adjustment”, then this may come across in the narrative – if it does, the USD should rally, and again my focus here is USDJPY and whether it can close through 109.00.

My view is the Fed give the impression that things are tracking ok, but prepared to act “appropriately” should economics deteriorate.

A flexible approach is a bullish approach and equities should find support, even if we also need to focus on comments about its plans to further support the repo market.

The point of conjecture here is around the expansion of its balance sheet, even if it is not deemed QE. Apple and FB numbers should be out soon and will also drive equities.

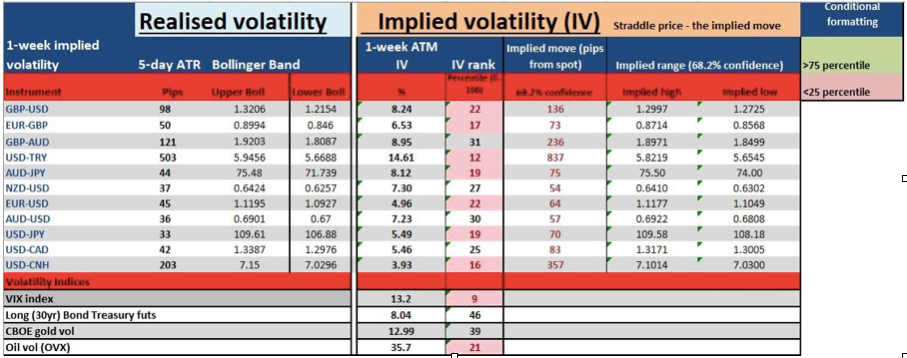

Implied Volatility

Just look at the realised and implied volatility in various FX pairs at present. To put context on these vols, I look at where they sit in their 12-month range, which is the IV (percentile) rank column.

The fact is despite all the data, central bank and political event risk due this week the market is calm and not expecting big moves in price. But are options traders correct in their assumption?

If I look at 1-week risk reversals, it’s striking to see how balanced the feel is, with the skew of put volatility largely in line with call vol.

We Have A Breakthrough In Brexit!

Well, Boris Johnson may have failed to get his Withdrawal Agreement Bill through the Commons, after the program motion failed, as was the case in his quest for a general election through the fixed-Term Parliaments Act, which required two-thirds of MP’s to vote it through.

However, after many were thinking we could be staring a period of prolonged stalemate, Corbyn has come to the conclusion that no-deal Brexit is suitably off the table and we’ve seen Johnson’s election bill passing by 438 to 20.

The UK is set to go to the polls on with an election date of 12 December.

The fact Deputy Speaker Lindsay Hoyle decided not to select a number of potentially key amendments, such as allowing EU citizens and 16/ and 17-year old’s to vote is interesting.

Certainly, from the perspective that these voters would most likely have added to the votes to remain-leaning parties, such as Labour and Lib Dems. Subsequently, Johnson would have been happy John Bercow was not selecting the amendments.

Anyhow, this continuous point is no longer a markets issue and we focus on how GBP trades into mid-December.

What Do Parties Stand For?

Firstly, understand what the parties stand for, as traditional election campaigns, fought around law and order, education, the NHS and the economy (etc), mean very little. In the eyes of the market, this is what the public are voting for.

- Conservatives – leave with the recently agreed deal

- Labour – Re-engage with the EU and put a vote to the public (i.e a new referendum)

- Lib Dems – Straight out revoke Article 50

- Brexit Party – Leave with no deal

The market, at this stage, is really eyeing two main scenarios:

- A Tory majority which sees Boris’s recent deal voted through.

- A hung parliament, with the Tories failing to get a majority.

I think we could see modest upside to the GBP on outcome 1, as we get certainty and a government able to pass legislation more readily. That said, we leave the EU with a deal many feel is a poor one and uncertainty around Scottish independence vote lurking in the wings.

Outcome 2 could see GBP sellers out in force, as frustrations kick in, and we question the prospects of forming a government ahead of the new deadline of 31 January.

It has real potential of occurring and could in itself be a reason why Brexit Party and undecided voters back them.

It certainly seems a decent stretch to believe Labour will get near a majority, but in theory, the market could bid up the GBP on a Labour-led coalition.

2nd Referendum

Any outcome that leads us to a second referendum would be GBP positive, even if the risk is we see a second vote to leave.

As we can see from the chart from the FT, the Tories are well ahead in the polls and these have been consistently for some time.

As long as these polls don’t throw any surprises, I’d expect GBPUSD to track a 1.3100 to 1.2700 range through November before we saw vols pick-up into early December.

That said, as we all know UK polling rightly has its cynics and could once again be a huge red herring.

Read more of Chris Weston’s analysis at Pepperstone