Acorns Review 2024

- Daytrading Review TeamAcorns will meet the needs of US traders looking for flexible investment portfolios with simple flat fees and low entry requirements.

Acorns is a US-based investment platform launched in 2012. This SEC-registered firm aims to make investing more accessible for anyone looking to start small, catering to a range of savings goals. With over 9 million clients, the firm has earned a strong reputation and is backed by a number of well-known investors and economists.

Stock Trading

Acorns offers a range of ETFs consisting of bonds, plus small, medium and large-cap stocks. The downside is that you can't choose your investments, but the broker does offer tailored recommendations based on your individual circumstances.

✓ Pros

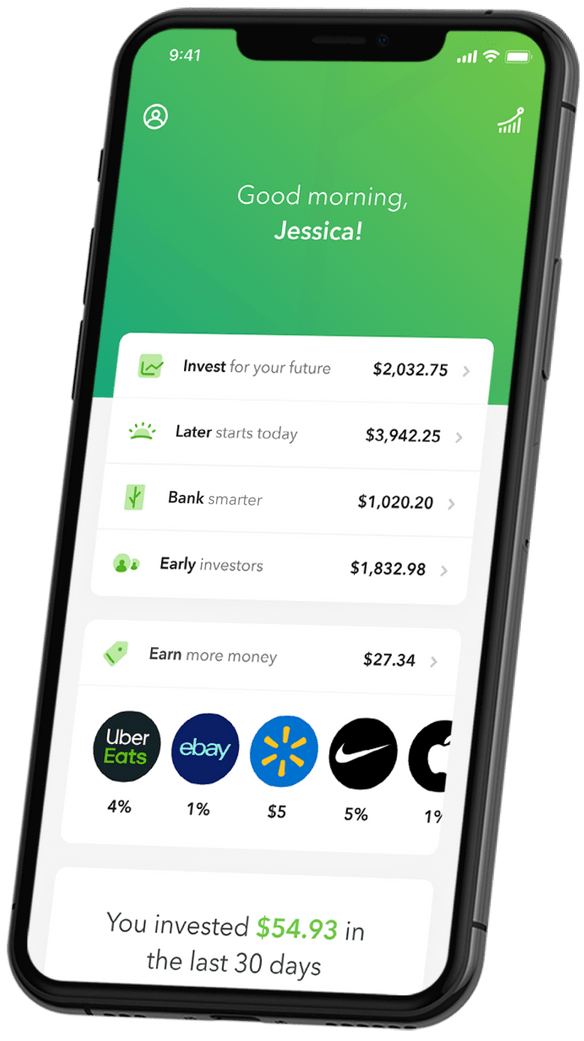

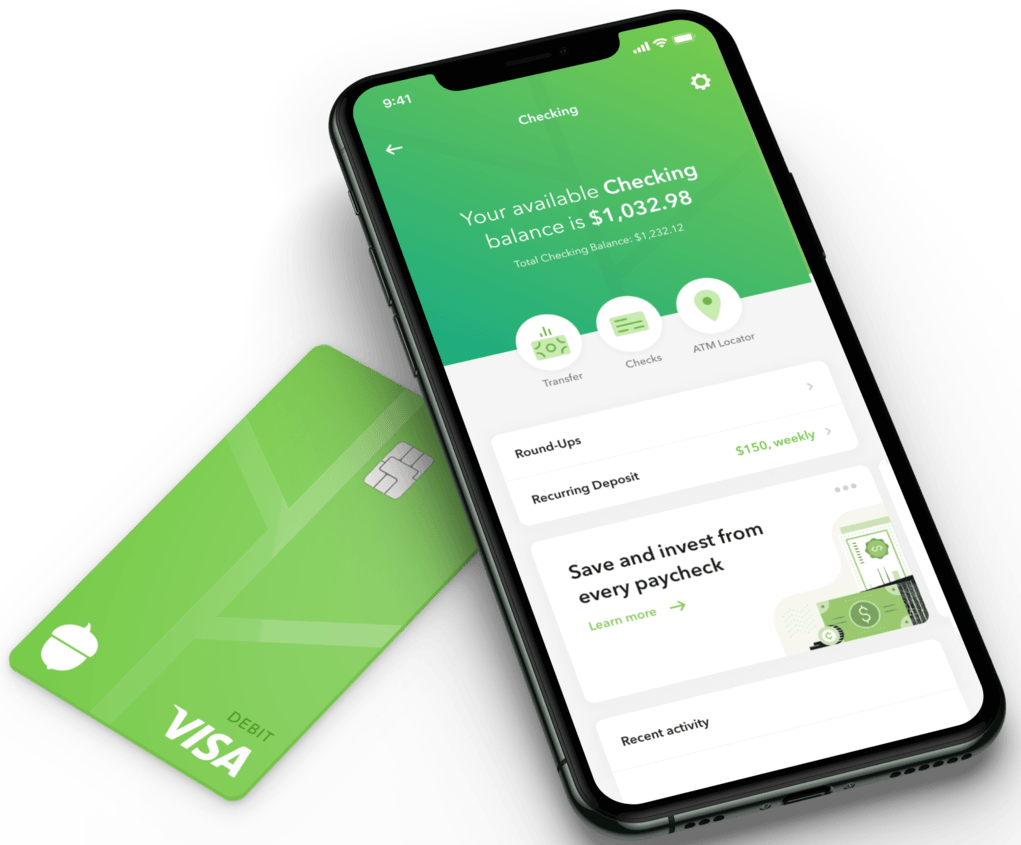

- Acorns Visa debit card included with all subscriptions plus a banking and investing app

- Earn bonus investments from popular brands when you shop their offers using your Acorns card

- Strong regulation from the SEC and membership with FINRA/SIPC, plus FDIC insurance up to $250,000

- Flat $3 monthly fee, plus no hidden charges, minimum balance fees or overdraft penalties

- Five risk levels from Conservative to Aggressive and a range of savings accounts

- Bitcoin-linked ETF offering exposure without owning BTC

- Welcome bonuses and financial incentives

✗ Cons

- Cannot manually change or choose investments

- Narrow choice of trading instruments with no forex

- Monthly fee might be high for those with smaller balances

- US clients accepted only

Acorns is an investment management company that offers a range of products and services, including automated portfolio management, a job finder and opportunities to improve savings and investments through Round-Ups and Smart Deposit. This 2024 Acorns review will cover the services offered, the markets available, the overall trading experience and whether this is a wise place to put your money.

Acorns Headlines

Brokerage services offered by Acorns are provided by Acorns Securities LLC, which is headquartered in Irvine, California. The broker was launched in 2012 by Walter Wemple Cruttenden III and Jeffrey James Cruttenden. It is a relatively new entry into the investment and retirement savings market and looks to stand out from its competitors by making it easier for people to save and invest in suitable portfolios. And whether it’s Acorns vs Robinhood, Stash or Wealthfront, this is certainly a competitive market.

The Acorns name and logo is all about starting small and growing large. The platform boasts over 9 million sign-ups on its website. In 2020, it had $3 billion in assets under management. The website is operated by Acorns Advisers LLC, which is SEC-registered. Acorns Securities LLC is also SEC-registered and a member of the Financial Industry Regulatory Authority (FINRA).

Assets

Acorns clients can invest in exchange-traded funds (ETFs). These are securities that essentially track a particular index, commodity, stock or basket of equities. Although they share similarities with mutual funds, ETFs can be freely bought and sold on the market. Many ETFs are good for managing risk as they automatically diversify your portfolio, with in-house workers actively managing risk.

The ETF portfolios offered by Acorns consist of a variety of securities, including government bonds, corporate bonds, company (small, medium and large-cap) stocks and more ( a mixture of securities with different levels of risk and yearly return). As a general rule of thumb, the ‘conservative’ portfolios are more bond-focused, whereas the ‘aggressive’ portfolios are more stock-focused.

Investors cannot choose which securities the funds are comprised of. Instead, investors put their money into a managed portfolio that is created and rebalanced by Acorns. However, although the broker recommends which portfolios are most suitable for you (by looking at your age and how close you are to retirement), investors can go against this advice and pick a more conservative or aggressive portfolio as they desire.

Acorns also offers sustainable portfolios, which are made up of assets chosen for their environmental, social and governance credentials. These are growing in popularity, although it is unclear whether they deliver the same returns as standard portfolios.

It is also worth pointing out that the platform does not invest its customers’ money in cryptocurrency (e.g BTC or XRP).

Fees

Acorns has a flat monthly fee for each of its two accounts, which applies whether you invest $30, $300 or $30,000. A $3 monthly subscription fee will get you access to an Acorns Personal Account, which includes Acorns Invest (investment account), Acorns Later (retirement account) and Acorns Checking accounts. This will be a suitable option for most investors, though there is the Acorns Family account for those wishing to set up investment accounts for their children. This is similar to a Personal account but with Acorns Early, a custodial account that can be transferred to children when they become adults.

For those investing larger quantities, these fees are relatively modest. Having said that, the company allows its customers to invest as little as $5 a day, week or month. For smaller investors, the flat fee could represent a disproportionate cost to the customer and have a meaningful impact on any profits from investments. It is worth noting that some similar companies like SoFi do not have any management fees.

Mobile Apps

Although Acorns customers may not need as frequent access to their accounts as a typical day trader would thanks to automatic rebalancing, the firm has made it easy to access its services through a simple website and a mobile app, available through the Apple App Store and Google Play Store. The investment app has received high ratings from users on the App Store, with an average of 4.7/5 from over 770,000 customer reviews. The app is not available in the UK or other countries in which the platform is not supported.

Payment Methods

Deposits

Deposit requests for investments made before 17:00 PST should be invested the next business day, although it can take 2-3 business days for investments to be fully processed. Contributions to Early and Later accounts will take 5-7 business days to be fully processed.

Acorns Checking account deposits typically occur within 1-3 business days. Unfortunately, the firm does not allow deposits through mobile payment apps like Zelle, though you can move money into your Checking account through a PayPal wallet.

Withdrawals

It can take 3-6 days for withdrawals from an Invest, Early or Later account to be completed. The process for withdrawing funds can be done conveniently through the broker’s web, iOS or Android apps, though Acorns requires verification of funding sources. Withdrawal requests placed before 11:00 PST on a market day will typically be processed the same day.

Customers should be aware that there may be tax implications for withdrawals from an individual retirement account (IRA). Processing times for Later Accounts are similar to Invest Accounts.

For withdrawals from a Checking account to a linked account, the processing time is within 1-3 business days.

When you make a deposit or withdrawal from an investment account, the company has to either buy or sell the shares in your portfolio which is why processing times can take longer than what might normally be expected.

Demo Account

There is no demo account available on Acorns, though this is no different from other providers offering similar services, such as SoFi and Vanguard. As the company rebalances your portfolio for you and chooses a portfolio based on your particular circumstances, the need for a demo account is less important. YouTube has videos uploaded by people who have done 1-year reviews, which may help potential customers understand how profitable it can be.

Deals & Promotions

There are various promotions and incentives offered, though you should be aware that some are not immediately obvious from browsing the website. There is up to $5 bonus rewards up for grabs by engaging with Acorns Earn.

The firm’s sweepstake competition has a 1 million dollar prize, although sweepstakes with smaller prizes (e.g $10,000) have also been up for grabs recently. Prizes like this 10k one are a key part of the company’s strategy to get people in.

There is also a $75 bonus scheme to encourage people to sign up for the Checking account. Acorns has previously had other cash incentives for signing up, such as the Dwayne Johnson 7 bucks promotion.

Regulation & Licensing

Investors should always check the trustworthiness of brokers before investing. Customers will be pleased to hear that the platform is a regulated and insured investment firm. The Checking deposit account is insured by the Federal Deposit Insurance Corporation (FDIC) for up to the value of $250,000.

Acorns Securities LLC is SEC-registered and a member of the Financial Industry Regulatory Authority (FINRA). It is also a member of the Securities Investor Protection Corporation (SIPC), which ensures securities in your investment and retirement accounts will be protected for up to $500,000 ($250,000 for cash claims).

With regards to tax documents, customers may receive a 1099 form if their investment activity meets the Internal Revenue Service (IRS) reporting standards. The firm will provide you with a 1099-R form by 31 January if you withdrew money from your Later account the previous year. For example, you will have received a 1099-R form on 31 January 2021 for any withdrawals made from Acorns Later during 2020. Whether it’s a Form W-2 or 8949, navigating your way through tax documents can be dull but investors need to be aware of tax implications.

Additional Features

The objective of Acorns is to make it as easy as possible for people to accumulate capital before saving and investing it. That is why Acorns has a job finder on its website, in the hope that it will allow its customers to invest more.

Also easily accessible on the website is educational and advisory material covering investment, savings, the meanings of financial terms and more. Again, this is part of the firm’s appeal to smaller investors who are looking for a company that will ease them into the world of investment.

Account Types

There are two main account types provided by Acorns. One is a Personal Account, which includes an investment account, retirement account and checking (banking) account. The other is a Family Account, which includes everything in the Personal Account plus an Early Account, which is essentially an investment account for your children. Further details of what each account provides are given below.

Acorns Invest (Investment Account)

- Designed to make it easier for smaller investors to invest in an ETF portfolio

- Automatic rebalancing of portfolios so you have more time to focus on other things

- Recurring investments so you can invest a small amount each month and gradually build up the size of your portfolio

- Acorns will match you with an appropriate investment strategy ranging from ‘conservative’ to ‘aggressive’ – all you need to do is answer a few questions

- Receive bonus investments (i.e cash-back, which is invested in your portfolio) when you shop with selected brands (over 12,000 in total) such as Apple, Walmart and Nike (also called Acorns Earn)

- Invest spare change from transactions (called Round-Ups) – please note you must be able to link a bank account (e.g. Truist, a product of the BB&T and SunTrust merger) to your account for this to work

Acorns Later (Retirement Account)

- Effectively an individual retirement account (IRA)

- Customers can roll over their existing 401(k) or IRA to Acorns Later

- Similar features to the Investment Account (e.g automated, recurring investments etc.)

- Tax advantages depending on the particular type of IRA chosen (i.e., Roth IRA, Traditional IRA or SEP IRA)

Acorns Checking Account

- Access to over 55,000 free ATMs around the world

- You must be a verified Acorns customer to sign up for Acorns Checking, however, no credit check is required

- Smart Deposit feature – a proportion of your income is taken and invested before you spend it

- Receive a debit card and invest any spare change from transactions (in other words, you can choose to round up transactions to the nearest dollar and invest the excess)

Acorns Early

- A custodial investment account for your children

- Recurring investments on Acorns begin from $5 a day, week or month

- The account can be transferred to your children when they become adults

- Funds can be used for any expense that benefits the child, whereas funds in a 529 plan can only be used for qualified educational expenses

As for whether an Acorns joint account is possible, the short answer is no. However, a joint personal checking account connected as your funding source is.

Trading Hours

Trading hours depend on the markets that customers are investing in (i.e the trading hours for the ETFs in your portfolio). However, most Acorns customers will not need to concern themselves with trading hours as their portfolios are diversified for them by the company itself.

Many additional features like Round-Ups will work 24/7.

Customer Support

Within the Acorns help centre, there is a chat function in the lower right corner that puts you in touch with a virtual assistant. This is the quickest way to make contact with the firm through its website, though customers can also submit a ticket detailing their issue and a member of Acorns’ support staff will respond as soon as possible.

- Email Address: support@acorns.com

- Phone: 855-739-2859

Acorns has social media accounts on Facebook, Twitter and Instagram, where you can see the latest updates, as well as a YouTube channel with 19,000 subscribers.

On the website, customers will be able to find answers to common problems like ‘I forgot my Acorns pin’ or ‘I lost my card’.

Safety & Security

Acorns has not been completely free from controversy. In 2017, the Financial Industry Regulatory Authority pulled up the firm for failing to maintain proper records and the company was fined.

In terms of the security and integrity of the app and website, Acorns has a relatively strong reputation. It uses encryption to protect customer data, as well as automatic logouts and ID verification. A user’s ability to login will also be disabled (i.e your account will be locked) if the company detects suspicious activity. Acorns also supports two-factor authentication (2FA).

Acorns Verdict

So, is Acorns worth it? Well, there has certainly been a lot of talk about the firm in 2024 on platforms such as Reddit and Yahoo Finance. Acorns has some clever features that make it easier for individuals to save and invest, particularly its Round-Ups and Acorns Earn features. However, this platform is not suitable for short-term investors, daytraders or those who want maximum control over their investments. It is more appropriate for larger investors (who can more easily absorb the monthly $3 or $5 fee) and those who prefer a more hands-off approach.

FAQs

What Is Acorns Round-Ups?

Round-Ups is a feature where Acorns rounds up your purchases, often to the nearest dollar. For example, if you make a purchase for £3.67, it would round this up to $4 and take the 33 cents to add to your investment portfolio.

Is Acorns A Mutual Fund?

No. Acorns is an investment management service, which, amongst other services, invests its customers’ capital into ETFs. Although ETFs and mutual funds have similarities, ETFs can be traded relatively freely, whereas mutual funds can only be purchased at the end of each trading day.

Is Acorns FDIC Insured?

Yes. Acorns is insured by the FDIC, which means Checking Account deposits are protected for up to $250,000.

Is Acorns Available In The UK?

No. Customers must be US residents to set up an investment account with Acorns. Therefore, whether you live in the UK, New Zealand or beyond, you will need to find an equivalent alternative, such as Plum in the UK.

How Much Does It Cost To Have An Acorns Account?

There are two main account types available. An Acorns Personal Account has a monthly fee of $3, whereas the Acorns Family Account has a monthly fee of $5. The broker recently scrapped Acorns Lite, which had a $1 a month subscription. Moving away from this $1 fee may reduce its appeal to smaller investors.

Top 3 Alternatives to Acorns

Compare Acorns with the top 3 similar brokers that accept traders from your location.

-

Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Go to Interactive Brokers -

IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Go to IG -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote

Acorns Comparison Table

| Acorns | Interactive Brokers | IG | Swissquote | |

|---|---|---|---|---|

| Rating | 3.2 | 4.3 | 4.4 | 4 |

| Markets | Stocks, ETFs, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $1000 |

| Minimum Trade | $5 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CBI, CIRO, SFC, MAS, MNB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC |

| Bonus | $5 | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, AutoChartist, TradingCentral |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:30 |

| Payment Methods | 4 | 6 | 6 | 5 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Swissquote Review |

Compare Trading Instruments

Compare the markets and instruments offered by Acorns and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Acorns | Interactive Brokers | IG | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Acorns vs Other Brokers

Compare Acorns with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Acorns yet, will you be the first to help fellow traders decide if they should trade with Acorns or not?