Best Day Trading Apps

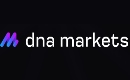

We’ve evaluated countless mobile platforms to bring you our selection of the best day trading apps. Discover the applications that stand out for their:

- User-friendly design

- Low fees for day traders

- Mobile-optimized charts and analysis tools

- Excellent compatibility with Apple and Android devices

But don’t just take our word for it, for each day trading app we scored highly, we’ve also compiled ratings from the Apple App Store and Google Play Store so you can see what other traders think.

Top Apps For Day Trading In 2024

These are the 5 best apps for day trading based on our findings:

- AvaTrade - iOS & Android

- OANDA US - iOS & Android

- Deriv.com - iOS & Android

- Pepperstone - iOS & Android

- XM - iOS, Android & Windows

Best Day Trading Apps Comparison

| Broker | iOS Rating | Android Rating | Minimum Deposit | Day Trading Markets | Regulators | Visit |

|---|---|---|---|---|---|---|

|

4.3 / 5 |

4 / 5 |

- | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | Visit |

|

4.7 / 5 |

3.7 / 5 |

$0 | Forex, Crypto | NFA, CFTC | Visit |

|

4.2 / 5 |

4.5 / 5 |

$5 | CFDs, Multipliers, Forex, Stocks, Indices, Commodities | MFSA, LFSA, VFSC, BFSC | Visit |

|

4.4 / 5 |

4.1 / 5 |

$0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | Visit |

|

4.7 / 5 |

3.9 / 5 |

$5 | Forex, Stock CFDs, Turbo Stocks, Indices, Commodities, Precious Metals, Energies, Shares, Crypto, Futures | ASIC, CySEC, DFSA, FSC, FSCA | Visit |

|

3.1 / 5 |

4.2 / 5 |

$200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, FSA | Visit |

|

4.8 / 5 |

4.4 / 5 |

$100 | CFDs, Forex, Stocks, Indices, Commodities | ASIC, FCA, xCySEC, SCB | Visit |

|

3.4 / 5 |

4.1 / 5 |

$50 | CFDs, Forex, Indices, Commodities | CySEC | Visit |

|

4.8 / 5 |

4.4 / 5 |

$100 | CFDs, Forex, Indices, Commodities, Stocks, Crypto | ASIC | Visit |

|

3.6 / 5 |

3.8 / 5 |

$100 | CFDs, Forex, Stocks, Cryptos, Futures, Options, Commodities | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA | Visit |

|

4.8 / 5 |

4 / 5 |

$50 | CFDs, Forex, Stocks, ETFs, Cryptos, Futures, Commodities, Bonds | FCA, ASIC, CySEC, FSA, FSRA, MFSA | Visit |

|

4.7 / 5 |

4.4 / 5 |

$10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | IFSC | Visit |

|

4.2 / 5 |

4.1 / 5 |

$10 | Digital Options on Stocks, Indices, Forex, Commodities, Cryptos | - | Visit |

|

5 / 5 |

3.8 / 5 |

$10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | FSC, FSA | Visit |

|

3.6 / 5 |

3.9 / 5 |

$50 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | FCA, ASIC, FSCA, VFSC | Visit |

#1 - AvaTrade

Why We Chose AvaTrade

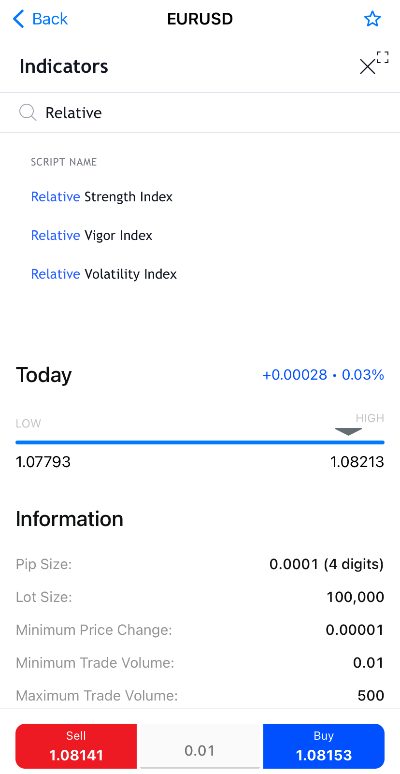

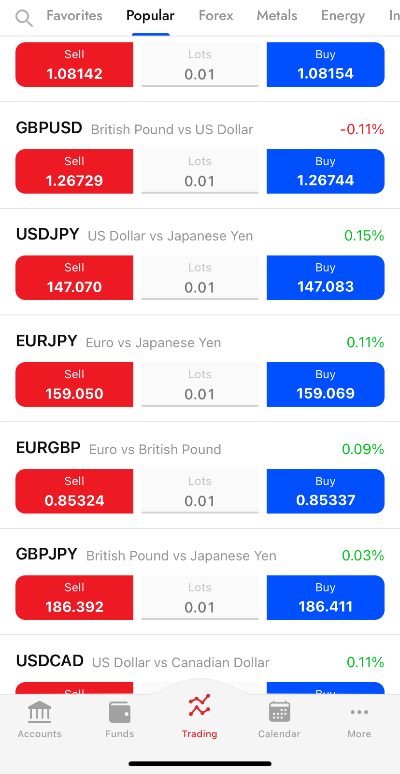

AvaTradeGO consistently impresses with its comprehensive mobile trading experience, boasting an interface that’s not just easy to use, but genuinely intuitive. Navigating the app is a breeze, ensuring fast access to hundreds of markets, including forex, stocks, indices, commodities, ETFs, and bonds. However, what sets AvaTradeGO apart is its AvaProtect™ feature, offering an unmatched level of risk protection that’s rare to find elsewhere.

"AvaTrade offers the full package for short-term traders. There is powerful charting software, reliable execution, transparent fees, and fast account opening with a low minimum deposit."

- DayTrading Review Team

- Mobile Apps: iOS & Android

- iOS App Rating: 4.3 / 5

- Android App Rating: 4 / 5

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting

- Regulator: ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM

- Platforms: WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (Retail) 1:400 (Pro)

About AvaTrade

AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Pros

- The broker’s unique risk management tool, AvaProtect, protects against losses up to $1 million and is easy to activate in the platform

- WebTrader is well-suited to beginners and features a strong suite of technical analysis tools and market research for day traders

- Day traders can access stable spreads and zero commissions with no hidden fees

Cons

- There is no ECN account with raw spreads

- Traders from the US are not accepted

- There’s an above-average $50 inactivity fee after three months, though this won't impact active day traders

#2 - OANDA US

Why We Chose OANDA US

OANDA’s app stands out for its deeply customizable interface, ensuring you can tailor every aspect of the trading experience to your strategy, from setting custom notifications to adjusting chart sizes and overlays. This level of personalization, combined with the ability to quickly react to market changes, manage risk, and stay informed with alerts on significant market events, makes it a category leader.

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

- DayTrading Review Team

- Mobile Apps: iOS & Android

- iOS App Rating: 4.7 / 5

- Android App Rating: 3.7 / 5

- Instruments: Forex, Crypto

- Regulator: NFA, CFTC

- Platforms: OANDA Trade, MT4, TradingView, AutoChartist

- Minimum Deposit: $0

- Minimum Trade: 0.01 Lots

- Leverage: 1:50

About OANDA US

OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- The broker offers a transparent pricing structure with no hidden charges

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

#3 - Deriv.com

Why We Chose Deriv.com

Deriv GO shines with its straightforward app design and diverse trading opportunities, from traditional markets to custom indices that simulate real-world markets and offer 24-hour trading, including on weekends. The in-app chat assistance, which can’t be found at many alternatives, is also fast and reliable, providing an important layer of support for new users.

"Deriv.com will suit day traders looking to make fast-paced trades using CFDs and multipliers with high leverage up to 1:1000. The broker is also the industry leader in synthetic indices, which simulate real market movements and are available around the clock. "

- DayTrading Review Team

- Mobile Apps: iOS & Android

- iOS App Rating: 4.2 / 5

- Android App Rating: 4.5 / 5

- Instruments: CFDs, Multipliers, Forex, Stocks, Indices, Commodities

- Regulator: MFSA, LFSA, VFSC, BFSC

- Platforms: Deriv Trader, MT5

- Minimum Deposit: $5

- Minimum Trade: 0.01 Lots

- Leverage: 1:1000

About Deriv.com

Deriv.com is a low cost, multi-asset broker with over 2.5 million global clients. With just a $5 minimum deposit, the firm offers CFDs, multipliers and more recently accumulators, alongside proprietary synthetic products which can't be found elsewhere. Deriv provides both its own in-house charting software and the hugely popular MetaTrader 5.

Pros

- The free demo account is ideal for practicing short-term trading strategies and no registration is required

- The low $5 minimum initial deposit suits those on a lower budget

- Deriv bolstered its short-term trading opportunities in 2024 with accumulator options on simulated indices featuring up to 5% growth rates

Cons

- The range of 100+ assets trails some competitors such as Quotex which offers 400+

- There are limited copy trading tools and analysis features compared to alternatives like IQ Cent

- There's no loyalty program or rebate scheme for high volume traders

#4 - Pepperstone

Why We Chose Pepperstone

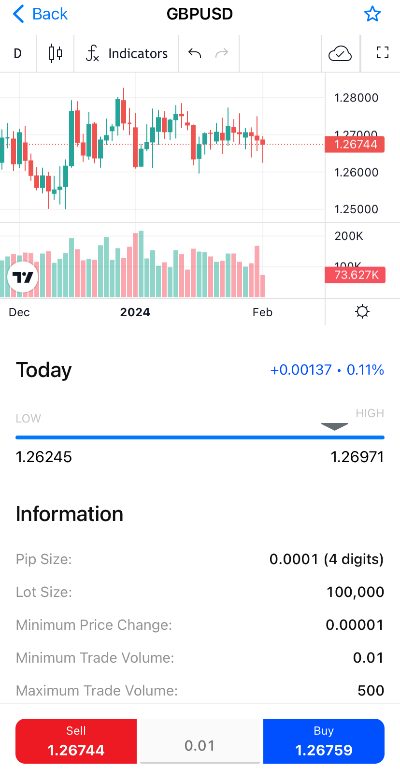

Pepperstone excels for its excellent integration with the MT4, MT5, cTrader, and TradingView apps, making it a standout option for day traders familiar with these leading third-party trading solutions. Despite the absence of a proprietary app, these platforms deliver a stable and reliable mobile trading experience, enhanced by Pepperstone’s almost unrivalled execution speeds and wide range of asset classes.

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

- DayTrading Review Team

- Mobile Apps: iOS & Android

- iOS App Rating: 4.4 / 5

- Android App Rating: 4.1 / 5

- Instruments: CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting

- Regulator: FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB

- Platforms: MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

- Minimum Deposit: $0

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (Retail), 1:500 (Pro)

About Pepperstone

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Pros

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- There’s no simplified proprietary trading platform, nor are there any social trading features, which could be a disadvantage if you are new to day trading.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets.

#5 - XM

Why We Chose XM

XM offer a mobile app for both Android and iOS that has been specifically tailored to each platform, maximizing the functionality of both. The app delivers the MT4 and MT5 software on the move, with full access to the broker’s 1000+ instruments. Where they shine is their dependability with minimal glitches and delays during testing. The built-in news, trading journal and push notifications also ensure you have everything you need to day trade from your hand.

"XM is one of the best forex and CFD brokers we have tested. The flexible account types will suit a variety of short-term trading styles while the $5 minimum deposit and smooth sign-up process make it easy to start trading."

- DayTrading Review Team

- Mobile Apps: iOS, Android & Windows

- iOS App Rating: 4.7 / 5

- Android App Rating: 3.9 / 5

- Instruments: Forex, Stock CFDs, Turbo Stocks, Indices, Commodities, Precious Metals, Energies, Shares, Crypto, Futures

- Regulator: ASIC, CySEC, DFSA, FSC, FSCA

- Platforms: MT4, MT5

- Minimum Deposit: $5

- Minimum Trade: 0.01 Lots

About XM

XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been known for its low fees on 1000+ instruments. XM is regulated by multiple financial bodies, including the ASIC and CySEC.

Pros

- XM continues to deliver diverse and multilingual educational materials and offers a useful live education schedule for its webinars and insights

- Powerful MT4 and MT5 platforms are available with 60+ and 80+ technical charting tools

- Accessible trading accounts with a $5 minimum deposit and fast account opening

Cons

- There is weak regulatory oversight through the global entity

- PayPal deposits are not supported

- There's $5 inactivity fee after only 3 months, though this won't affect active traders

Where brokers do not offer their own proprietary trading apps, and instead support third-party applications like MT4, MT5 or cTrader, we have shown these ratings from the respective app stores. Also kindly note that ratings from app stores may change.

Comparing Day Trading Apps

In recent years, we’ve seen the day trading landscape shift, with more retail investors using smartphones for online trading. In fact, the number of trading app users has risen year-on-year according to Business of Apps.

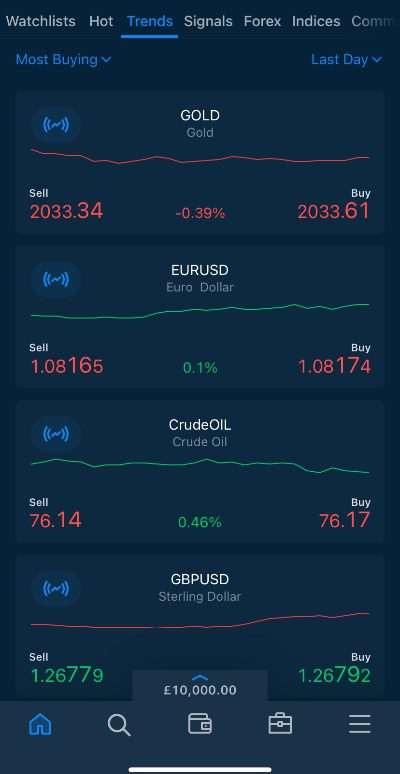

Application functionality has also improved, where once you could just view portfolios and make basic trades, the best day trading apps today offer the complete package for all types of traders.

However, despite significant investment in app development and varied personal preferences, the key qualities of an outstanding app for day trading remain the same:

We explain these comparison factors and our methodology in detail below…

They Are Easy And Enjoyable To Use

For intraday traders, where every second can count, selecting a day trading app with a user-friendly design that allows for easy navigation is essential.

The ability to quickly analyze data and execute trades with minimal clicks or fuss is a key feature of top apps. Given the trend of apps like Robinhood, which gamify trading with features like digital confetti when you make a trade, it’s important for serious day traders to avoid such distractions.

We assess the usability of day trading apps by evaluating how they balance providing key information for informed trading decisions, without overwhelming users with excessive data. This approach ensures that the apps we recommend offer an optimal user experience, catering to the specific needs of day traders.

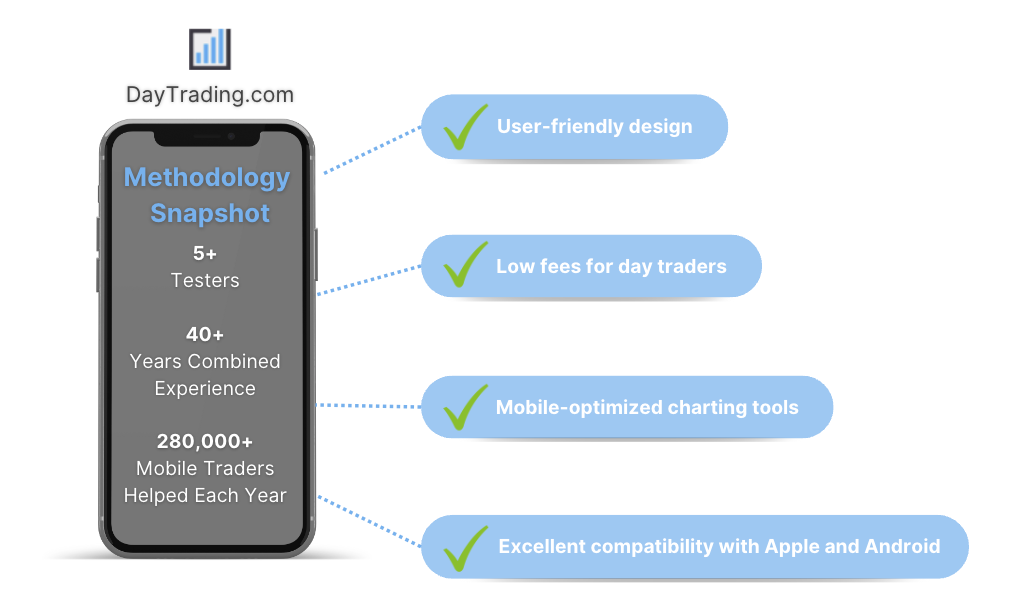

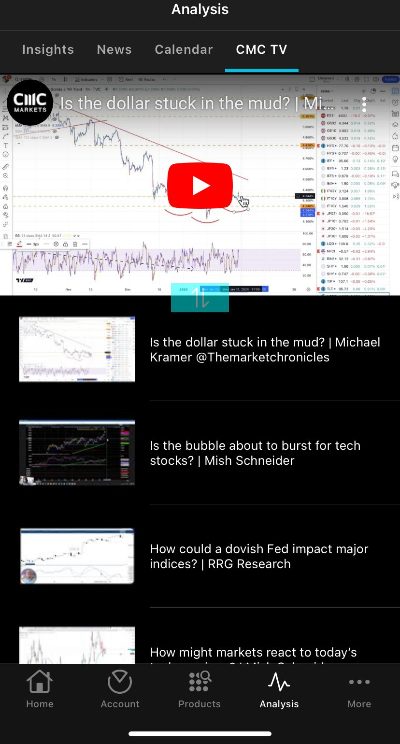

- Our firsthand experience with the CMC Markets app reveals its significant investment in recent years, resulting in an intuitive and user-friendly design that we love. The app simplifies market analysis and trade management for the full spectrum of traders, offering a seamless experience that earned it one of our annual awards.

They Offer The Tools You Need To Day Trade Effectively

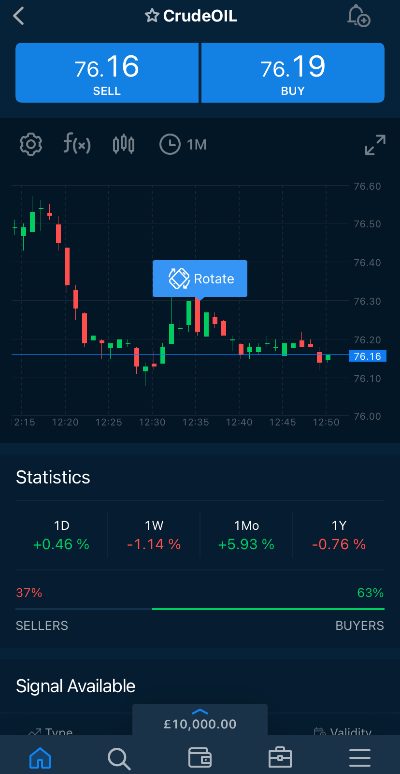

From our many years in the industry, we understand that transitioning from desktop to mobile trading platforms often means compromising on functionality, particularly in charting tools, which are vital for day traders.

Therefore, we look for day trading apps that deliver a comprehensive mobile trading experience, including mobile-friendly charts with numerous technical indicators and drawing tools, as well as a complete range of order types.

Additionally, we value standout features such as SMS alerts and push notifications that provide buy and sell signals or important market updates, improving the overall trading experience.

- Our time testing the FxPro app has been excellent, particularly for its advanced yet user-friendly charting functions and huge selection of technical indicators. The mobile interface allows easy customization of charts, and the split-screen feature is a real plus, enabling simultaneous viewing of charts and trading data on one screen.

They Provide Seamless Compatibility With Your Device

We’ve found that while most top day trading apps are available on both the Apple App Store and Google Play Store, their performance can vary between iPhone/iPad and Android devices.

For example, during our analysis, E*Trade scored 4.6/5 on the Apple App Store but only 2.9/5 on the Google Play Store, indicating a less optimal experience for Android users.

Therefore, we prioritize the mobile trading experience on both Apple and Android platforms, blending our own testing observations with feedback from other traders. This approach helps us ensure that the day trading apps we recommend deliver a high-quality experience, regardless of the device.

- Our evaluation of AvaTrade solidifies its position as a top-tier day trading app. It impressed us with its smooth and flawless performance during our tests, and this excellence is mirrored in its equally high ratings on both the Apple App Store and Google Play Store.

They Offer Excellent Pricing For Day Traders

It’s vital to select day trading apps with low fees, as this can help maximize profits by reducing the ongoing transaction costs that quickly add up in the high-frequency environment of day trading.

In our hands-on assessments, we carefully review the fees associated with day trading in popular markets like stocks, forex, and commodities.

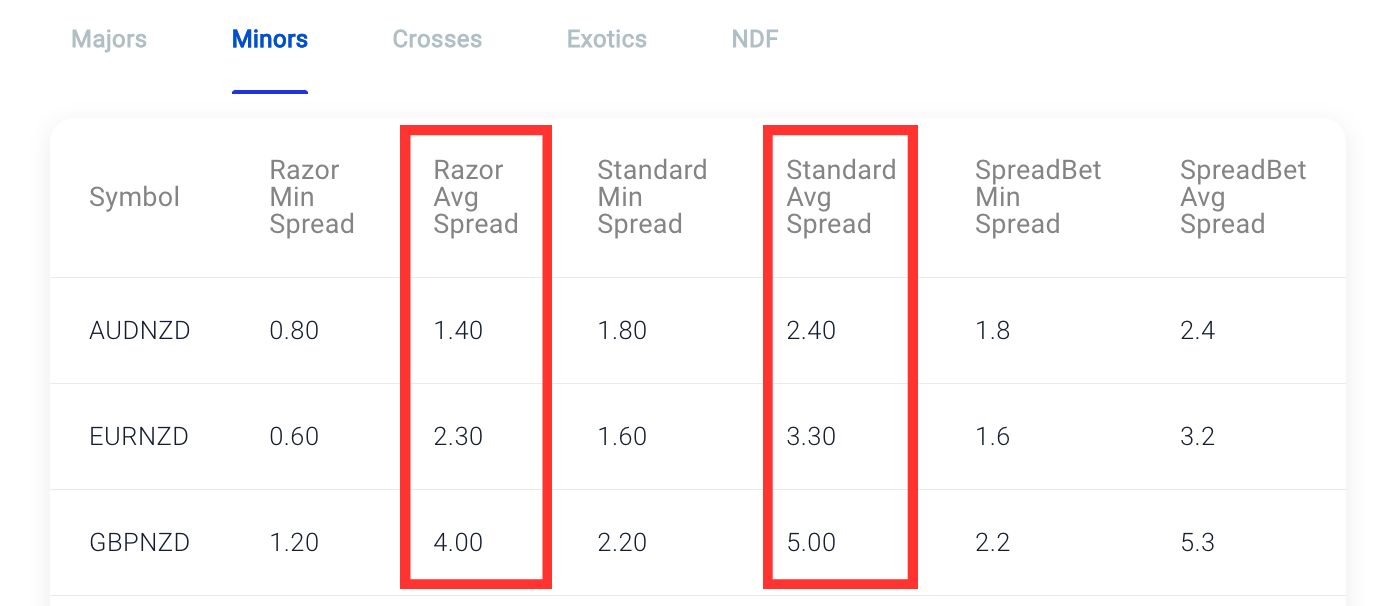

We also consider the needs of different traders. Beginners, for example, may prefer a commission-free model with variable spreads and zero inactivity fees, keeping pricing simple with no penalties if they choose to stop day trading. On the other hand, experienced day traders often prefer models that feature tight spreads and low, fixed commissions.

- Pepperstone continues to deliver competitive pricing for day traders. We’ve found the commission-free Standard account to be a decent option for entry-level traders, but it’s the Razor account for experienced traders that really stands out. With average spreads of just 0.3 on the USD/JPY and a reasonable $3.50 commission per lot per side, it’s a particularly attractive choice, especially when combined with the rebate program for active traders.

If you’re still unsure which app to use for day trading, I recommend test-driving a few applications using demo accounts. This will help you find good day trading apps with designs you enjoy, tools you need, low fees, and excellent integration with your mobile or tablet devices.

FAQ

What Is A Day Trading App?

A day trading app is a downloadable application for your mobile or tablet, allowing you to conduct day trading activities like market analysis, trade execution, and account management.

Some day trading brokers, such as CMC Markets, have built their own apps that offer everything in one package, while other firms, such as IG, have stand-alone apps for different purposes such as trading and education.

There are also brokers, such as Pepperstone, that provide access to popular third-party apps that can be used for charting and day trading, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

What Are The Most Popular Day Trading Apps?

Based on our findings, 5 of the most popular day trading apps are eToro, Webull, Trading 212, MetaTrader 4 and MetaTrader 5.

To qualify as ‘popular’ we scoured the Apple App Store and Google Play Store for day trading apps that have been downloaded more than 10 million times with ratings of at least 3.5/5 at the time of writing.

What’s The Best Day Trading App For Beginners?

eToro is the best day trading app for beginners. As well as providing a fantastically simple interface that we’ve loved using for many years, it offers all the key features of the web platform, from real-time trading to market updates, historical data and in-built support.

Its social trading community is also world-class, allowing beginners to engage with and learn from experienced traders, while the demo account is the perfect entry point for new traders.

What’s The Best Day Trading App For Advanced Traders?

CMC Markets is the best day trading app for advanced traders. It’s obvious the broker has invested serious time and money into creating an optimal mobile trading environment in recent years. There’s a huge range of over 12,000 markets, mobile-optimized charts with more than 40 indicators and drawing tools, plus an easily customizable workspace where you can move, minimize and maximize tiles.

However, where it really stands out is the reliable interface. During testing it was incredibly receptive, creating a fast and stable trading environment that should give serious day traders confidence.

For Specific Countries

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com