Absolute Markets Review 2024

Absolute Markets is a multi-asset broker offering the MT4 platform, copy trading and ultra-fast trade executions.

Forex Trading

Speculate on 200+ major and minor currency pairs with variable spreads based on the account type.

Stock Trading

Absolute Markets offers 75+ stocks and shares including Apple and Coca-Cola.

CFD Trading

Absolute Markets offers competitive trading conditions on a range of contracts for difference.

Crypto Trading

Trade popular crypto tokens against major currenciess

Copy Trading

Copy trading services are offered within the proprietary WebTrader platform. Follow leading investors or create strategies and earn a profit client that copy your positions.

Awards

- Fastest Growing Forex Broker

- Best Trading Experience

Absolute Markets is a multi-asset trading broker. Based in Saint Vincent and the Grenadines and SVGFSA-regulated, the relatively new brokerage offers a bespoke trading platform, plus the industry-renowned MT4 terminal. Day traders can invest in 500+ instruments including forex, stocks and indices. This 2024 review will cover platform features, login security, account options, fees and more. Find out what our expert traders made of Absolute Markets.

Company Details

Absolute Markets LLC was founded in 2021 by a trio of ex-traders. The vision of the company is to make investing easy and accessible across the globe. The brand is a good option for beginner traders looking for a hassle-free and straightforward investing environment.

Absolute Markets is registered in Saint Vincent and the Grenadines and regulated by the Financial Services Authority (SVGFSA).

The broker has 5345+ active traders and offers investing services in over 170 countries.

Trading Platforms

Absolute Markets offers two trading platforms; a proprietary WebTrader and MetaTrader 4 (MT4). The bespoke web-based platform can be used directly through an internet browser. The MT4 terminal is available to download to Windows and Mac devices and is also accessible via a web-based profile.

Both platforms are suitable for beginners, though we would recommend using the demo account first to learn the features and functionality.

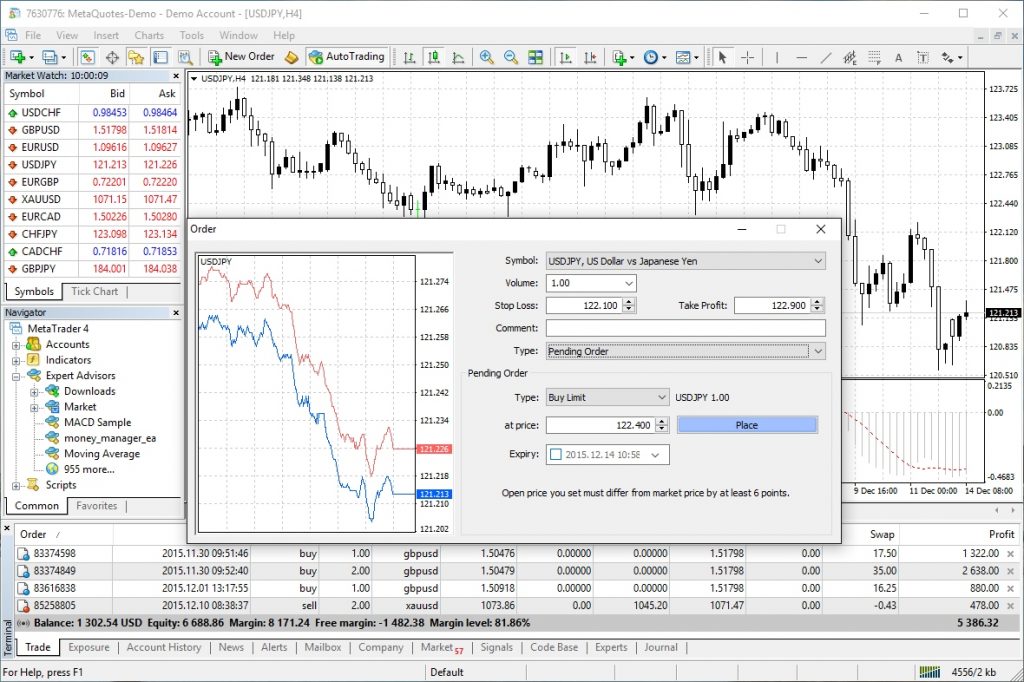

MetaTrader 4

- Nine timeframes

- Multilingual interface

- Fully customizable charts

- One-click order execution

- Three order execution types

- MQL4 programming language

- 30+ built-in technical indicators

- Direct access to Expert Advisors and automated trading systems

WebTrader

- View full trading history

- 100+ technical indicators

- 0.01 second trading execution

- TradingView charting software

- Follow trading signals with live market suggestions

While using the proprietary trading platform, our experts found the software is easy to use, though customization and advanced trading tools are limited.

How To Place A Trade

Once you have verified your account, you can begin trading:

- Find an asset using the navigational search bar

- You can use either one-click order execution or the market watch functionality to monitor prices

- To open a position, complete the order form by selecting ‘buy’ or ‘sell’ and adjust the trade size

- Here you can add stop-loss or take-profit limits

Assets & Products

Absolute Markets offers 500+ assets:

- Trade 76 company stocks including Apple, Facebook and Coca-Cola

- Invest in a variety of commodity markets such as precious metals and energies

- Speculate on 200+ major and minor currency pairs including EUR/USD, GBP/USD and EUR/JPY

- Trade on some of the world’s largest stock indices including the FTSE100, S&P500 and Germany40

- Establish cryptocurrency positions across 61+ digital currency coins including Bitcoin, Litecoin and Ethereum

Spreads & Fees

Fees vary depending on account type and trading instrument. The Micro Account and Variable Account incur zero commissions while spreads start from 1.4 pips on the Micro Account and 1.2 pips on the Variable Account. Real-time spreads can be viewed within the broker’s trading interface.

Both ECN profiles apply a commission-based fee structure. This is $10 per round turn lot. Day traders can also expect spreads from as low as 0 pips during periods of high liquidity, similar vs Pepperstone.

Dormant accounts will be liable for a $5 monthly fee after six months of inactivity. Swap fees apply for positions held overnight.

Leverage

As an offshore organization, Absolute Markets offers substantial margin trading opportunities. The maximum leverage available across all account types is 1:1000, although this is flexible and can be reduced. Applying the highest leverage would mean a $50 deposit will provide traders with $50,000 in purchasing power.

Although trading with high leverage can increase profits, it can also increase losses. With this in mind, ensure you have appropriate risk management strategies in place.

Mobile App

Absolute Markets does not currently have a proprietary mobile app, though keep an eye out for app announcements as this may be added in the future. In the meantime, both trading terminals can be used on mobile devices. The WebTrader terminal has been developed for compatibility with smaller screens and portable devices. The MetaTrader 4 mobile application is available for free download to iOS and Android devices.

When using the Absolute Markets WebTrader interface on mobile, our experts found the platform to be stable, with fast execution speeds. The profile was intuitive and suitable for beginners. Features included one-click trading, flexible leverage, plus stop-loss and take-profit orders.

The MT4 mobile app offers day traders access to the tools, features and functionality found on the desktop terminal. You can manage your account, open and close positions, check live market pricing and view charts while on the go. Reviews on the Apple App store are also positive, rated 4.8 out of 5.

Payment Methods

Deposits

Minimum deposit requirements vary by account type, the lowest being $50. Some payment methods also have separate minimum funding amounts. For example, the minimum deposit requirement is $200 for an international bank wire transfer.

Exchange rates may apply if you are depositing in a currency other than your account base currency. Absolute Markets does not charge a deposit fee for any payment methods, although third-party charges may apply.

Accepted payment methods include:

- Perfect Money – EUR and USD, instant processing time

- Virtual Pay – KES, UGX, TZS and GHS, instant processing time

- PayRedeem – EUR and USD, 15 minutes to 1 hour processing time

- Mobile Money – UGX, KES, RWF, GHC, TZS and CFA, instant processing time

- International Bank Wire Transfer – USD only, 1 to 5 days processing time

- Credit/Debit Card (Visa and MasterCard) – EUR and USD, instant processing time

- Cryptocurrency (Bitcoin, Ethereum and Tether) – All currencies, processing time varies depending on network confirmation

Simply select your chosen finance method via the deposit section in your profile interface. Account verification must be completed to make a successful deposit.

Withdrawals

Withdrawal options are limited vs deposits. All transfers are processed during standard business hours, 9 AM – 6 PM (GMT +2), Monday to Friday, although the time to receive funds back to the original account will vary. Weekend dates and public holidays may cause delays.

Minimum withdrawal limits and fees apply:

- VLoad – Minimum withdrawal $25, 6% fee

- Perfect Money – Minimum withdrawal $1, no fees

- International Bank Wire Transfer – Minimum withdrawal $100, bank fees apply

- Cryptocurrency (Bitcoin, Ethereum and Tether) – Minimum withdrawal $25, 0.5% fee for Bitcoin withdrawals, 1.99% for Tether withdrawals, and 1%+0.006 ETH for Ethereum withdrawals

Demo Account

A free Variable or ECN demo account is available to prospective Absolute Markets day traders. These are available on both MT4 and WebTrader terminals. Access up to $1,000,000 in virtual funds with flexible leverage in a simulated environment. A simple online registration form is required.

Paper trading accounts are a great way to practice strategies risk-free and learn platform features and tools.

Deals & Promotions

While using the Absolute Markets platform, we were not offered any promotions or bonus incentives. With that said, as an offshore broker, Absolute Markets will not be impacted by ESMA’s restrictions on financial incentives introduced in 2018. As a result, new investors may be offered welcome deals or no deposit bonuses during registration in the future, including a 30% bonus for new users.

Remember to check the terms and conditions of financial incentives before exploring as unrealistic minimum thresholds and requirements may apply.

Regulation & Licensing

Absolute Markets LLC is registered in St Vincent and the Grenadines. The broker is licensed and regulated by the local Financial Services Authority (SVGFSA).

Although it was good to see some retail trader safeguards, including negative balance protection, the broker is not overseen by a top-tier regulator such as the Cyprus Securities & Exchange Commission (CySEC) or the Australian Securities and Investments Commission (ASIC).

The broker accepts clients in 170+ countries. This includes residents of the US, UK and more.

Additional Features

We were disappointed with the lack of educational resources and content available to day trading clients. Absolute Markets does not offer trading insights, investing materials or tutorials for new or experienced traders.

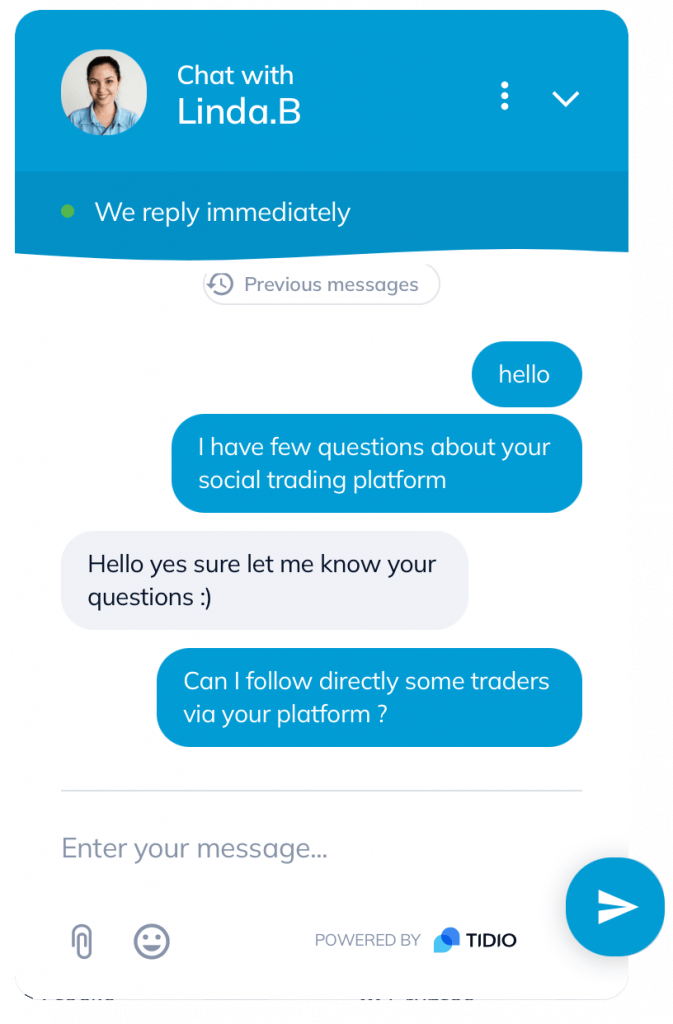

Copy trading services are offered within the WebTrader platform. Traders can follow leading investors and monitor their performance in real-time. Additionally, users can create strategies and earn profits from clients that follow them.

Account Types

Absolute Markets offers several account types. Packages have been tailor-made to suit clients with varying portfolio types and initial investment requirements.

All accounts offer access to fast trade executions, leverage up to 1:1000, and a range of trading tools. Retail investors can open accounts in USD, EUR and GBP account denominations.

Micro Account

- Commission-free

- No access to bonuses

- Spreads from 1.4 pips

- $50 minimum deposit

Variable Account

- Commission-free

- Access to bonuses

- Spreads from 1.2 pips

- $100 minimum deposit

ECN Account

- Access to bonuses

- Spreads from 0.1 pips

- $500 minimum deposit

- $10 per round turn lot commission

VIP ECN Account

- Access to bonuses

- Spreads from 0.0 pips

- $5000 minimum deposit

- $10 per round turn lot commission

A halal swap-free, Islamic profile is also available.

It is quick and easy to open a new account with Absolute Markets. To register, visit the ‘Start Trading’ link on the top right of each web page. Complete the application form and provide the relevant verification details, including financial information and previous trading experience. It can take up to 24 hours for documents to be verified.

Pros

Benefits of creating an account with Absolute Markets include:

- Secure global login

- $50 minimum deposit

- Multiple live accounts

- Copy trading available

- Various deposit methods

- Negative balance protection

- Proprietary platform and MT4 terminal

- Demo account with access to virtual funds

- Responsive customer contact support including live chat services

Cons

Drawbacks of registering with Absolute Markets include:

- Offshore regulation

- Restricted security features

- Limited educational resources

Trading Hours

Absolute Markets trading hours will vary by instrument. The forex market is available to trade 24 hours per day between Sunday to Friday. Cryptocurrency, on the other hand, can be traded 24 hours per day, 365 days a year.

It is worth viewing the published session timetable on the broker’s terminal interface. This is particularly useful to stay up to date with upcoming market closures such as public holidays.

Customer Service

Customer contact options are limited. The broker offers an email address (info@absolutemarkets.com), an online contact form, and live chat services. Nonetheless, we were pleased with the fast response times, particularly the instant support from the live chat facility.

Customers can also request one-to-one support or phone calls with customer service agents. In addition, a comprehensive self-help FAQ section can be found on the broker’s website via the Help Center. The page is categorized into four groups; accounts, deposits & withdrawals, trading and troubleshooting.

Note, you can also stay up to date with the latest news by following Absolute Markets on social media.

Security

Our experts found limited information regarding trading security and safety. There is minimal evidence of personal data safeguarding and segregated client funds. The broker does, however, offer negative balance protection, as part of the client agreement.

Our traders did not find any evidence of additional security settings such as two-factor authentication (2FA) when using Absolute Markets software. Be cautious of scams, particularly when trading with offshore brokers.

Absolute Markets Verdict

Absolute Markets is a relatively new broker offering 500+ assets. When we used the services offered by the brokerage, we were pleased with the responsive customer support, demo account services and various account types. The major drawbacks for day traders are the lack of regulatory oversight and limited security features.

FAQs

Is Absolute Markets Regulated?

Absolute Markets broker is licensed in Saint Vincent and the Grenadines, and regulated by the Financial Services Authority (SVGFSA). This is an offshore authority, therefore it may not provide the same levels of consumer protection afforded by top-tier regulators such as the FCA.

What Trading Platforms Does Absolute Markets Offer?

Absolute Markets offers a proprietary WebTrader terminal and the MetaTrader 4 platform. Both can be used via major web browsers or on mobile devices. One-click trading, alongside a suite of technical and fundamental indicators, are available with both platforms.

What Deposit Options Does Absolute Markets Offer?

Absolute Markets details several international deposit options including Perfect Money, bank wire transfers, credit/debit cards, cryptocurrency, and PayRedeem. The minimum deposit is $200 and most payments are processed instantly.

Is Absolute Markets Broker A Scam?

After testing the services of Absolute Markets, we are comfortable that the broker is not a scam. Although regulated offshore, the brokerage provides negative balance protection and a reliable customer support service.

What Is The Minimum Deposit For An Absolute Markets Trading Account?

Absolute Markets’ minimum deposit requirements vary by account type. The lowest is $50 or equivalent currency. This makes it a good option for beginners. Note, minimum deposits also vary by payment method.

Top 3 Alternatives to Absolute Markets

Compare Absolute Markets with the top 3 similar brokers that accept traders from your location.

-

IC Markets – IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Go to IC Markets -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets -

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone

Absolute Markets Comparison Table

| Absolute Markets | IC Markets | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 1.3 | 4.8 | 4 | 4.8 |

| Markets | CFDs on forex, indices, shares, commodities, cryptocurrencies, futures | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $200 | $100 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | SVGFSA | ASIC, CySEC, FSA | ASIC, CySEC, ESMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | 30% Deposit Bonus | – | – | – |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, TradingView | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade |

| Leverage | 1:1000 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Payment Methods | 8 | 14 | 9 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IC Markets Review |

FP Markets Review |

Pepperstone Review |

Compare Trading Instruments

Compare the markets and instruments offered by Absolute Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Absolute Markets | IC Markets | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Absolute Markets vs Other Brokers

Compare Absolute Markets with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Absolute Markets yet, will you be the first to help fellow traders decide if they should trade with Absolute Markets or not?