Alpho Review 2024

Trade forex and CFDs with rich trading tools and real-time market data.

Forex Trading

Trade the most liquid & volatile forex pairs.

Stock Trading

Trade global share CFDs with high leverage.

CFD Trading

Access a range of markets with online CFDs.

Alpho offers a variety of products across multiple asset classes on the MT5 trading platform. This review dives into the broker’s key features, including payments, online trading tools, fees, and mobile apps. We’ll help you determine if Alpho is a safe broker to sign up with.

Alpho Company Details

Alpho is a brand name of Gulf Broker Ltd, a company registered in the Seychelles and regulated by the Financial Services Authority (FSA).

Alpho offers superior customer service on a safe platform to both retail and institutional clients. The broker offers trading in forex, indices, commodities, and shares, using the popular MetaTrader 5 platform.

MetaTrader 5 Platform

MT5 is one of the most widely used trading platforms by both casual traders and professional clients. The platform is easy to navigate and offers over 80 technical analysis indicators and tools, an advanced strategy tester, Level 2 pricing, an economic calendar, over 20 timeframes, and a full set of order types.

The platform is available for download to Windows computers but is also available as a web version for macOS users.

Assets

There are four main asset classes available at Alpho, which include over 60 forex pairs, 14 stock indices, 15 commodities, and many global CFD stocks. This review would have liked to see cryptocurrency trading but a decent range of markets is still provided.

Spreads & Commission

Alpho offers commission-free trading on its accounts, apart from CFD shares which are charged at 0.5% per 1 lot. Typical spreads are fairly high, however, coming in at 3 pips for EUR/USD and 5 pips for major indices like the FTSE 100. This makes the broker one of the more expensive online providers.

Aside from standard swap rates, Alpho also charges a monthly maintenance fee of 10 USD (or currency equivalent) on accounts that have been inactive for at least one month or more. Note that most brokers will charge this kind of fee only after 3 months of inactivity.

Alpho Leverage

Leverage is offered up to 1:500 on forex pairs. This is relatively high and clients should be aware that leveraged trading can carry considerable risk to the inexperienced trader. Margin requirements can be found on the broker’s website.

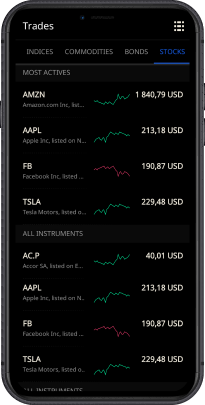

Mobile Apps

Users can take advantage of the feature-rich mobile app, which works with both iPhone and Android devices. The high-performance interface is customisable and supports many of the same features as the desktop version. Users can access trade history, economic news, and full-fledged charting capabilities. iPad users can also conveniently display four charts in one window.

The MT5 mobile app is also free of charge and can be downloaded from the App Store or Google Play.

Payment Methods

Unfortunately the broker isn’t transparent about deposits and withdrawals with limited information available on the website. This is a shame, as most brokers provide these details as standard. With that said, Alpho does appear to offer Visa and Mastercard payments, but a better variety of funding methods can be found at other competitors. Alpho also isn’t forthcoming about transaction fees which is a red flag.

Demo Account

Another area where this broker falls down is demo accounts. Any beginners looking to practice their online trading skills will need to look elsewhere, as Alpho doesn’t offer practice accounts. The lack of a demo account is a serious drawback in this review.

Alpho Bonuses

At the time of writing, Alpho does not offer any promotions. Traders can check in with the website or social media pages for any upcoming bonuses.

Regulation

Gulf Brokers Ltd (Alpho) holds a license with the Financial Services Authority (FSA) of Seychelles, under license number SD013. Whilst some level of regulation is good, the FSA is not a highly regarded regulator and therefore will not provide the same level of trader protection as more reputable bodies such as the FCA or CySEC.

Additional Features

Alpho offers a small selection of additional resources, including a market news section and some videos. The education and blog sections are rather neglected, however, and don’t offer as much detail or insight as other brokers. There is also a basic economic calendar, but other useful tools such as forex calculators or webinars are not offered.

Alpho Accounts

Alpho offers just one standard account and an Islamic swap-free account. Both accounts offer the same features, including a minimum trade size of 0.01 lots on forex, leverage up to 1:500, and access to the advanced MT5 platform. As with other areas, more transparency on account features and requirements is needed.

Benefits

Advantages of opening an account with Alpho include:

- Commission-free trading

- Good customer reviews

- 250+ trading products

- Islamic account

- MT5 platform

Drawbacks

We did also uncover several downsides in this review:

- Monthly maintenance fee

- Crypto trading not offered

- No live chat support

- Offshore regulator

Trading Hours

Trading hours at Alpho depend on the asset traded. Forex trading, for example, is available around the clock throughout the week and weekend. However, opening times for stocks vary depending on the respective exchange, with equities on Spanish, German and Dutch markets available from 11:00 to 19:30, while Swiss stocks are available from 11:00 am to 19:20, and US shares can be traded from 17:30 to 00:00. Note, opening times are listed in CET.

Head to the broker’s website for a full breakdown of trading hours, including upcoming holiday breaks and market closures.

It is also worth noting that spreads typically widen during periods where markets are illiquid with limited volatility.

Trader Security

MetaTrader 5 is a secure online trading platform, which provides SSL encryption security on data exchanges and also allows two-step verification at the trader’s choice.

Alpho Verdict

Overall, whilst Alpho does offer a good selection of CFD and forex products on the MT5 desktop and mobile app, there is a lack of competitive additional features for traders seeking a well-rounded experience. Traders may also struggle to trust the broker with the lack of transparency around payments and no demo account.

Top 3 Alternatives to Alpho

Compare Alpho with the top 3 similar brokers that accept traders from your location.

-

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone

Alpho Comparison Table

| Alpho | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.5 | 4 | 4 | 4.8 |

| Markets | Forex, CFDs, indices, shares, commodities | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $1000 | $100 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FSA Seychelles | FCA, FINMA, DFSA, SFC | ASIC, CySEC, ESMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | – | – | – | – |

| Education | No | No | Yes | Yes |

| Platforms | MT5 | MT4, MT5, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade |

| Leverage | 1:500 | 1:30 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 1 | 5 | 9 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Swissquote Review |

FP Markets Review |

Pepperstone Review |

Compare Trading Instruments

Compare the markets and instruments offered by Alpho and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Alpho | Swissquote | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

Alpho vs Other Brokers

Compare Alpho with any other broker by selecting the other broker below.

Customer Reviews

4 / 5This average customer rating is based on 1 Alpho customer reviews submitted by our visitors.

If you have traded with Alpho we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Alpho

FAQ

How do I open an account with Alpho?

You can register for a live account using the sign-up form on the broker’s website. The form will ask for some personal details and verification documents.

What is the maximum leverage offered at Alpho?

The maximum leverage available at Alpho is 1:500. Whilst high rates, leveraged trading does come with the risk of larger losses.

What assets are available at Alpho?

Alpho offers instruments across forex, indices, CFD shares, and commodities. The only notable absence is cryptocurrency trading.

Is Alpho safe to trade with?

Alpho is an offshore broker regulated by the FSA of Seychelles. Whilst better than no regulation, the FSA is unlikely to provide as much protection as other bodies. Interested traders should be cautious when considering offshore brokers like Alpho.

Where is Alpho based?

Alpho is located at Suite C2, 2 Floor, Orion Mall, Palm Street, Victoria, Mahe, Seychelles. The broker does not have any additional support offices.

I like Alpho due to the very high leverage they allow me to use. It allows me to take full benefit when I feel certain of a trade.