ArgusFX Review 2024

ArgusFX is a Cyprus-based broker offering MT4 trading from a sleek client portal.

Forex Trading

Invest in major, minor and exotic FX pairs.

Stock Trading

Trade 65 stock CFDs with high leverage.

CFD Trading

Online CFD trading is available in multiple financial markets.

Awards

- Most Reliable Forex Broker Award 2018 - UK Forex Awards

ArgusFX is an established MT4 and MT5 forex broker based in Cyprus. Before you download the platform and login to the client portal, take a look at this review for information on minimum deposits, account types, fees, and additional features.

ArgusFX Details

ArgusFX Ltd is a Cyprus-based broker founded in 2003. The broker is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC).

ArgusFX has 50 years of trading expertise and provides an exclusive STP model. The broker also offers over 100 financial instruments on several cross-platform solutions and two live accounts.

Trading Platforms

MetaTrader 4

MT4 is a powerful tool for technical analysis and online trading. The platform suits advanced trading styles with hedging and scalping capabilities, while also being easy to navigate for less-experienced traders. Users can enable trading robots and utilise the vast collection of indicators and drawing tools on three different chart types.

MT4 at ArgusFX is easily accessible and works with both Mac and Windows operating systems.

MetaTrader 5

MT5 offers superior algorithmic and copy trading tools for advanced traders. Users can access an unlimited amount of charts, with numerous timeframes and over 80 technical indicators and analytical tools. There’s also financial news and an economic calendar for fundamental analysis, plus trading signals and a built-in forex VPS.

MT5 is currently only available for Windows operating systems.

Assets

Available markets at ArgusFX include around 60 currency pairs, including exotics and crosses, plus 65 CFD stocks. You can also trade a variety of indices and commodities, as well as 14 futures contracts and spot metals. In addition, the broker has teamed up with Match-Prime to provide deep liquidity across more than 1,000 trading instruments.

ArgusFX could improve its offering further by providing cryptocurrency trading.

Spreads & Commission

Average spreads come in at 1.8 pips for EUR/USD in the Standard account but drop to 0.3 pips in the Pro account. Minimum spreads for indices in the Standard account start from 0.6 pips for the S&P 500 and from 0.46 for spot silver. These are pretty decent compared to similar retail brokers.

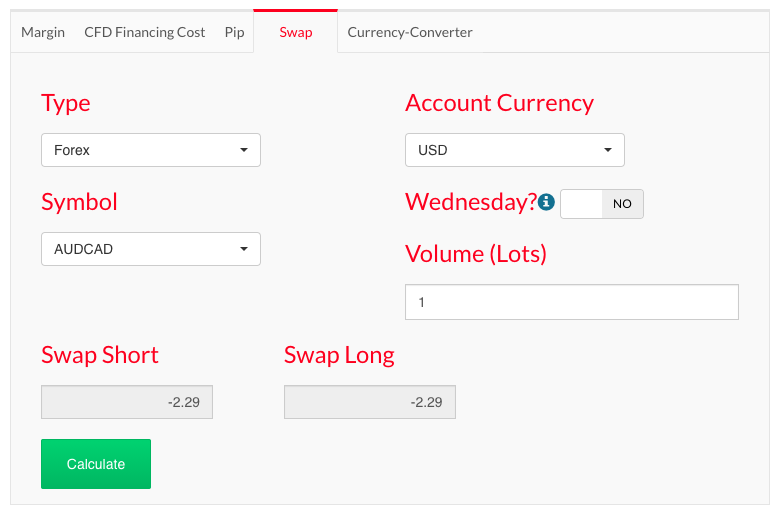

Monthly data fees are charged on stocks and futures starting from 1.5 per contract for retail clients. There are also commissions on cash indices, from 0.5 EUR/USD per lot. Swap fees are also charged on overnight positions.

Leverage Review

ArgusFX offers a default leverage limit of 1:30 for major currency pairs and less for other assets. Clients can apply for higher leverage if they meet certain criteria. The margin calculation for forex trading is also provided on the broker’s website.

Mobile App

ArgusFX offers the MT4 mobile app to all clients. Whether you’re trading on a smartphone or tablet, MT4 caters to all your on-the-go trading needs, including 24/5 access to the forex market, over 50 indicators and analytical tools, real-time quotes, and 4 order types. There’s also email and chat features, plus a useful financial news feed.

Deposits & Withdrawals

There’s a decent selection of funding methods available at ArgusFX, including credit/debit card, bank wire transfer, Skrill, Neteller, Qiwi, Yandex Money, and Sofort.

Cards and bank wire deposits are processed within 1 business day, whilst other methods take around 1 hour. There are zero deposit fees for bank wire, Skrill, and Neteller, but there is a 1.35 EUR/USD/GBP fixed fee on cards and 2% on the deposit for other methods.

All withdrawals are processed within 1 business day but it can take up to 7 days for funds to be credited to your account. There’s also a 1.8% commission on the withdrawal amount for cards, Skrill, and Neteller. Bank wire withdrawals depend on the bank used and range from 5 to 15.5 EUR/USD.

Demo Account

A considerable disadvantage of this broker is the lack of a demo account. Most brokers offer a practice account in which beginners can test out the trading platforms in a risk-free environment. It’s a shame that ArgusFX doesn’t offer this, as it will likely turn away a few beginners.

ArgusFX Welcome Bonus

Due to CySEC restrictions, there are no promotional offers available at ArgusFX at this time. Bonuses and promotions are more commonly found at brokers who are licensed by more relaxed regulators.

Regulation Review

ArgusFX is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under CIF license number 334/17. The broker also complies with the European Markets in Financial Instruments Directive (MiFID).

CySEC is one of the most reputable financial regulators in the world and provides strict guidelines to ensure client safety. This includes segregating client funds at top tier banking institutions and being a member of the Investor Compensation Fund.

Additional Features

ArgusFX offers a market analysis and webinar section, however, these areas have been neglected, with no updates within the last couple of years. There are some additional tools, including economic and holiday calendars and a variety of forex calculators.

ArgusFX Accounts

Traders have a choice of two accounts at ArgusFX: Standard STP and Pro STP. The Standard account has no minimum deposit requirement, average spreads from 1.8 pips, and no commissions. The Pro STP account requires a $200 minimum deposit, with average spreads from 0.3 pips, plus commissions.

Both accounts require a minimum transaction size of 0.01 lots. They also allow hedging, scalping and Expert Advisors, plus additional features such as a dedicated account manager and educational tools and reports.

Islamic swap-free accounts are also available.

Benefits

Notable features of ArgusFX include:

- CySEC-regulated

- $0 minimum deposit

- MT4 and MT5 platforms

- Commission-free trading

- Deep liquidity via Match-Prime

Drawbacks

This review also found several limitations:

- Cryptocurrency trading not offered

- Educational resources lacking

- No demo account

Trading Hours

Trading hours for stocks are 16:30 – 23:00 (GMT+2), Monday to Friday and for commodities, trading takes place between 01:05 and 23:55 GMT+2, Monday to Friday. For currencies, hours are from 00:00 Monday until 23:00 Friday (GMT+2). Specific times for all other assets are listed in the contract specifications.

Customer Support

You can get in touch with ArgusFX via live chat, telephone, or email. Unfortunately, on testing the live chat service within working hours, we did not receive a response.

- Email – info@argusfx.com

- Telephone – +357 22059059

The broker’s headquarters is located at 148 Stovolos Avenue, 1st Foor, CY 2048, Nicosia, Cyprus.

Security Review

The MT4 and MT5 platform have encrypted technology-enabled, which safeguard client data exchanged on the broker’s server. There’s also the option to add both telephone and email verification upon login.

ArgusFX Verdict

ArgusFX is a CySEC-regulated broker offering good trading features, including the popular MT4 platform. Users also enjoy minimum deposits from $0 on two accessible live accounts. The only major drawbacks this review found were the unresponsive customer support and lack of a demo account.

Top 3 Alternatives to ArgusFX

Compare ArgusFX with the top 3 similar brokers that accept traders from your location.

-

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets -

GO Markets – GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

Go to GO Markets -

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade

ArgusFX Comparison Table

| ArgusFX | FP Markets | GO Markets | AvaTrade | |

|---|---|---|---|---|

| Rating | 0.8 | 4 | 3.9 | 4.9 |

| Markets | Forex, CFDs, commodities, cryptocurrencies, futures | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, forex, indices, shares, energies, metals, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $0 | $100 | $200 | – |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC | ASIC, CySEC, ESMA | ASIC, CySEC, FSC of Mauritius | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Bonus | – | – | 30% cash rebate | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | MT4, MT5, AutoChartist, TradingCentral | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:500 | 1:30 (Retail) 1:400 (Pro) |

| Payment Methods | 5 | 9 | 7 | 13 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | FP Markets Review |

GO Markets Review |

AvaTrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by ArgusFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ArgusFX | FP Markets | GO Markets | AvaTrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

ArgusFX vs Other Brokers

Compare ArgusFX with any other broker by selecting the other broker below.

FAQ

Where can I make a deposit at ArgusFX?

You can fund your account from within the secure Client Portal, by clicking on the Deposit/Withdraw tab.

Where is ArgusFX based?

Argus FX is based in Nicosia, Cyprus, but also has an additional office in Limassol, Cyprus.

What can I trade at ArgusFX?

You can trade currency pairs, CFD stocks, indices, and commodities, plus futures contracts.

Is ArgusFX regulated?

Yes, ArgusFX is regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 334/17.

What is the maximum leverage at ArgusFX?

The maximum leverage for retail clients is 1:30. Professional clients can apply for leverage up to 1:500.

Customer Reviews

There are no customer reviews of ArgusFX yet, will you be the first to help fellow traders decide if they should trade with ArgusFX or not?