AMarkets Review 2024

- Daytrading Review TeamThe copy trading service at AMarkets will appeal to beginners while experienced traders will rate the wide range of trading products, including ETFs, bonds and cryptos.

AMarkets is an established forex and CFD broker registered in the Cook Islands. Founded in 2007, the brokerage has over 1 million clients and is regulated in several offshore jurisdictions, including St Vincent and the Grenadines and Mwali. Over 1400 instruments are available on the popular MT4 and MT5 platforms.

Forex Trading

AMarkets offers a decent range of 42 majors, minors and exotics with low spreads from 0.2 pips in the ECN account. With that said, Standard account spreads come in at around 1.5 pips for EUR/USD, which is higher than the best forex brokers.

Stock Trading

Go long or short on 144 major shares with a $100 minimum deposit. Traders can also utilize the integrated economic calendar or market sentiment tool to uncover stock opportunities.

CFD Trading

Experienced traders can access leverage up to 1:1000 on a range of CFDs across metals, energies, indices and more. Beginners can also follow and copy successful CFD trades in the copy trading account.

Crypto Trading

Access a decent range of crypto pairs against USD and deposit just 10 MBT to access the broker's Micro Bitcoin account. Deposit methods include Bitcoin, Binance Coin and Ethereum.

Copy Trading

The copy trading service is a good option for newer traders and you can pick investors to follow based on their profitability, fees, number of followers and more. The $100 starting deposit is also accessible for beginners.

Awards

- Best Value Broker Middle East 2020 - Global Forex Awards

- Fastest Growing Forex Broker in the Middle East 2019 - Egypt Investment Expo

- Best Execution Speed Highest Client Success Rate 2014 - IAFT Awards

- Fastest Growing Broker 2013 - STP Broker Asia

- Best Educational Program 2011 - Show FX

✓ Pros

- Cashback program with up to $17 rewarded for every lot traded, plus a VIP program with better trading conditions

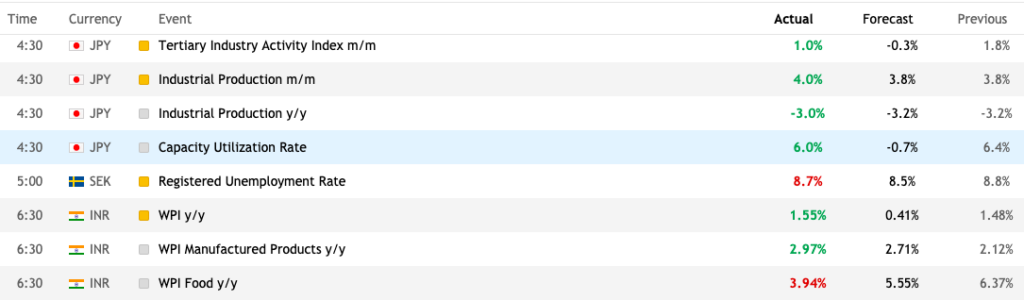

- A range of trading tools including a calculator, economic calendar, and sentiment indicators

- Copy trading USD account with a $100 minimum deposit, leverage up to 1:500 and hedging

- Regular trading news, forex analysis and trading ideas in the broker's Telegram channel

- Micro Bitcoin (MBT) account available for beginners with a low 0.001 BTC deposit

- No fees for deposits and a range of fast methods, including crypto transfers

- Access to Autochartist analysis with signals and automated position entry

✗ Cons

- There are wider standard spreads than many competitors

- We found that educational materials trail alternatives

- No top-tier regulation reduces the trust score

- Withdrawal fees up to 1.8%

AMarkets is an ECN broker offering forex and CFD trading on two award-winning platforms, including MetaTrader 4 (MT4). This broker review covers real and demo accounts, minimum deposit requirements, bonus deals, login security and more. Could AMarkets be the right choice for you?

AMarkets Details

AMarkets Ltd has been providing brokerage services in Latin America, Asia and CIS since 2007. The company is registered and authorised in Saint Vincent and the Grenadines, but has numerous global support offices across Europe, Asia and Africa. AMarkets serves over 350,000 clients and has picked up a number of global forex awards since its establishment.

The broker offers two of the most popular trading platforms available, plus various account types to suit different traders. There are also some additional trading tools, including access to Autochartist and copy-trading features.

Trading Platforms

MetaTrader 4

The MT4 platform is the forex industry’s top choice for online trading, offering reliability and convenience. The platform is beginner-friendly but boasts powerful and sophisticated price analysis tools for traders of any level.

The platform includes 30 technical indicators, which are supported on 9 different time frames. There’s also a single thread strategy tester, access to global news and the option to use automated strategies with trading robots (Expert Advisors).

MetaTrader 4 can be run directly from an internet browser, or you can download it onto your Windows or MacOS computer.

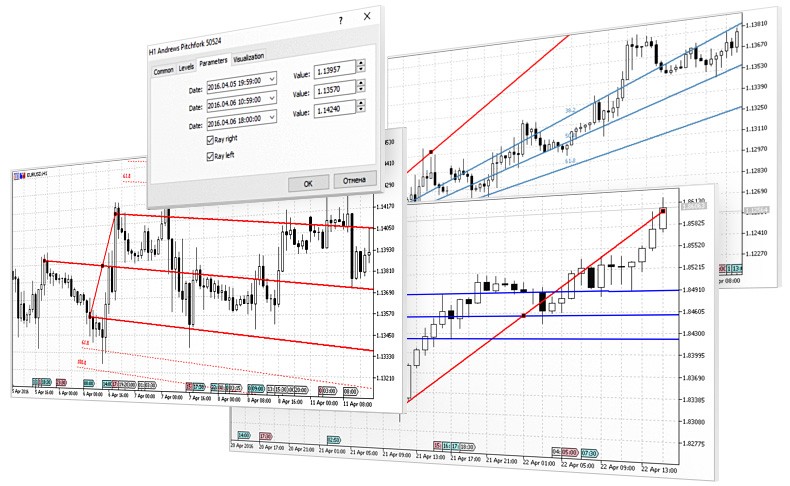

MetaTrader 5

MT5 is the revised version of MT4, offering superior tools for comprehensive analysis of the markets and access to copy-trading. Traders enjoy 38 pre-loaded indicators supported by 21 time frames, a built-in economic calendar, an updated strategy tester, 6 types of pending orders, an embedded community chat, Depth of Market (DoM) and hedging options.

MT5 is also available as the Web Trader version, or the downloadable terminal for Windows and MacOS users. Both solutions offer the same features and functionality.

Markets

AMarkets offers various asset classes, from currencies to commodities:

- Forex – 42 currency pairs across majors, minors and exotics, including EUR/USD

- Cryptocurrencies – 7 digital coins available, including Bitcoin and Ethereum

- Bonds – 2 futures bonds available: Euro-Bund and 10-Year Treasury Note

- Stocks – 144 popular global shares, such as Amazon and Pfizer Inc.

- Metals – 7 precious metals, including gold, silver and copper

- Indices – 16 indices, including FTSE 100 and Dow Jones

- Commodities – 11 energy and agricultural commodities

Spreads & Commission

Typical ECN spreads at AMarkets start from 0.2 pips for popular pairs such as EUR/USD and USD/JPY. Crude oil spreads are around 3 points and gold is around 21 points. Note that Standard account spreads come in at around 1.5 pips for EUR/USD.

If you’re trading in the Standard or Fixed account, commissions are included in the spread. In the ECN account, commissions start from $2.5 per 1 lot on forex. Rollover or swap rates will also apply to positions carried over into the next day.

Leverage Review

Leverage is available up to a maximum of 1:1000 on forex in the Standard and Fixed accounts. In the ECN account, the maximum leverage is 1:200 on forex. New traders should note that leveraged trading carries a high level of risk and may result in heavy losses.

Mobile Apps

Traders can access both the MT4 and MT5 mobile apps with AMarkets, which are available for iPhone/iPad and Android devices.

The mobile apps are convenient yet powerful and offer most of the features available on the desktop versions. Traders can use the various charting tools to analyse prices and keep up with the markets using the integrated news feed. Orders can also be placed with just one tap and prices can be viewed in real time within the Market Watch window.

Payment Methods

Deposits

There are plenty of payment options available, including wire transfer, bank cards and electronic payment systems such as Skrill and FasaPay. AMarkets does not charge for deposits and processing times are instant for all methods, except for bank transfers, which take 3 – 5 business days.

Withdrawals

Withdrawal fees start from 0.5% for Perfect Money and Fasapay. Bank cards are charged from 2.2% and fees for bank transfer will depend on your bank. The minimum withdrawal amount for most methods is 10 USD or EUR. Processing times are generally instant but can be up to a few hours for bank cards and up to 5 days for bank transfer.

Demo Account

Traders who want to trade in a risk-free account can sign up to the demo, which comes with $10,000 of virtual funds. A demo account is an excellent tool for both new traders and experts, as they allow you to practice trading skills and place trades without investing any real capital.

AMarkets Bonuses

AMarkets offers a few trader bonuses and promotions, including a 25% welcome bonus on minimum initial deposits of $500. There’s also a cashback loyalty program, where part of the spread is paid back to clients who trade regularly. Make sure to check the bonus terms and conditions before signing up.

Regulation Review

AMarkets Ltd is authorised and registered by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, with registration number 22567 IBC 2015. This is an offshore jurisdiction, so client protections are typically not as strong as those under UK or EU regulations, for example.

Nonetheless, the broker is a member of the The Financial Commission, an independent dispute resolution organisation which insures traders’ interests up to €20,000. The broker also offers negative balance protection, which prevents trader accounts from dropping below zero.

Additional Features

AMarkets offers some educational content, including forex news and analytics, as well as a blog. Clients can also get free access to the Autochartist indicator, plus an economic calendar and trader calculator. Copy-trading is also available in the RAMM account, where traders can earn up to 50% of investors’ profits on copied trades.

Account Types

There are 3 main accounts available at AMarkets: Fixed, Standard and ECN. There are also Islamic swap-free accounts, plus PAMM and RAMM accounts.

The minimum deposit for the Fixed and Standard accounts is 100 USD or EUR, whilst the minimum for the ECN account is 200 USD or EUR. Order volumes are from 0.01 lots for all three accounts. Commissions are only charged in the ECN account which offers the tightest spreads. All accounts come with negative balance protection.

Trading Hours

Trading at AMarkets opens Monday at 00:00 and closes Friday at 23:00 Eastern European Time (EET). Specific market hours vary depending on the asset. For example, forex trading hours are Monday at 12:02 am to Friday at 11:00 pm (EET). You can find a full list of session times on the broker’s website.

Customer Support

AMarkets offers 24-hour support from Monday to Friday via telephone, email, or chat services such as WhatsApp and Telegram. Support is provided in over 12 countries including the UK, Armenia, Russia, Thailand and Nigeria.

- Email – support@amarkets.com

- WhatsApp – +44 77 234 229 89

- Telephone – +44 330 777 22 22

Security

Both MetaTrader platforms use industry-standard security procedures, including Secure Sockets Layer (SSL) encryption to safeguard data exchanged between servers. Traders can also add two-step verification upon login, which protects against hackers signing in from an unknown device.

AMarkets Verdict

AMarkets offers Standard and ECN accounts on the MetaTrader 4 and 5 platforms, plus additional tools and copy-trading. There’s also a range of good deposit and withdrawal methods, plus a demo account to suit beginners and experienced traders. The main downside is the offshore regulation, which may not provide adequate protections compared to other brokers.

Top 3 Alternatives to AMarkets

Compare AMarkets with the top 3 similar brokers that accept traders from your location.

-

AvaTrade – AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for day trading, alongside a comprehensive education center and multilingual customer support.

Go to AvaTrade -

Vantage – Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

Go to Vantage -

Admiral Markets – Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

Go to Admiral Markets

AMarkets Comparison Table

| AMarkets | AvaTrade | Vantage | Admiral Markets | |

|---|---|---|---|---|

| Rating | 2.8 | 4.9 | 4.7 | 3.5 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | – | $50 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FSA SVG | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | FCA, ASIC, FSCA, VFSC | FCA, CySEC, ASIC, JSC |

| Bonus | 25% welcome deposit bonus | – | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | ProTrader, MT4, MT5, TradingView, DupliTrade | MT4, MT5, TradingCentral |

| Leverage | 1:1000 | 1:30 (Retail) 1:400 (Pro) | 1:500 | 1:30 (EU), 1:500 (Global) |

| Payment Methods | 8 | 13 | 12 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | AvaTrade Review |

Vantage Review |

Admiral Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by AMarkets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| AMarkets | AvaTrade | Vantage | Admiral Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

AMarkets vs Other Brokers

Compare AMarkets with any other broker by selecting the other broker below.

FAQ

Does AMarkets offer a no deposit bonus?

At the time of writing, AMarkets is not offering a no deposit bonus deal. However, traders can check the website or social media pages for any upcoming deals.

How do I open an AMarkets demo account?

You can click on the Demo button at the top of the broker’s website and fill in your contact details to set up your demo login details. You will then be automatically redirected to the trading platform.

How much money do I need to start trading at AMarkets?

The minimum initial deposit to start trading in the Standard and Fixed accounts is 100 USD or EUR.

Is AMarkets regulated?

AMarkets is licensed offshore by the Financial Services Authority in Saint Vincent and the Grenadines (FSA SVG) with register number 22567 IBC 2015.

What can I trade at AMarkets?

AMarkets offers a diverse range of instruments, including forex and cryptocurrency pairs, commodities and precious metals, indices, stocks and bonds.

Customer Reviews

There are no customer reviews of AMarkets yet, will you be the first to help fellow traders decide if they should trade with AMarkets or not?